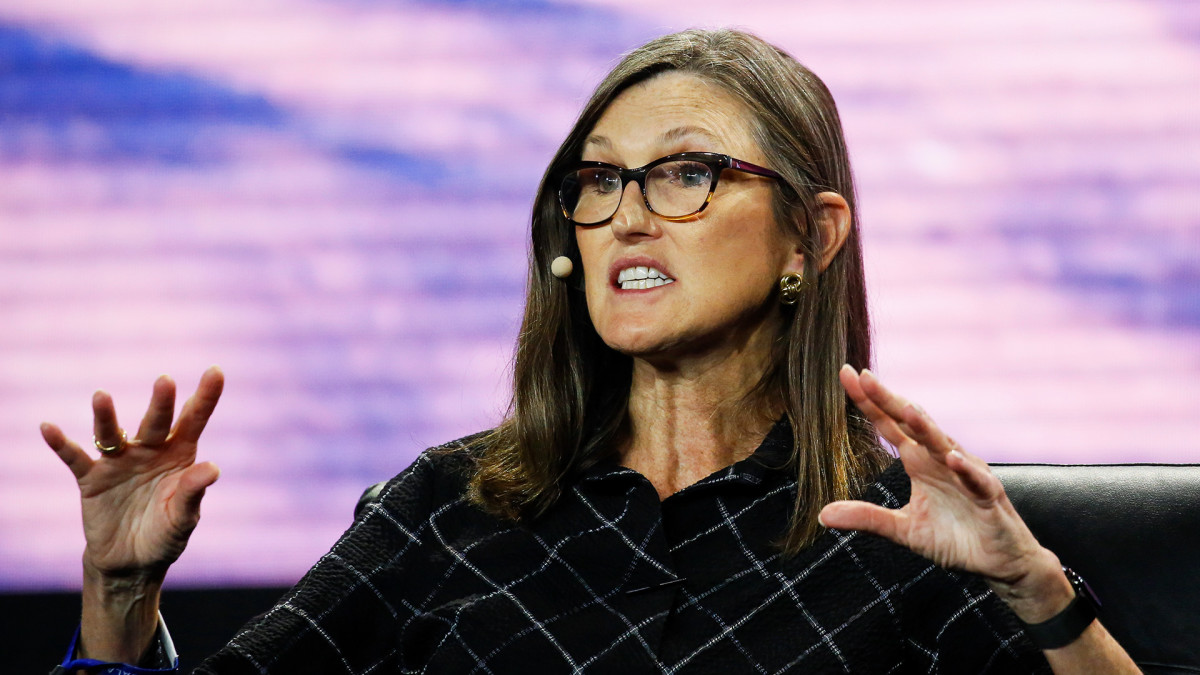

Cathie Wood's Ark Invest is focused on providing investors exposure to world-changing technology. In keeping with that philosophy, the company doesn't look at the short-term value of any of its holdings.

Ark instead pushes price targets with five-year time horizons, unlike the more traditional 12-month horizons offered by most analysts.

Under that mentality, Ark has predicted that Tesla (TSLA) -) will be trading at $2,000 per share by 2027, a valuation that is roughly 10 times above the stock's current valuation. This prediction is based on Ark's expectation of Tesla's imminent success with robotaxis, which has yet to come to any level of fruition.

Related: Cathie Wood buys into a favorite stock for the first time in months

Ark also remains bullish on the electrification of automation, an effort the firm thinks Tesla is poised to dominate in.

But even as electric vehicle adoption has continued to grow this year, hitting new record numbers, the rate of that growth has fallen and traditional automakers have turned cautious.

Both Ford (F) -) and General Motors (GM) -), citing profitability issues, have postponed EV lineups and trimmed EV investments throughout the year.

This more cautious approach to EVs is, according to Ark, a "mistake."

Legacy automakers, Tasha Keeney, Ark's director of investment strategies, said in a recent webinar, remain unable to produce EVs as cost-effectively as Tesla essentially because Tesla got started around a decade before they did.

Now, traditional automakers are stuck with costly EV production and low profitability, even as they still must support their gas-powered cars, Keeney said.

The pullback in EV investments, she said, will "only help Tesla cement even more of a lead in the space," a sentiment that Deepwater's Gene Munster has expressed in the past.

Related: New report predicts what the electric vehicle market will look like in 2024

This pullback, according to Wood, will ensure that these automakers won't be successful in EVs for a long time.

"It is so interesting to us that both GM and Ford are pulling back on EVs because of profitability issues," Wood said. "They won't become profitable unless these companies scale. That's the conundrum for them."

Citing GM's recent increase in its quarterly dividends and its $10 billion stock buyback program, Wood said that both of the automakers seem to have "more of a short-term oriented shareholder base, or a very value-driven shareholder base."

"They should be scaling if they want to be part of the EV game," Wood said.

Tesla's stock, more than doubled for the year, rose above $260 Wednesday.

S&P Global Mobility recently predicted that 2024 will see continued growth in the EV sector, despite seemingly turning consumer sentiment and the pullback in EV investments by major automakers.

S&P's forecast "for 2024 is one of cautious optimism — with an increase in affordable EVs, reliable vehicle-charging ecosystems and profitable returns."

Related: Tesla bulls say electric vehicle demand is soaring. Here's what's really happening

Get exclusive access to portfolio managers’ stock picks and proven investing strategies with Real Money Pro. Get started now.