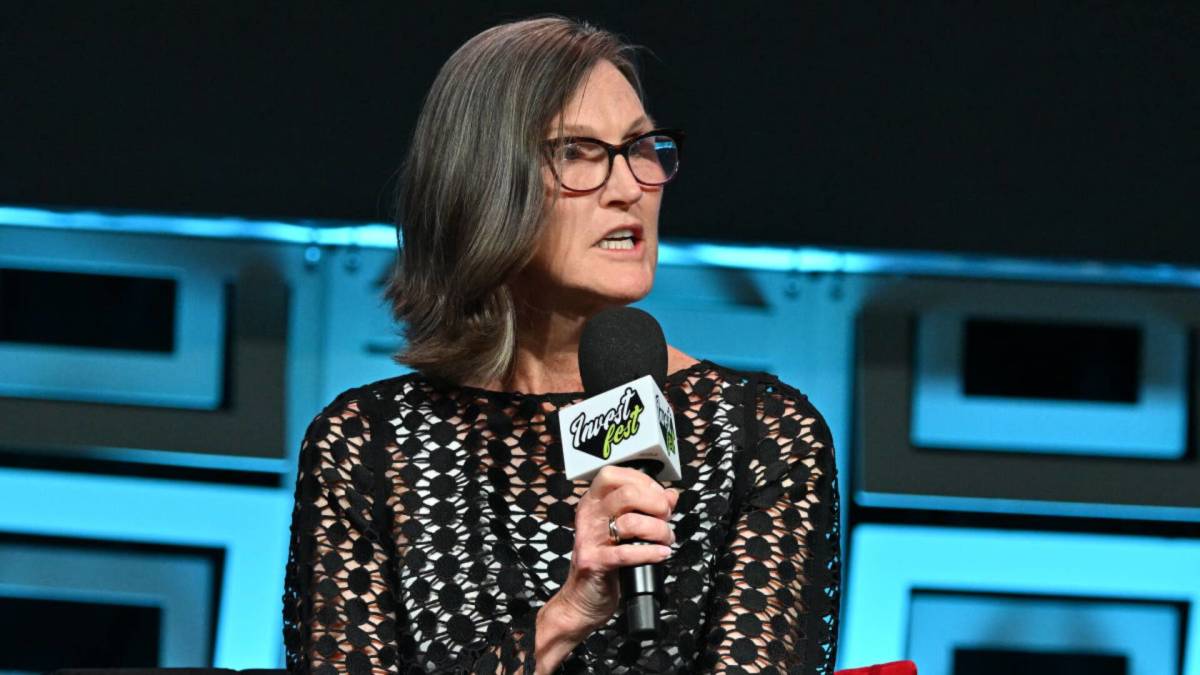

Cathie Wood, chief of Ark Investment Management, doesn’t give up on her favorite stocks easily.

Sometimes she’ll buy them on the way down, hoping for a bargain. And sometimes she’ll even acquire them on the way up. That’s what she has done this week.

Investors and analysts diverge in their opinions of Wood, possibly the country’s best-known investor after Warren Buffett. Boosters contend she’s a technology guru, while critics maintain she’s simply a mediocre money manager.

Wood (Mama Cathie to her followers) rocketed to fame after a stupendous return of 153% in 2020 and easy-to-understand explanations of her investment strategy in numerous media appearances.

But her longer-term performance isn’t so hot. Wood’s flagship Ark Innovation ETF (ARKK) , with $5.7 billion in assets, produced annualized returns of 8% for the past 12 months, negative 28% for the past three years and positive 1.05% for five years.

Related: Veteran fund manager unveils startling Nvidia stock forecast

That pales in comparison to the S&P 500. The index registered positive annualized returns of 28% for one year, 9% for three years and 16% for five years. Ark Innovation’s numbers also fall well shy of Wood's goal for annual returns of at least 15% over five-year periods.

The Ark fund’s biggest five holdings include:

- Electric vehicle titan Tesla (TSLA) , $736.87 million.

- Streaming stalwart Roku (ROKU) , $584.69 million.

- Coinbase Global (COIN) , the country’s biggest cryptocurrency exchange, $435.37 million.

- Videogame platform Roblox (RBLX) , $390.19 million.

- Financial services provider Block (SQ) , $284.62 million.

Cathie Wood’s straightforward strategy

Her investment philosophy is quite straightforward. Ark ETFs usually purchase emerging-company stocks in the high-tech categories of artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics.

Wood maintains that companies in those categories will be game changers. Of course, these stocks are quite volatile, so the Ark funds’ values often fluctuate widely.

Esteemed investment research firm Morningstar is highly critical of Wood and Ark Innovation ETF. Investing in young companies with slim earnings “demands forecasting talent, which ARK Investment Management lacks,” Morningstar analyst Robby Greengold wrote in March.

Related: Cathie Wood unloads $6 million of surging tech stock

“Results range from tremendous to horrendous” for Wood’s young, often unprofitable stocks, he said.

She has defended herself from Morningstar’s criticism. “I know there are companies like that one [Morningstar] that do not understand what we're doing,” she told Magnifi Media by Tifin in 2022.

“We do not fit into their style boxes. And I think style boxes will become a thing of the past, as technology blurs the lines between and among sectors.”

Some of Wood’s customers apparently agree with Morningstar. Over the past 12 months, Ark Innovation ETF suffered a net investment outflow of $2.4 billion, according to ETF research firm VettaFi.

Cathie Wood purchases Shopify shares

On Monday through Wednesday Ark Next Generation Internet ETF (ARKW) bought a combined 45,662 shares of e-commerce platform Shopify (SHOP) , valued at $3.3 million as of Wednesday’s close.

The stock has soared 37% since Aug. 6, benefiting from a positive second-quarter earnings report. “The firm reported strong results and provided third-quarter guidance that was meaningfully better than our expectations,” wrote Morningstar analyst Dan Romanoff.

Related: Cathie Wood's net worth: The Ark Invest CEO's wealth & income

Revenue rose 21% in the second quarter from a year earlier to $2 billion. And gross profit grew 25% to $1 billion. For the third quarter, Shopify expects revenue to grow at a low-to-mid-20s percent rate from a year ago.

Romanoff, like Wood, is bullish on Shopify. “We continue to believe that Shopify is well positioned as a leader in e-commerce and has a variety of irons in the fire to sustain durable growth,” he said.

He assigns SHOP a wide moat, which means he sees it with competitive advantages for at least 20 years.

Cathie Wood snatches DraftKings stock

Also Monday through Wednesday, Ark Next Generation Internet snagged a combined 95,790 shares of DraftKings (DKNG) , also valued at $3.3 million.

The stock has ascended 22% in the past 12 months and 13% since Aug. 12 amid explosive growth in sports gambling.

Wall Street Analysts:

- Analysts reboot Grand Theft Auto maker's stock price target

- American Express stock analyst flags concerning shift in consumer behavior

- Analyst resets Nvidia stock price target before earnings

“The firm’s second-quarter results demonstrated that its leading technology and product offering should generate strong revenue and [earnings before interest, taxes, depreciation and amortization] growth for the foreseeable future,” wrote Morningstar analyst Dan Wasiolek.

“We see [the] shares attractive for long-term investors.”

Revenue climbed 26% in the second quarter from a year earlier to $1.1 billion. And adjusted Ebitda registered $128 billion, up 75% from a year earlier.

Wasiolek assigns DKNG no moat.