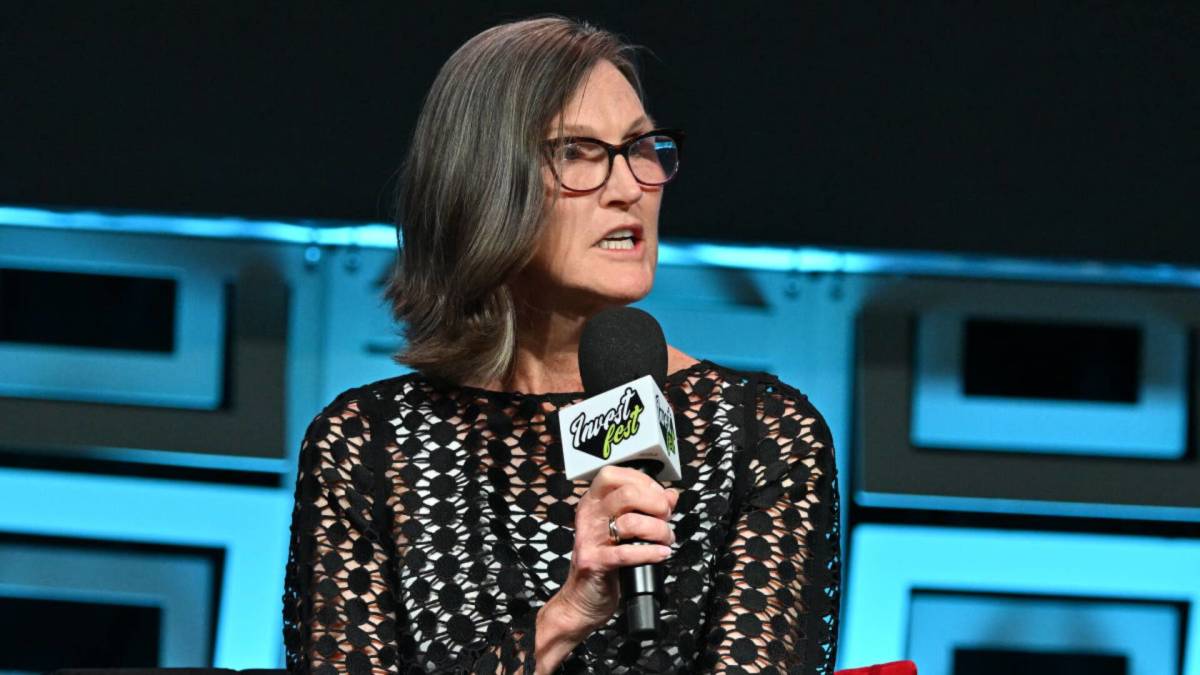

Cathie Wood, chief of Ark Investment Management, often makes big bets on her target tech stocks.

Sometimes, she’ll buy them on the way down, hoping for a bargain. And sometimes she’ll even acquire them on the way up. That’s what she has done this week–she bought a rallying tech stock for four consecutive trading sessions.

Despite underperforming the market in 2024, her strategy is proving effective so far in 2025:

The flagship Ark Innovation ETF (ARKK) has returned 18% this year as of Feb. 14, easily surpassing the S&P 500 Index and the Nasdaq Composite, which have gained roughly 4% and 3.7%, respectively.

💰Presidents Day Sale: Get Free access to TheStreet Pro for 31 days – Claim your offer today! 💸

Opinions on Wood vary. She is a visionary to her supporters, who proved her instincts in 2020 with a remarkable 153% return. Her longer-term performance has raised doubts about her aggressive approach.

As of Feb. 14, Ark Innovation ETF, with $6.3 billion under management, has delivered an annualized three-year return of negative 2.08% and a five-year return of 3.20%.

In comparison, the S&P 500 index has a three-year annualized return of 13.32% and a five-year return of 14.36%.

Cathie Wood’s investment strategy explained

Wood’s investment strategy is straightforward: Her Ark ETFs typically buy shares in emerging high-tech companies in fields such as artificial intelligence, blockchain, biomedical technology and robotics.

Wood says these companies have the potential to reshape industries, but their volatility leads to major fluctuations in Ark funds' values.

Related: Cathie Wood's net worth: The Ark Invest CEO's wealth & income

Investment research firm Morningstar criticized Wood and her ETFs last year.

Investing in young companies with slim earnings “demands forecasting talent, which Ark Investment Management lacks,” wrote Morningstar analyst Robby Greengold. “Results range from tremendous to horrendous.”

"The firm’s ability to spot winners and manage their myriad risks is less so. … It has not proved it is worth the risks it takes,” he said.

Some analysts say that things might change as Donald Trump returns to the U.S. presidency.

Todd Sohn, ETF and technical strategist at Strategas Securities, noted that since Trump's Nov. 5 reelection in November, Ark Innovation ETF and Ark Next Generation Internet ETF (ARKW) have seen significant gains.

Since the election, the two ETFs have returned 39% and 40% respectively.

"We still strongly believe that ARKW is about as good a proxy for Trump 2.0 as one might find, with heavy exposure to bitcoin, crypto derivatives, Tesla (TSLA) and defense," Cohn told MarketWatch.

Wood recently expressed optimism about a shift to looser regulation under Trump’s presidency.

“What the new administration is doing is changing fear with optimism,” Wood told Bloomberg in January. It’s “highly underestimated how important deregulation is going to be to unleashing animal spirits. We are pretty excited about this.”

Not all investors echo Wood's confidence. Over the past year, Ark Innovation ETF has seen a net outflow of nearly $3 billion, with $133.46 million exiting the fund in the past month, according to ETF research firm VettaFi.

Cathie Wood bought $37 million of Iridium Communications

Wood bought Iridium Communications (IRDM) over four consecutive trading sessions this week.

From Feb. 11 to 14, Wood’s Ark Innovation ETF bought 1,173,688 shares of Iridium. That purchase came as the stock rose more than 11% over the previous five days.

Related: Billionaire Bill Ackman buys $2.3 billion of beat-down tech stock

That chunk of stock was valued at roughly $37.1 million as of Feb. 14’s close.

Iridium Communications is a global satellite communications company based in McLean, Va. It operates the Iridium satellite constellation, a network of 66 active satellites providing mobile voice and data communications.

Clients include enterprises worldwide, the United States and international governments, and non-governmental organizations.

On Feb. 13, the technology company reported 31 cents earnings per share for the 2024 fourth quarter, beating the consensus estimate of 16 cents by 93.75%. Revenue for the quarter was $213.0 million, beating the consensus estimate of $204.1 million.

In January, investment firm Cantor Fitzgerald initiated coverage of Iridium with an overweight rating and $40 price target, according to thefly.com.

Iridium is best positioned to benefit from improving investor confidence in the space sector, along with healthy growth in cloud foundry and portfolio optionality, according to the analyst.

Additionally, Cantor believes Iridium's cash flow stability generates a substantial valuation moat as companies navigate an increasingly complex risk environment.

Matt Desch, Iridium's CEO, said the company's "continued strong cash flow supported return of capital to shareholders approaching a half billion dollars in 2024, including dividends and share repurchases."

Iridium shares stumbled in 2024, falling nearly 30%.

Fund manager buys and sells:

- Veteran fund manager offers blunt take on recent AI project

- Fund manager who predicted Nvidia’s selloff makes a bold move

- Iconic fund manager has blunt words on markets after Trump return

BWS Financial said a year ago that the company was facing increased competition from Elon Musk's Starlink and was modifying its accounting practices for the useful life of its satellite network, which could lead to the stock price stalling for a considerable amount of time in 2024.

However, Iridium is up 9% year-to-date.

As of Feb. 14, the stock ranked 32nd among Ark Innovation’s holdings, accounting for 0.51% of the portfolio, according to online data firm Stock Analysis.

Related: Veteran fund manager issues dire S&P 500 warning for 2025