This article was originally published on Cannabis & Tech Today and appears here with permission.

The cannabis extraction market is an exciting one. With the U.S. market predicted to hit $5,940 million by 2026 according to Facts and Factors, and the global market $28.5 billion by 2027 as reported by Grand View Research, everyone is getting in on the action.

What these compelling numbers don’t describe are the continued volatility and real-world limitations cannabis extractors face scaling their production.

Growing isn’t always easy in the extraction space. Extractors must navigate the ever-changing landscape of new markets, regulations, and consumer demands, all while staying profitable.

Growing an extraction business is about flexibility and future-proofing investments. Because pivoting as a processor isn’t always possible, planning for growth from the start is the key to success.

So, what can a concentrate maker plan for today to ensure future growth is as smooth as possible?

Frustrations and Pain Points Common in the Extraction Industry

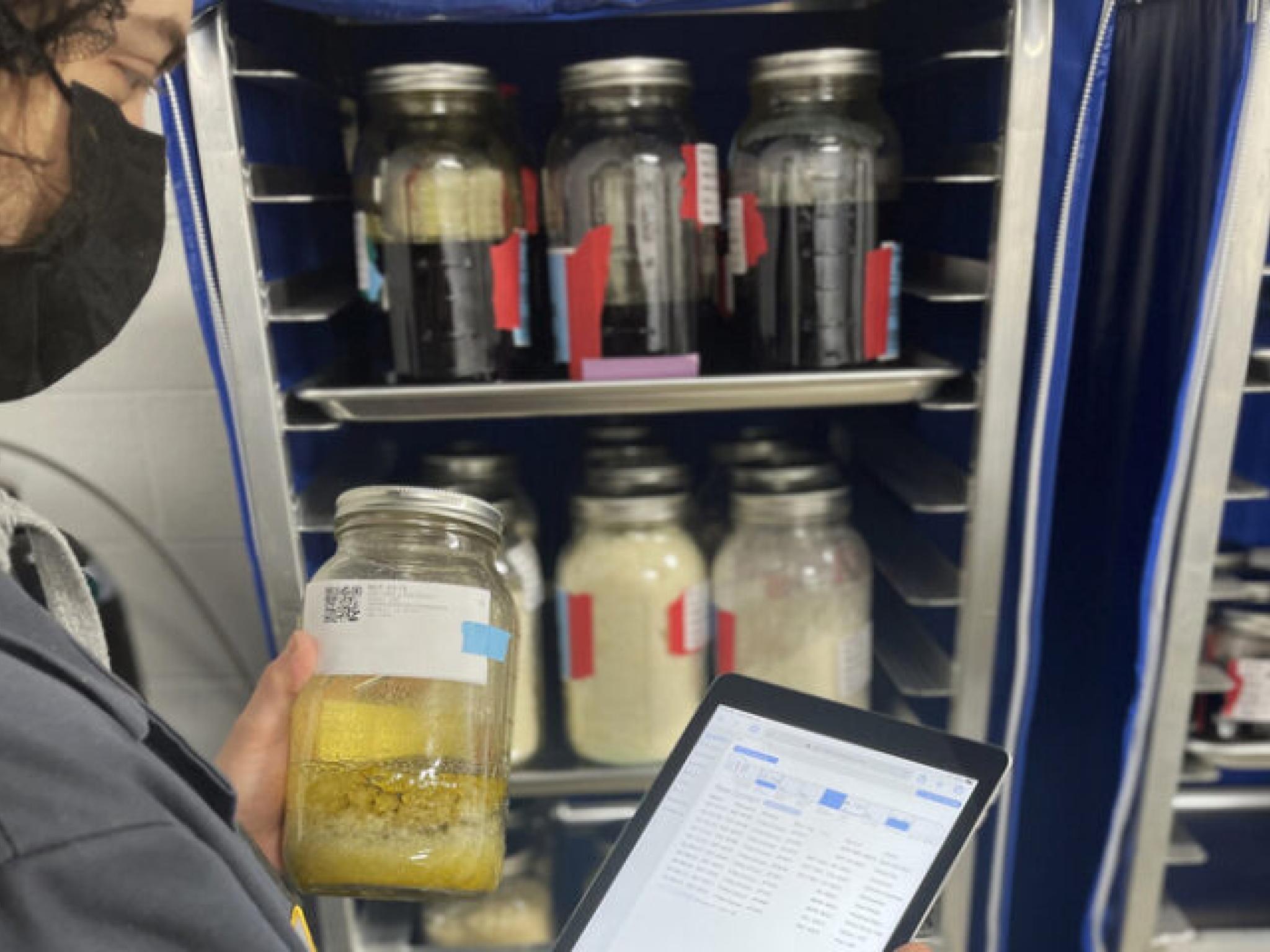

Photo courtesy of Nature’s Lab Extractions.

Cannabis processors each navigate unique sets of circumstances depending on the state and even the county in which they operate. Yet, despite the high degree of regional variability, there are several common pain points.

First, is the astronomical start-up cost. Nearly everyone interviewed for this piece mentioned how tight budgets are, not only restricted to the initial build-out, but also to the future potential of a facility.

Cutting corners in the early days frequently places significant limitations on future expansion.

Marcus Moates, owner and founder of Nature’s Lab Extractions, has set up operations across the country, including in California, Nevada, and Oklahoma.

In his experience, “most of the multi-state operators spend so much money that by the time they land with the right consultant group, they’ve already spent excessive amounts of money, and they just don’t feel like spending more.”

If adjustments are needed, Moates has found these operators are tapped out and the capital has dried up. Facilities are forced to make current systems work, often to the detriment of product quality and future growth.

A second common frustration occurs during expansion into new markets.

Across the country, there is a patchwork of legislation and regulation covering all things cannabis. Most multi-state extractors face an entirely new set of challenges in every state and often in every county.

For example, the local county fire marshal plays a significant role not only in determining how many (if any) cannabis operations exist in their district, but also in what sorts of operations they can run.

Not all counties are open to all solvents, with many placing restrictions on volatiles like butane.

Moates detailed how Nature Lab Extractions operates under a Type 6 Non Volatile Solvents Extraction License in California because securing a Type 7 Volatile is all but impossible.

He is not the only processor to have discovered that facility expansion is largely restricted by the local regulation on the solvents themselves.

Plan to Pivot According to Local Limitations

Backbone. Photo courtesy of Timothy Revenko.

What is clear for all extraction facilities is the limitations of the local environment. What are regional restrictions on volatile solvent-handling? What does the local landscape offer for raw material? Once the parameters are laid out, it’s possible to scale within them.

For example, if the plan is to expand a hydrocarbon extraction operation, there are likely regional limitations for on-site capacity. If there isn’t room to increase the physical infrastructure because the local fire marshall is wary of higher concentrations of butane on-site, what other options are there?

In this case, increasing production (and profits) may simply be a numbers game. Instead of new equipment, can new software help improve total system efficiencies across the supply chain? Backbone is one such option: a supply chain and compliance tracking software that integrates directly into the production floor.

As Erika Tingey, Head of Product, explained, “Backbone specifically targets manufacturing and the whole supply chain” to reduce the burden of compliance data entry and help extractors make data-based adjustments across the full supply chain.

Erika Tingey, Head of Product for Backbone.

In another example, Moates opened up about another local limitation that forced a dramatic pivot. He strategically adjusted plans for Missouri because of the low quality of the local raw materials.

He described how “the city is adamant about helping you get going. The state is adamant about helping you get going. But the problem is, as soon as you do get going, there is no material. And a lot of the material that is available is very, very low quality, we’ll say.” In this new market, Moates plans to focus on distillate, which doesn’t require top-quality inputs for purity of outputs.

Although Nature’s Lab Extracts produces premium high-terpene, full-spectrum extract in other markets, cultivation is just getting started in Missouri. In this case, it’s not local regulations dictating his operation but the available product.

Future-Proofing Investments in Equipment

Kellan Finney, Co-Founder and Chief Financial Officer of Eighth Revolution.

As the cannabis market explodes, many equipment manufacturing companies have pivoted their marketing to target the sector. There is big money to be made in cannabis, and these manufacturers are eager to get

on board.

However, not all extraction equipment will work within a mature cannabis market. Very soon, regulators are expected to double down on specific equipment certifications for extractors.

Both Bryan Fields (Co-Founder and CEO) and Kellan Finney (Co-Founder and Chief Scientific Officer) of Eighth Revolution warn against cutting costs on cheap, non-certified equipment.

Eight Revolution approaches the cannabis and hemp industry with an analytical mindset, to provide a quick-witted approach to an industry facing ongoing changes. Already, in their short two years of operation, they’ve helped several large extractors navigate many of these equipment challenges.

Fields and Finney expect several layers of certification will be required on every piece of plant-touching equipment, including UI, NRDL, and GMP. Much of the current extraction equipment used across the industry will not cut it.

As Finney detailed, “Equipment manufacturers saw [cannabis] as an exciting opportunity to sell equipment in the space.” Still, only experienced equipment manufacturers in food-related industries may understand how critical certain components are for safety standards.

For example, certification can cover everything from the metal composition (grade 316 steel) to the welding maps, to clear displays of these features across every piece of equipment.

In the very near future, Eighth Revolution predicts that all extraction equipment in mature markets will have high requirements for equipment certifications. As per Fields, “Misunderstanding of what that takes is going to be eye-opening to operations currently in the space.”

Any processor looking to scale has to keep the looming certification requirements in mind. It’s often not possible to retroactively certify equipment.

Bryan elucidated, it’s not “as easy as just putting a sticker on some of them. It will take a substantial amount of R&D in order to get these pieces of equipment ready and certified.” He has already witnessed one extractor find themselves with a costly, uncertified, six-figure paperweight on their hands.

Operators will need to plan to have current machines upgraded and ensure all new purchases fall within the expected parameters.

Takeaways on Scaling in Extraction from Industry Insiders

Whether starting out or preparing for growth, cannabis extractors face a complicated jigsaw puzzle of regulation, limitations, and future variability. There are three critical takeaways from many conversations with industry experts.

First, cannabis extraction is a game best played by brands with deep pockets. Cutting corners in the early stages will not make it easier in the long run. No matter the solvent or process, making smart investments in certified equipment will pay off as the market matures.

Second, take the time to understand the local limitations and work within them. Working closely with the local fire marshall is only one example. It’s also critical to understand the local supply of raw materials. Implement a detailed data-analytics tool to scale within the parameters intelligently.

Third, plan for a future where cannabis extraction requires intense certifications, including UI, NRDL, and GMP. Purchasing interim and uncertified machines may save money today, but it could result in headaches and nightmare scenarios of the six-figure paperweight in the near future.

Scaling in extraction is not as simple as adding more machines and more solvents. There are real, local limitations to navigate and looming regulation from a maturing market. Use all the tools available to operate a tight, efficient operation, and don’t cut corners on equipment investments.