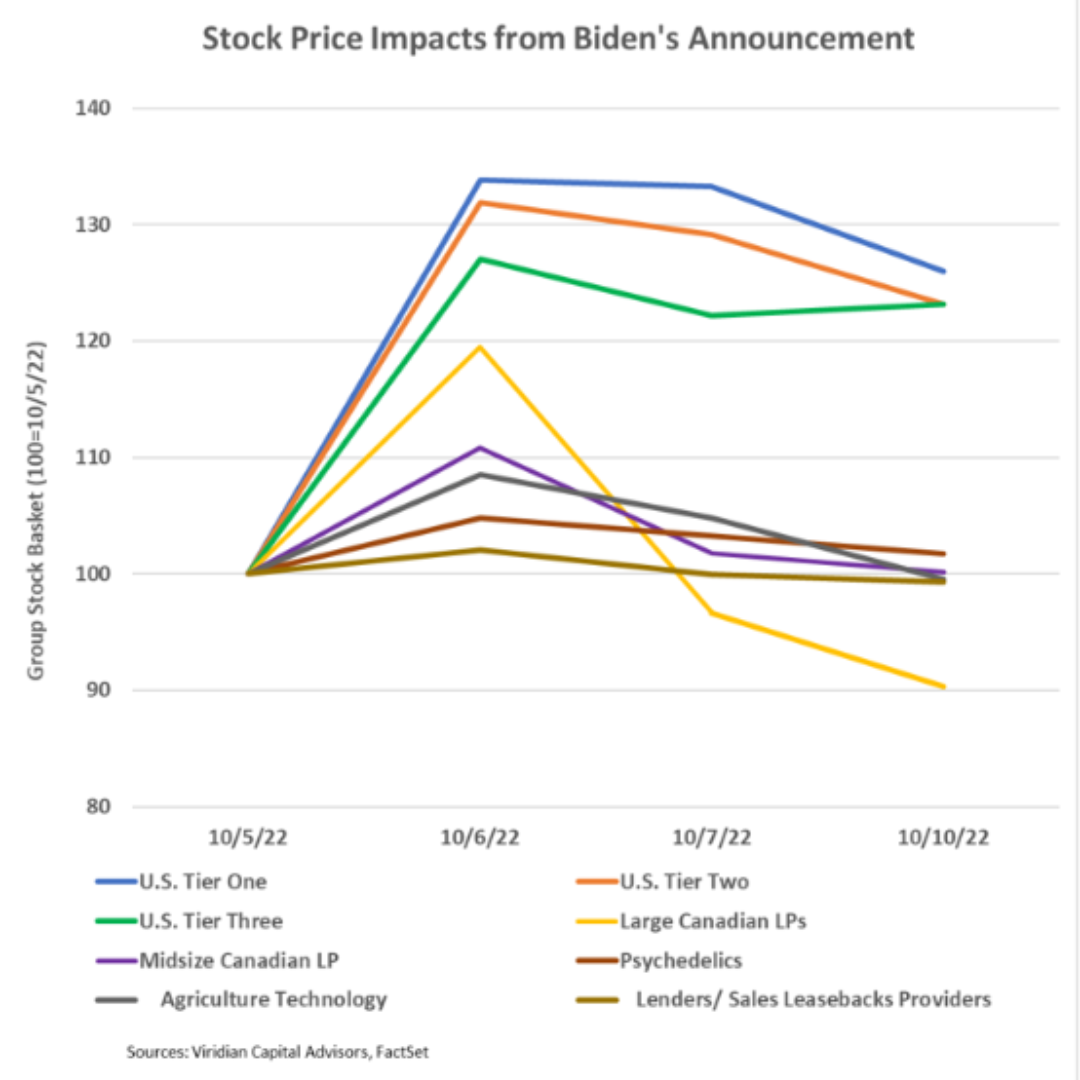

Biden's announcement of federal cannabis pardons and a review of the CSA scheduling of cannabis produced a whopping 32.4% pop in the MSOS ETF for the week, easily the largest gain since the ETF was created. After a 10-point retracement, MSOs remain over 20% higher. The pullback signals a realization that Biden's program is not an immediate fix for the industry's issues and leaves important questions about future legislative/regulatory directions.

The chart shows the stock price reactions of various subsectors of cannabis in the three trading days after Biden's announcement. Sector prices were indexed so that 100 equals the 10/5/22 price. Tier One US MSOs faired the best, while large Canadian LPs are down nearly 10%. Agriculture Technology and Lenders are both down slightly since before the news.

-

The press minimized the impact of the President's cannabis pardons because the action would release no federal prisoners. Arguably, however, the pardons remove one of the most contentious stumbling blocks for the passage of SAFE+. By frontrunning this issue and pushing states to follow through, Biden's action significantly improves the likelihood of a SAFE+ bill passage in the lame-duck session.

Rescheduling/de-scheduling is a longer-term matter, and it will likely take several years to accomplish. The DEA requests a scientific and medical evaluation and recommendation, which the FDA prepares. The DEA evaluates the data and makes a final proposal. Note the FDA has been studying the safety and efficacy of CBD since the Farm Bill of 2018 and has not yet rendered a definitive opinion! To expect them to quickly approve the safety of the high THC products in the adult-use market strains credulity.

On the campaign trail, Biden said he supported a rescheduling to schedule 2, which would provide no substantive benefit to the industry besides promoting further cannabis research. It would not influence public exchange up-listing opportunities (Nasdaq-NYSE) or bank custodial issues for public stock certificates, and it would not remove 280e.

Still, we cannot imagine that adult-use cannabis will be completely de-scheduled any time soon. Moreover, a complete de-scheduling would open the floodgates to interstate commerce and be disastrous for the industry and the limited license states. Complete de-scheduling is possible only for limited THC medical cannabis products.

A group called the Schedule 6 Foundation has proposed an innovative solution. They advocate a new schedule being created to eliminate 280e taxation while keeping cannabis under state regulation. The combination of limited license state regulation and 280e reform strikes us as a near-ideal economic outcome.

-

Investors should keep their eye on the prize. Near-term, the SAFE+ bill is the best that can be expected. Its importance mustn't be lost amid rescheduling/de-scheduling daydreams.

The Viridian Capital Chart of the Week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy. The Deal Tracker is a proprietary information service that monitors capital raise and M&A activity in the legal cannabis, CBD, and psychedelics industries. Each week the Tracker aggregates and analyzes all closed deals and segments each according to key metrics:

-

Deals by Industry Sector (To track the flow of capital and M&A Deals by one of 12 Sectors - from Cultivation to Brands to Software)

-

Deal Structure (Equity/Debt for Capital Raises, Cash/Stock/Earnout for M&A) Status of the company announcing the transaction (Public vs. Private)

-

Principals to the Transaction (Issuer/Investor/Lender/Acquirer) Key deal terms (Pricing and Valuation)

-

Key Deal Terms (Deal Size, Valuation, Pricing, Warrants, Cost of Capital)

-

Deals by Location of Issuer/Buyer/Seller (To Track the Flow of Capital and M&A Deals by State and Country)

-

Credit Ratings (Leverage and Liquidity Ratios)

Since its inception in 2015, the Viridian Cannabis Deal Tracker has tracked and analyzed more than 2,500 capital raises and 1,000 M&A transactions totaling over $50 billion in aggregate value.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.