Investors are in Verizon (VZ) as a flight-to-safety trade. These investors are typically looking for low volatility and a decent yield while they wait.

They likely weren’t expecting Verizon stock to fall 6% today after disappointing quarterly results.

That’s particularly after the boost we saw in AT&T (T) stock after it reported better-than-expected results.

As we size up telecom, this group has been part of the so-called “risk-off” trade, which is observed as investors move into safer assets amid increasing volatility.

We’ve seen it playing out for a while now — and not just in AT&T and Verizon. Johnson & Johnson (JNJ), Walmart (WMT) and Procter & Gamble (PG) have ball been trading well too, just to name a few.

While these are good companies, they are not normally market leaders.

Verizon reported a decent first quarter, but trimmed its full-year guidance, leading to today’s dip. Is it an opportunity?

Trading Verizon Stock

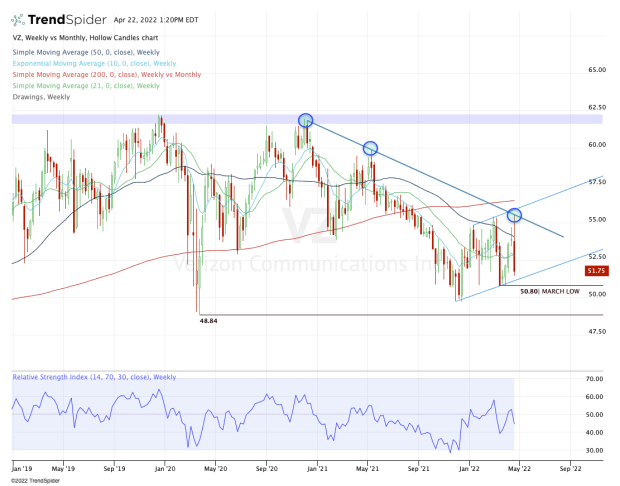

Chart courtesy of TrendSpider.com

Looking at the chart, two things stick out immediately: Over the longer term, Verizon stock is stuck in a downtrend and in the short term, it’s in a rising channel.

So far, both remain in play.

Downtrend resistance continues to hold over the long term. That came into play once Verizon failed to clear resistance near $62. That led to a series of lower highs, a trend that still remains in play (shown on the chart with blue circles).

In the short term, Verizon has been making higher highs and higher lows, as it rides the channel higher. But this short-term trend is trumped by the longer term trend and needed something — like earnings — to break it out.

That didn’t happen, though.

Now below all of its daily moving averages, we need to see where support comes into play.

On the upside, a move back above the 10-day and 21-day moving averages could put long-term downtrend resistance in play. This measure has been critical since December 2020. To break out over it could mean a potential move to the $60 to $62 area.

On the downside, longs should watch channel support. While that area can waver as support, the March low is much more noteworthy, sitting at $50.80.

A drop below this mark that doesn’t reverse could put Verizon in a monthly-down rotation, likely putting the lows in play just below $50, followed by the Covid lows down at $48.84.

For some investors, $3 a share in risk isn’t all that bad for a stock with a low valuation and 5% yield. However, for others they would rather bet on the stock with the wind at its back and in this case, it’s AT&T. Not to mention its superior yield at 5.7%.