Snap (SNAP) shares are slumping on Friday, down about 38% at last check after the Snapchat parent reported earnings.

Twitter (TWTR) didn’t wow anyone either, although it has the whole Elon Musk saga dragging out and acting as a dominant talking point. The microblogging site's shares are flat to lower on the day.

Snap’s results are weighing on the social-media and digital-ad space as a whole, with Meta (META), Alphabet (GOOGL) (GOOG), Pinterest (PINS) and others all under pressure.

That comes on the heels of Snap’s second-quarter earnings report, which was mixed. The company edged past analysts’ earnings expectations but missed on revenue estimates as sales grew 13% year over year.

Management said current-quarter revenue is roughly flat year over year so far, although Q2 active users on the photography-related site rose 18%. That bright spot is being overlooked. Snap declined to issue short-term guidance, which isn’t helping matters.

Snap’s drop this morning serves as a reminder that the market is still very much in a bear market and the stocks that disappoint investors will be punished.

Trading Snap Stock

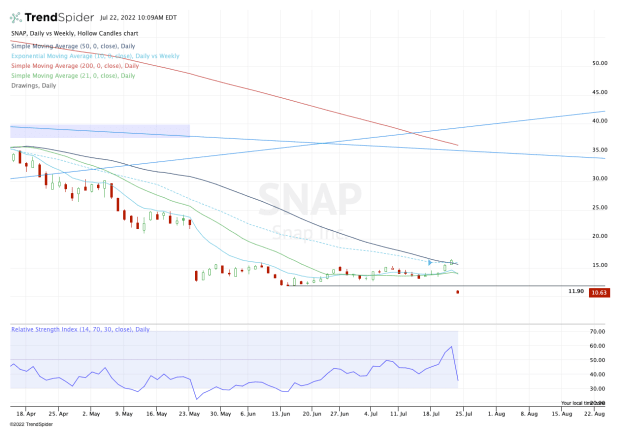

Chart courtesy of TrendSpider.com

After a five-day dip, Snap stock went on a five-day rally ahead of the earnings report.

Amid the dip, the shares did not retest the lows. Amid the rally, the shares moved up 25%, which sent them right into the 50-day and 10-week moving averages.

The stock was set to rip on good results and — as shown today — get crushed if it disappointed. Now, there’s just two levels that really matter: $11.88 and $10.

The $11.88 level was the prior low from last month and marked the 2022 low. That, of course, is no longer the case with today’s action.

Had Snap opened below $11.88 and reclaimed this level, the bulls would have had an opportunity for a quick long position against today’s low. Instead, Snap stock opened at $11.10 and has been eroding lower since.

Now, investors must wonder if shares will drop below $10, into the single digits.

At this point, many traders will identify this stock as having no bullish momentum — and they’re right.

We'll have to keep an eye on $11.88 on the upside to see if this area acts as resistance. On the downside, traders should watch $10.

If Snap does hit $10, though, that doesn't mean it’s a buy. Remember, Snap stock traded $7.89 at its covid low in March 2020. It’s entirely possible we see that level again.

Snap is a much better company now than it was then, but that doesn’t always matter to the market in the short term. As the old trading mantra goes, "when in doubt, stay out."