In March 2022, NYMEX palladium futures soared to a record $3,380.50 per ounce. On January 26, the price was 71.3% lower at the $969 level. In a November 22, 2023, Barchart article, I wrote, “I believe the plunge in palladium is a buying opportunity, and PALL is an ETF that could have a significant upside over the coming months.” Nearby palladium futures were trading at $1,056 per ounce, with the PALL ETF at the $97.13 level on November 22. At $88.55 on January 29, PALL declined 8.8%, while nearby futures were 8.2% lower. The ETF does an excellent job tracking palladium, which continues to be a falling knife in late January 2024.

The worst-preforming traded precious metal in 2023

Palladium was the worst-performing precious metal of the four traded on the CME’s NYMEX and COMEX divisions. After settling at $1,798 per ounce at the end of 2022, NYMEX palladium futures moved 38.3% lower to settle at $1,109.30 on December 29, 2023. In a year where gold was 13.4% higher, silver edged 0.2% to the upside, and platinum fell 7.3%, palladium’s price action was ugly. Meanwhile, rhodium, another platinum group metal that does not trade in the futures arena, did worse, posting a 62% decline in 2023.

The bull market from 2008 through 2022 ended

Gravity hit the palladium market after years when the metal outperformed the other precious metals.

The monthly chart highlights palladium’s explosive rally from the December 2008 $160 per ounce low. Palladium made higher lows and higher highs, reaching a record $3.380.50 high in March 2022 when Russia invaded Ukraine. Since Russia is the world’s leading palladium-producing country, supply fears gripped the market, leading to the spike higher.

Palladium ran out of upside steam at the March 2022 high, and the price plunged and traded under $1,000 per ounce in December 2023 and January 2024 for the first time since 2018.

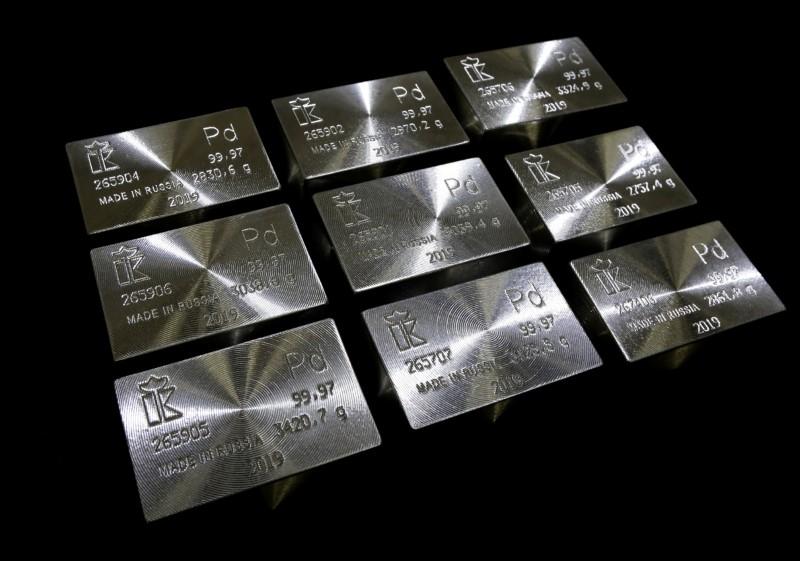

Russia is a critical world supplier- Palladium is rare

Russia is the leading palladium-producing country, with South Africa a close second. Together, they account for 80% of annual supplies. In 2022, there were 210 metric tons of worldwide palladium, with Russia producing 88 tons and South African output at 80 tons.

In 2022, worldwide platinum output was slightly lower at 190 tons as the platinum group metals are extremely rare. Gold output was 3,100 metric tons in 2022, while silver production was 26,000 metric tons.

Palladium and platinum are rare metals, and the futures markets suffer from low participation, making daily volumes and the total number of open long and short positions low compared to gold, silver, and other more liquidly traded commodities.

Industrial requirements are critical

Platinum group metals’ density and heat resistance make them crucial ingredients in the catalysts that clean toxins from the environment. Automobile catalytic converters require palladium, oil, and petrochemical refining, and fiberglass catalysts require platinum group metals.

Industrial palladium consumption includes dentistry, jewelry, electronics, electrical contacts, hydrogen storage and purification, surgical instruments, and even concert-quality flutes.

In 2022, automobile exhaust systems consumed 241.90 metric tons of palladium or 82% of total consumption. Considering production was 210 tons, there was a supply deficit in the global palladium market. The difference was likely covered by strategic reserve sales, likely from Russia.

Investors could turn to palladium as low liquidity translates to volatility

The total value of the gold, silver, platinum, and palladium futures markets sheds light on why we can expect continued price volatility in palladium over the coming months and years.

COMEX gold open interest on January 22 stood at 467,069 contracts. At $2,025 per ounce, with each contract representing 100 ounces, the value of the gold futures market was over $94.5 billion.

COMEX silver open interest on January 22 stood at 138,868 contracts. At $22.45 per ounce, with each contract representing 5,000 ounces, the value of the silver futures market was over $15.58 billion.

NYMEX platinum open interest on January 22 stood at 78,392 contracts. At $905 per ounce, with each contract representing 50 ounces, the value of the platinum futures market was under $3.6 billion.

NYMEX palladium open interest on January 22 stood at 22,278 contracts. At $945 per ounce, with each contract representing 100 ounces, the value of the palladium futures market was under $2.2 billion.

Palladium is the least liquid precious metals futures contract. Over the past years, the low liquidity pushed the price to a record high in March 2022 as offers to sell disappeared during the rally after Russia invaded Ukraine. The price decline to below $1,000 occurred as bids to purchase the futures evaporated during the bearish trend. Illiquid markets experience far more price volatility than those with high daily volumes and open interest levels.

The palladium futures arena could be in for a significant price recovery when it finds its bottom. However, the trend remains bearish in early 2024, and bear markets in illiquid markets can take prices to irrational, illogical, and unreasonable levels that defy fundamental and technical analysis. I am a scale-down buyer of palladium below the $1,000 level, using the physical market and Aberdeen Physical Palladium ETF product (PALL), which does an excellent job tracking the metal’s price action as it owns physical palladium bullion. I will leave plenty of room to add on further declines if the price action becomes irrational.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.