McDonald’s (MCD) stock has been trading pretty well lately. Given its defensive nature and the volatility in the stock market though, that’s not too surprising.

Shares are up about 3% on Thursday after the company reported better-than-expected earnings results.

Earnings rose more than 15% year over year, while revenue rose more than 10%. Both metrics topped analysts’ expectations.

As previously reported by TheStreet, “menu price hikes and solid global sales helped offset the impact of its suspension of business in Russia and higher food and labor costs.”

All in all, it was a solid quarter and it’s giving the stock a nice boost as a result. After the stock got oh-so-close to our downside target, we’ve seen a huge rally since.

Are all-time highs back on the menu?

Trading McDonald’s Stock

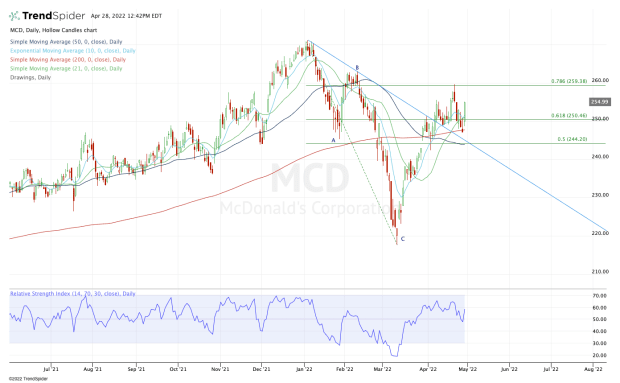

Chart courtesy of TrendSpider.com

The stock sprung off the $220 level in March, quickly erupting back up through $240, where it consolidated before continuing even higher.

Amid the move, the stock pushed through downtrend resistance (blue line) and ran to the 78.6% retracement of the current range near $260 and pulled back. When it did so, a number of moving averages were able to hold as support — which was impressive considering the strength of the selloff in the overall market over the last few days.

Now rotating higher, McDonald’s stock is trading above all of its major daily moving averages.

From here, bulls will want to see it clear the $260 area. Doing so not only puts it over the 78.6% retracement, but it also clears the April high. Should the move come next week — or at any point in May — it will give bulls a monthly-up rotation to work with.

While not much further beyond that level, a close over $260 puts the $262.50 to $263 area in play, followed by a push to $270.

The $270 area has been resistance and it’s near where McDonald’s stock finds its all-time high, up at $271.15.

If the market cooperates with a bounce and McDonald’s can continue to push higher, all-time highs may be within the realm of possibilities.

On the downside, a move below this week’s low at $247.05 sucks the momentum out of the bulls’ favor.