In a January 21, 2025, Barchart article on the lumber market, I concluded:

Bullish and bearish factors are pulling lumber prices in opposite directions as the market moves towards the 2025 construction season in spring. High interest rates could depress new home demand, while pent-up demand for new homes, reconstruction efforts in California, and shortages created by tariffs could lift prices over the coming months. We could see another explosive move to the upside if interest rates fall.

Commodity Bulletin: From crude oil to coffee, this FREE newsletter is for industry pros and rookies alikeI favor higher lumber prices over the coming months as the current price limits the downside. As we learned in 2021 and 2022, the illiquid lumber futures market could explode higher, making the upside potential far more interesting from a risk-reward perspective.

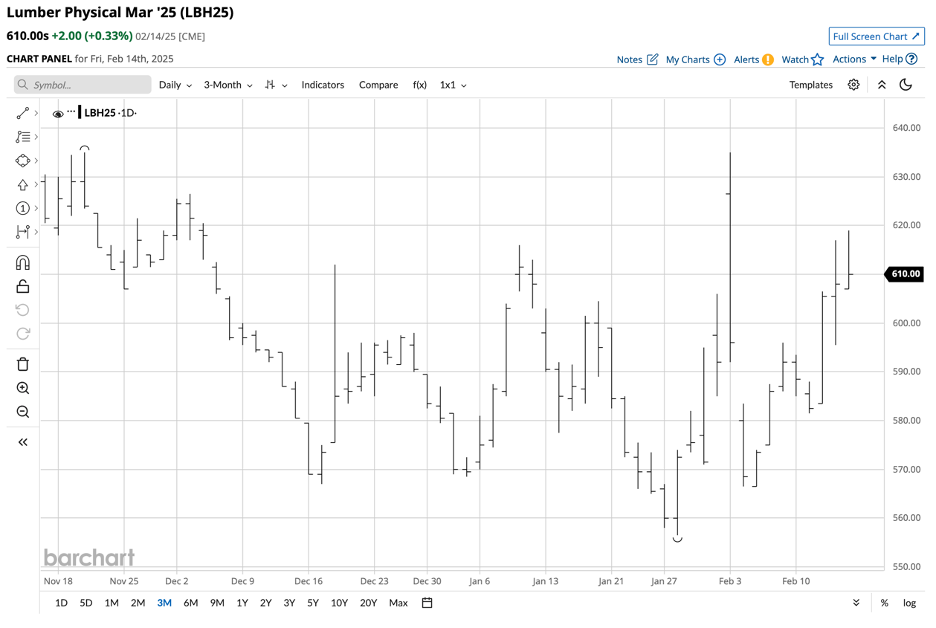

March CME lumber futures were at the $595 level on January 17 and have edged higher in February.

Lumber’s price is steady, but the trend since mid-2024 is higher

At the $610 per 1,000 board feet level, the physical lumber futures price was steady in late February 2025.

The daily chart highlights that lumber futures for March delivery have traded in a $556.50 to $635.00 range in 2025. At the $610 level, lumber was above the middle of the trading range, with $600 as a pivot point.

Tariffs did not impact the lumber futures market

U.S. President Trump did not wait long to impose tariffs on three U.S. trading partners. While he delayed 25% tariffs on imports from Mexico and Canada, the 10% tariff on China stuck in early February. Canada exports lumber to the U.S. A 25% tariff would add approximately $150 per 1,000 board feet to Canadian lumber imports to the U.S. above the current futures price.

Meanwhile, the threat of tariffs, which could be a negotiating tool, did not cause lumber futures to break out of the current trading range to the upside. Time will tell if the President begins tariffs on Canada after the thirty-day extension.

LA’s fires could be very bullish

Many homes were destroyed when fires raged across greater Los Angeles in early 2025. More than 16,000 homes and other structures were damaged or destroyed by the flames. Rebuilding will require a significant amount of wood and other building materials over the coming months, increasing lumber demand.

Meanwhile, pent-up housing demand in the U.S. will likely increase lumber demand if mortgage rates begin falling. Existing home sales remain stagnant, as many current homeowners have mortgages that are far below current rates. The lack of existing homes for sale increases the level of new home construction to meet the demand, further increasing lumber requirements.

Interest rates will guide wood prices

The U.S. Fed has cut the short-term Fed Funds Rate by 100 basis points since March 2024. The current short-term rate stands at 4.375%. Meanwhile, longer-term rates have remained stubbornly high as inflation remains above the Fed’s 2% target. As tariffs create trade barriers that distort commodity prices, inflationary pressures could remain elevated, with some analysts doubting the Fed will cut the short-term rate by another 50 basis points in 2025.

The seven-year 30-year U.S. Treasury Bond futures chart displays the bearish trend since the March 2020 pandemic-inspired high to the October 2023 107-04 low. The long bond futures have settled into a trading range not far above the low, keeping mortgage rates high and reducing the addressable market for new home building. Moreover, the lack of existing homes and pent-up housing demand have kept home prices near record highs, a double whammy that reduces the number of homebuyers who can afford to own a residence in the current environment. Rent prices have increased, inflating housing expenses for potential buyers.

Limited downside and the potential for an explosive upside

Lumber prices face bullish and bearish factors going into the spring 2025 construction season. While the demand for new homes is rising, rebuilding Los Angeles will require substantial wood demand, and tariffs threaten to boost prices, stubbornly high mortgage rates and sky-high home prices have limited the addressable market of new home buyers.

Meanwhile, at around $610 per 1,000 board feet, the price action over the past years suggests that lumber prices have a limited downside and an explosive upside potential. Prices were over $1,700 in 2021 and above $1,400 per 1,000 board feet in 2022 on the random-length lumber futures contract, more than double the current price level.

Lumber remains a highly illiquid futures market compared to crude oil, copper, and other industrial commodities. Illiquid futures markets are highly susceptible to extreme price volatility as bids to purchase can disappear during selloffs, and offers to sell can evaporate during rallies. Therefore, lumber prices can gap higher and lower, as we have seen over the past years, because of the lack of trading volume. The Chicago Mercantile Exchange attempted to bolster liquidity by delisting the random-length contract and replacing it with the physical contract with a smaller contract size and more flexible grade and delivery specifications. However, volume and open interest, the total number of open long and short positions in the lumber futures market, have not improved, suggesting that hedgers, speculators, and other market participants continue to avoid the futures arena because of the potential dangers of owning long and short positions in an illiquid and highly volatile market.

The odds favor higher lumber prices over the coming months as the fundamental supply-demand balance suggests that lumber demand will increase. While lumber prices could move lower, the upside price potential remains far greater than the downside price risk in early 2025.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.