At the end of the month, in supermarkets across Japan, regular staff and a secret army of wholesalers will work the shelves through the night on a project that none of them — from national chains to local stores — are able to talk about openly.

When the food retail industry’s collective doors open on October 1, shoppers who have barely experienced inflation since the early 1990s will be hit by the most severe price shock in almost two generations.

The prices of more than 6,000 daily food items will have soared overnight; so too, say experts whose warnings have long gone unheeded, will the Japanese public’s realisation of what it means to depend upon the most vulnerable food supply system in the developed world.

Japan’s high-quality, low self-sufficiency food system has always been a proxy for the march of globalisation. It could now become a proxy for its reversal.

The spectre of faltering food security, admit government officials, is a symbol of both the country’s decline as an economic superpower and the decaying norms of the globalised economic system that allowed Japan to thrive.

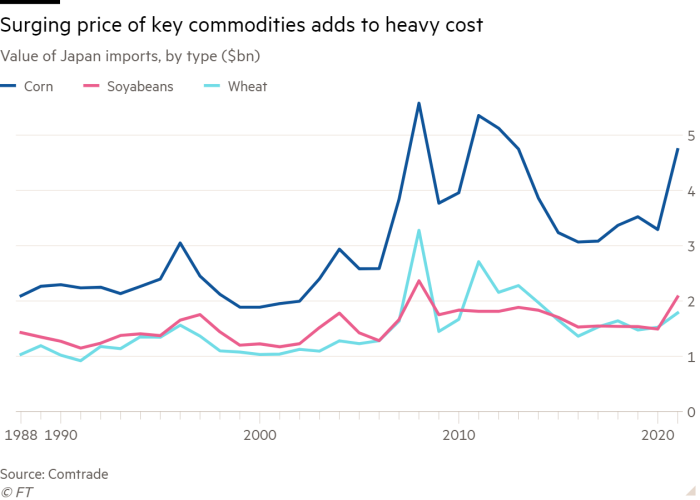

For the past year, Japan’s supermarket industry has shielded customers from a 48 per cent rise in import prices — much of that surge driven by the high cost of energy and, since March, the sustained collapse of the yen to a 24-year low against the dollar.

The choreographed effort to raise prices is in keeping with decades of habit in Japan’s fragmented and competitive supermarket industry — and in an economy that defined the phenomenon of deflation for the rest of the world. None would have felt comfortable acting on their own, particularly after more than 20 years where wages have stagnated. Now, however, unless businesses pass on the cost to consumers, they will struggle to survive.

There have been other shocks over the years, say officials, but this one feels different. Extreme weather, climate change and Covid-related disruption of logistics have highlighted the fragility of systems on which Japan has come to rely. By disrupting the global flows of food commodities, energy and chemical fertiliser, Russia’s war in Ukraine has laid bare the huge risks that Japan has, over decades, allowed to become structural within its food supply system.

If tensions between Taipei and Beijing escalate into a military conflict in the Taiwan Strait, disruption to this vital shipping route would be crippling for Japan’s food imports. Without immediate agricultural reforms, warns one of the country’s leading food experts, the sophisticated modern Japanese diet would be sent back to the rice and sweet potato spartanism of the 1940s.

The Japanese government has acknowledged the darkening threat that now hangs over its food security: the question is whether it has the time, the incentives, the human resources and powers of innovation required to avert disaster.

“What’s different from the past is that Japan’s economic status has fallen. We need to think of [a new] strategy of supplying food to everyone now that the premise that Japan can buy whatever it likes from wherever in the world at any price is gone,” says Atsushi Suginaka, director-general for policy co-ordination at the ministry of agriculture, forestry and fisheries.

“The biggest problem facing agriculture is the lack of a willingness to take on new challenges. For an ageing population, it’s difficult to try something different and that’s why we need the participation of younger people.”

Geopolitical obstacles

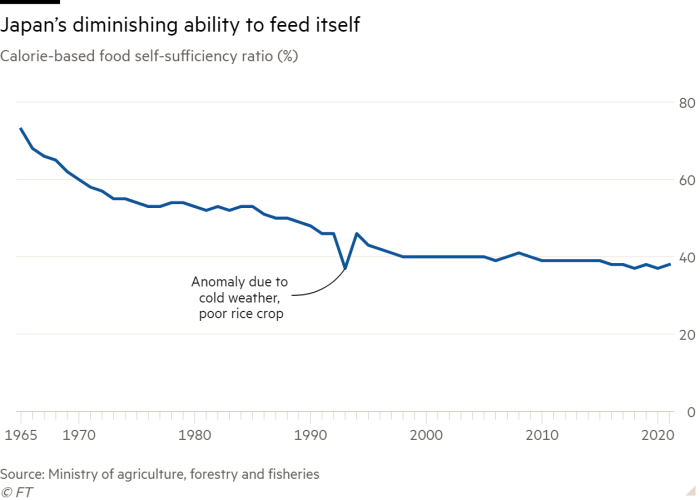

Though the October price increases are not enough to ruin Japanese households, they will provide an unambiguous reminder of the country’s food self-sufficiency rate of just 38 per cent, and its dependence on imports to make up the remaining calories consumed.

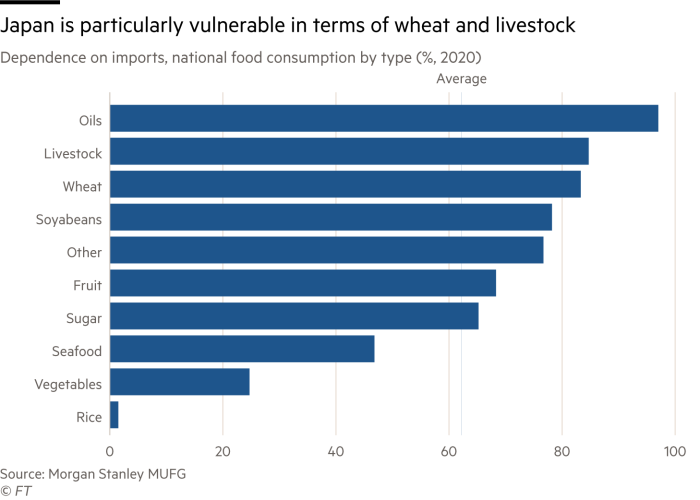

The self-sufficiency rate — now the lowest among major countries — has fallen from 73 per cent in 1965 as demand has risen for meat and other food it cannot produce on its own. Some of Japan’s dependencies, such as wheat (83% imported), soyabeans (78% imported) and edible oils (97% imported) are exceptionally skewed.

The culinary scene Japan is famed for — from backstreet ramen noodle shops ranked by Michelin among the world’s finest restaurants, to the tempura udon dishes worshipped by traditionalists and specialist breads that triumph in international baking competitions — is almost entirely dependent on the outside world.

Russia’s invasion of Ukraine has caused upheaval in global food supplies as both countries are important grain exporters, between them accounting for almost a third of the world’s traded wheat. With supplies already tight, the situation could worsen if global crop yields also decline due to the shortage and high prices of fertilisers, where Japan’s import dependence is high at 75 per cent.

Even before the war, prices for key fertilisers jumped last year after the EU announced sanctions over human rights abuses against Belarus, a leading potash producer, and China and Russia, also large fertiliser exporters, put in place export curbs to safeguard domestic supply.

So far, Japan has navigated these geopolitical obstacles by securing deals with alternative suppliers such as Morocco and Canada for phosphate, potassium and other fertiliser ingredients. Over decades, the resource-poor country has carefully cultivated a sophisticated network of trading houses and economic partners as well as contingency plans so it can get hold of many of its imported foods even in cases of emergencies such as natural disasters and armed conflicts.

But even then, officials say, Japan’s sourcing ability will be severely limited if prices continue to rise, making it impossible to compete against China and other rivals with much bigger purchasing power.

Alarmed by the looming crisis, a group of parliamentarians from the ruling Liberal Democratic party in May submitted proposals for strengthening Japan’s food security. A month later, when Prime Minister Fumio Kishida unveiled a draft of his “new capitalism” programme, a section was devoted to outlining plans to revive the agricultural industry and deploy new technologies to make the sector more attractive to the younger generation.

“To establish food security in Japan, food self-sufficiency will be improved by creating robust agriculture, forestry and fisheries industries,” it read. As part of that effort, the government will aim to boost exports of agricultural, forestry and fishery products from ¥1.2tn last year to ¥5tn by 2030.

Still, some agricultural ministry officials say the Kishida administration has placed a bigger emphasis on economic security matters in areas such as semiconductor and battery technologies in the wake of the supply chain disruptions caused by Covid-19 and the risks exposed by the war in Ukraine. The same sense of urgency should be applied to food security, these officials say, especially since Japan retains internationally competitive technology in the breeding of rice, fruits and vegetables.

“Farming remains in Japan, and it is still highly regarded overseas. That’s not the case with semiconductor technology,” Suginaka says. “There is a risk that Japan will lose its development skills and would not be able to do farming if it cannot secure fertilisers from China. Then we would be in the same situation as chips. We must make sure that we do not lose our existing advantages.”

Homegrown solutions

With a succession crisis facing many of Japan’s ageing farmers, the prospects are grim for increasing domestic production of wheat and other agricultural products to reduce Japan’s dependency on imports. Instead, a key pillar of the Kishida administration’s food security agenda rests on the use of innovation and digital technologies to boost productivity and encourage younger people into the shrinking agricultural sector.

One example of this is the new venture capital arm of Norinchukin — an agricultural bank that has since 2019 established itself as an investor in a small selection of start-ups focused on agricultural technology. This ranges from robot wheelbarrows for elderly farmers to online systems for organising the dispatch of foreign workers to farms short of human staff.

Among the start-ups tackling Japan’s food crisis is Algal Bio, a University of Tokyo spin-off which is researching the use of algae as a supplement for animal protein to feed livestock or as fertilisers. The goal is to make the entire value chain for food products self-sufficient using algae that can be homegrown on almost any kind of land.

“The solutions for Japan’s energy crisis are clear. But when it comes to agriculture, that’s not the case,” says Amane Kimura, chief executive of Algal Bio, noting that the country can turn to nuclear power and renewable energy to reduce its reliance on imported energy.

In the case of agricultural products, however, simply increasing the volume of production is not necessarily the answer since Japan would still need to import fertilisers to grow the food. “There is an increasing sense of urgency for the need to create a new value chain for foods in order to genuinely raise the self-sufficiency rate,” Kimura adds.

Japan’s vulnerability to outside shock arises from a variety of factors that go beyond the country’s fundamental dependence on imports of energy and other critical resources.

The central crisis, argues Kazuhito Yamashita, a former agricultural ministry official and now research director at the Canon Institute for Global Studies, is that the long years of relatively crisis-free reliance on imports have permitted Japan to either overlook, or actively nurture, massive problems in domestic agriculture.

In common with the rest of the Japanese economy, the nation’s agriculture is placed at immediate risk by the ageing and shrinkage of the population. The countryside has experienced this particularly acutely, as its young have migrated to cities.

But even before they left and the average age of a Japanese farmer rose to 68, Japanese agriculture was inefficient and riddled with deep structural weaknesses and distortional incentives. The average size of Japanese farms, limited by a long history of prohibitively cumbersome legal baggage associated with the sale and consolidation of farmland, is extremely small. The national average is 3.1 hectares, but that average is significantly raised by the 30ha average in the northern island of Hokkaido.

Reform is vital, experts say, but there is currently little political momentum behind streamlining the sales of agricultural land to consolidators that could ultimately increase.

“Despite progress in agriculture reform, a much bigger crisis may be needed in order to trigger a response large enough to achieve the resilience and sustainability needed in the Japanese food supply chain,” said Morgan Stanley economist Robert Feldman.

Let them eat rice

In a recent study of the increasingly acute concerns around Japanese food security, Morgan Stanley analysts highlighted one of the key misconceptions that have provided both politicians and the general public with a false sense of security.

Despite the ever increasing ratio of imported to domestically produced food, Japan has historically remained politically committed to the idea that the nation should be 100 per cent self-sufficient in rice and that the price of domestic rice should remain artificially high.

That commitment, says Yamashita, has created some of the most dangerous distortions to Japan’s food supply, particularly as average rice consumption in Japan has fallen from a peak of 118kg a year in 1962 to 53.5kg in 2018.

In the face of that declining popularity, driven by the fact that the population is ageing and older people generally consume less food, the effort to maintain domestic rice at the highest price anyone in the world pays for the grain has created a system where owners of high quality farmland are incentivised not to grow rice and, therefore, squeeze supply.

“The Japanese government should have used a policy of allowing rice prices to fall in order to control its production and increase demand for rice while raising wheat prices to increase its production and control demand for wheat,” says Yamashita. “In reality, it implemented a policy that has achieved the exact opposite.”

The danger behind the dogma of rice self-sufficiency, say analysts, is that it has created a complacency whereby the threat of external shock on the food system is dismissed with the response, “Well, we will just eat more rice.”

Unfortunately, according to calculations by the investment bank Morgan Stanley, that is impossible. Wheat consumption in Japan, the bank said in a recent research paper, provides about 324 kcal a day per person and rice consumption about 519 kcal. If all of the wheat was replaced by rice, then rice production would have to rise by about 62 per cent.

There are two possible ways Japan could attempt to achieve this: either by finding extra paddy land or by raising the productivity of each hectare under rice cultivation. The implied additional demand of 4.8mn tonnes would require 900,000ha of new rice paddy cultivation. The government, meanwhile, estimates that the total of recoverable unused farmland in 2020 was 90,000ha.

Raising productivity would also be a non-starter, analysts say. Between 2000 and 2020 output per hectare grew by 0.184 per cent a year on average. At this pace, according to Morgan Stanley’s research, increasing output per acre by 62 per cent would take 262 years.

Meanwhile, the threat of external shock rises. “Japan has some very bad neighbours: North Korea, China and Russia. We could have a food crisis if there is some sort of incident in the Taiwan Strait and the imports of food are disrupted,” adds Yamashita, who argues that the Japanese government’s obsession with maintaining high rice prices made a mockery of its stated new concerns regarding food security.

For too long, Japan had underestimated its food security risks, says Akio Shibata, president of the Natural Resource Research Institute. Similar to how the country’s manufacturers expanded by building plants worldwide, its food strategy was also based on the pursuit of economic efficiency and global trade — which in turn was a symbol of Japan’s status as a global economic power.

“The reality now is that Japan can no longer get hold of food or energy resources at reasonable prices, and it needs to reverse its strategy of depending so heavily on the outside world,” Shibata said. “There were signs of strain from before, but Japan had not taken action thinking it was a temporary phenomenon. Now it may be too late to reverse course.”