When it comes to semiconductor stocks, Intel (INTC) has certainly lost a bit of its reputation vs. its peers.

Nvidia (NVDA) and Advanced Micro Devices (AMD) are shining bright in the semiconductor spotlight, despite the recent weakness in the latter.

Other names have continued to trade well too, like Broadcom (AVGO), Super Micro Computer (SMCI) and more recently Micron (MU).

Over the past year, Intel stock is down 31%, lagging all of its peers listed above. However, it’s trying to claw back some of those losses on Friday.

DON'T MISS: Buy or Sell Amazon Stock on Earnings? Chart Lends a Clue

Shares were up 9% at the session high and are currently up 3.5% at last glance as the company rallies after its earnings report. A better-than-expected loss and revenues that exceeded consensus expectations has investors in good spirits.

The news may be bullish for investors, even amid a backdrop of other issues. For now though, let’s see how the charts look.

Trading Intel Stock on Earnings

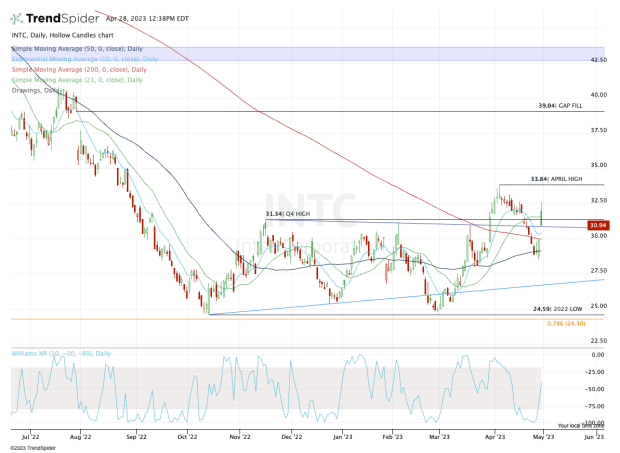

Chart courtesy of TrendSpider.com

Intel stock opened near $32 this morning, putting it above the 10-day, 21-day and 200-day moving averages, as well as a key resistance area near $31.

The fourth-quarter high at $31.34 has served as notable resistance for several months now, as has downtrend resistance (blue line).

The technicals were looking pretty good when shares were trading near $32.50. Now pulling back though and bulls will really want to see Intel stock hold up above the $31 area.

This level has kept shares in check for most of the year, with the exception of an upside burst in early April.

DON'T MISS: Zoom Video Stock Has Slumped; Is It Time to Buy?

If the $31 area can’t act as support, the gap-fill is back in play at $30. Below that and this week’s low near $28.50 is vulnerable for a retest.

On the upside, it’s quite simple. Bulls need to see a move over $32.50 for a sustained rally to occur. If it happens, that could open the door up to the April high at $33.84.

Above that level and $35 or higher is possible.

For now, let's see if $31 holds as support.