General Motors (GM) has not had an easy run lately. Shares are down 2% so far on Tuesday and were down as much as 6.2% at the lows.

The move comes after Morgan Stanley analysts downgraded the stock and lowered their price target to $55. That’s a significant reduction from the prior target of $75.

They argue that GM’s move to electric vehicles (EV) will “likely produce a negative compound annual growth rate, in terms of overall revenues, between now and the end of the decade.”

Today’s decline is causing even further weakness in the stock, as it’s now down five days in a row.

It doesn’t help that General Motors stock has declined in each session since reporting earnings on Feb. 1. Then Ford (F) stock fell after reporting earnings two days later, adding more selling pressure to the group.

While Ford stock has a pretty clear buy-the-dip setup, the charts for GM stock are less clear. Let’s take a look at the charts and see what key levels are in play.

Trading GM Stock

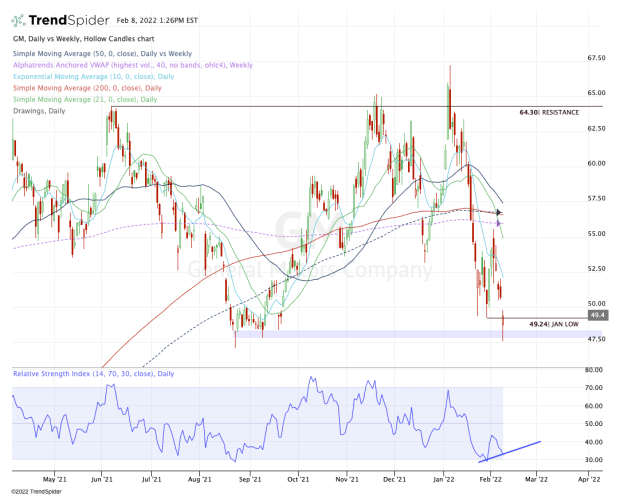

Chart courtesy of TrendSpider.com

There are a couple of things to note when I look at the chart.

First, I like seeing that there is some bullish divergence on the RSI reading at the bottom of the chart. Even though GM stock is making new lows, the RSI is not.

Without any sort of reversal or rotation though, this divergence is meaningless and even worse, it can be misleading.

However, shares are reversing, with GM stock reclaiming the January low at $49.24. This is key for the bulls.

Investors now need to see the stock hold up over this level, opening the door to $50, followed by a gap-fill up at $50.52. Above that and we could see a test of the declining 10-day moving average.

If GM can really catch a wave of momentum, perhaps last week’s high near $55 could be in play, along with the 21-day moving average.

Given the bearish momentum in both Ford and GM at the moment though and this feat does not seem to be in the cards over the short term.

This morning’s bounce came from the third-quarter support zone near $48. Should GM stock trade lower and break below this zone (as well as Tuesday’s low), then we may see more selling pressure in the days and weeks ahead.