Shares of FedEx (FDX) at last check were up more than 4% following the package-delivery major's better-than-expected earnings report.

Of course, it helps that the stock market is enjoying a nice rally on the day as well.

The day before the report, FedEx stock hit a one-month low, while at today’s high the shares were up almost 6.5%.

The rally comes after the company delivered an earnings beat fueled by cost cutting, while missing on revenue estimates as sales declined almost 3% year over year. Full-year guidance wasn’t all that promising.

But the rally is a pleasant surprise for a stock that has dropped by about a third this year.

The report is also giving a boost to peer United Parcel Service (UPS), which is up about 1.5% on the day.

The question bulls have is simple: Can the FDX rally continue?

Trading FedEx Stock

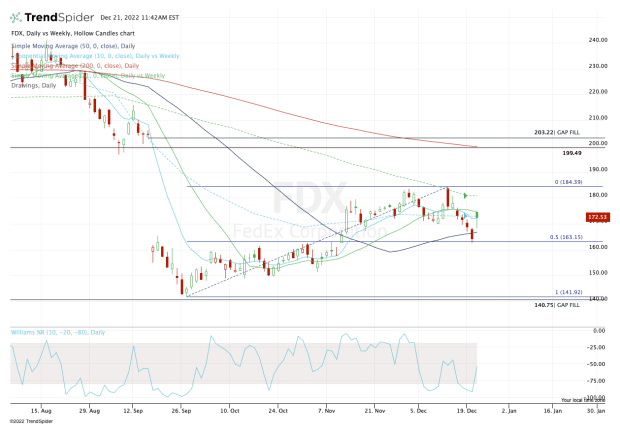

Chart courtesy of TrendSpider.com

FedEx stock suffered a nasty drop of 21% on Sept. 16, when it previously reported earnings. But the stock bottomed a few days later and began trading in a slow but steady uptrend.

Amid that rally, the 21-week moving average was resistance, while support came into play near the 50-day moving average and 50% retracement.

Now the stock is stuck between both those measures, and traders must be patient.

Let’s keep an eye on $175, which comes into play just ahead of Wednesday’s current high. If FedEx stock can clear this level, it will put it back above the 10-day, 10-week and 21-day moving averages.

That would open the door to the 21-week moving average, then this month’s high at $184.39.

What the bulls really want to see is a move up through those two levels. That would technically put in reach the $200 area and the declining 200-day moving average.

On the downside, the bulls would hate to see FedEx stock lose the 50-day moving average.

That would put the 50% retracement and this week’s low back in play near $163. If this level were to be tested and fail as support, that would put $158 in play, followed by $150.