Boeing (BA) stock has had some turbulence after the aerospace giant reported earnings before the open. It's now trying to gain altitude.

The shares at last check were off just 0.2%. At the session low, Boeing stock was down more than 4%.

The moves come after a mixed report from the company, as Boeing reported a top- and bottom-line miss, but stronger-than-expected free cash flow.

While the free cash flow results were unexpectedly good, the bottom line has investors hesitant to buy the stock. That’s as Boeing reported a loss of $1.75 a share vs. expectations for a slight profit.

Of course, the overall price action in the stock market isn’t helping matters, as Microsoft’s (MSFT) post-earnings dip weighed on Big Tech in early trading.

Coming into the report, Boeing stock was up 75% from the Sept. 30 low. Had the gains been more muted coming into the print, then we’d likely see a better reaction today.

That said, the trend has been incredibly strong in this name.

Trading Boeing Stock

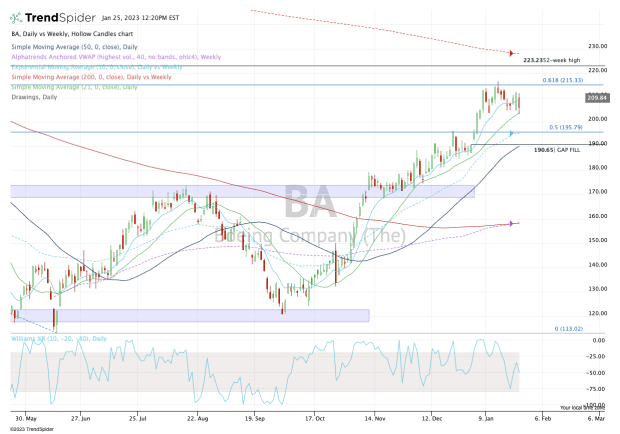

Chart courtesy of TrendSpider.com

When a stock rallies aggressively into an event like earnings, it raises the bar for what the company needs to deliver for that price to continue higher. For Boeing, that bar got pretty high and thus we’re seeing a little air come out of its stock price today.

That said, down less than 1% is a pretty favorable reaction for a stock that’s rallied so much from the low.

Today’s pullback sent Boeing stock down to the 21-day moving average, its first test of this measure since Dec. 7. So far, the reaction has been the same, as the stock bounces nicely from this level.

Aggressive bulls can be long from that bounce zone and fish for higher prices so long as Boeing holds above today’s low of $203.11.

If the shares can clear the $215 to $216 resistance zone — which is also the 61.8% retracement — that opens the door to the $223 to $225 zone. That’s where Boeing finds its current 52-week high, as well as the declining 200-week moving average.

On the downside, there would be a high-conviction buy-the-dip setup if we saw a correction down to $190 to $195 zone.

That’s where we find a major breakout zone, the 10-week and 50-day moving averages and the gap-fill level.