Apple (AAPL) is often be a market mover, literally since it commands a market cap of roughly $2.5 trillion and figuratively in that the iPhone producer carries a lot of weight in regard to investor sentiment.

Apple started off the year on a rather downbeat note, notching a 52-week low in the first trading session. Since then, though, it’s been a much better run for the bulls.

Don't Miss: Can AMD Stock Break Out as a Big Investor Takes a Stake?

It ripped off four straight weekly gains, rallying more than 26% in the process, as investors were willing to overlook a less-than-stellar quarterly report.

On Monday, Goldman Sachs analysts initiated the stock with a buy rating and $199 price target, sending Apple stock higher by 3% at last check.

The shares are now up more than 8% in the past three days, but on the flip side, a big resistance area is nearby.

Trading Apple Stock

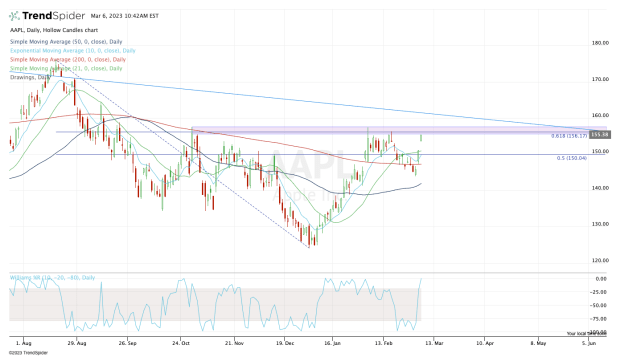

Chart courtesy of TrendSpider.com

The previous rally into early February ran out of steam in the mid-$150s. That’s also where it faded in October, as the fourth-quarter high stands at $157.50.

Further, the 61.8% retracement is in this zone as well, at $156.17.

With that in mind, bullish traders may want to take note of the $155 to $157.50 region. Apple stock has struggled with this zone for several months and there’s reasonable skepticism about the stock breaking out over this area.

That said, this could be a situation of “the third time's the charm.”

If that’s the case and Apple stock breaks out over $157.50, I would keep an eye on the $160 to $161 region. That’s where downtrend resistance comes into play (blue line).

Above that and $165 is on the table.

Don't Miss: Costco Stock Nears a Must-Hold Support Level After Earnings Dip

If resistance holds strong, the bulls will first want to see Apple stock hold the $150 level, as well as the 10-day and 21-day moving averages. Below that and further weakness might be in the cards.

Ideally, the shares will stay above last week’s low at $143.90.

Again, keep in mind how important Apple is to the market, both from a size perspective — and thus its impact on the broad market — as well as in regard to investor sentiment.