Advanced Micro Devices (AMD) for weeks now has been riding the artificial-intelligence coattails of Nvidia (NVDA).

AMD stock fell more than 9% on May 3 after the firm’s disappointing outlook weighed on investor sentiment.

Just a day later, though, the shares rocketed after reports surfaced about Microsoft (MSFT) and AMD working together on an AI chip.

While there’s been some denial of those reports, the sentiment hasn’t cooled off.

Don't Miss: Walmart Stock Has Been on Fire. Here's the Dip-Buying Opportunity.

A robust outlook from Nvidia a few weeks later reignited the long trade in AMD, which has enjoyed a 64% rally from off its post-earnings low to last week’s high.

Now, AMD shares are seesawing back and forth, trying to consolidate the recent gains without giving up too much ground.

When to Buy AMD Stock

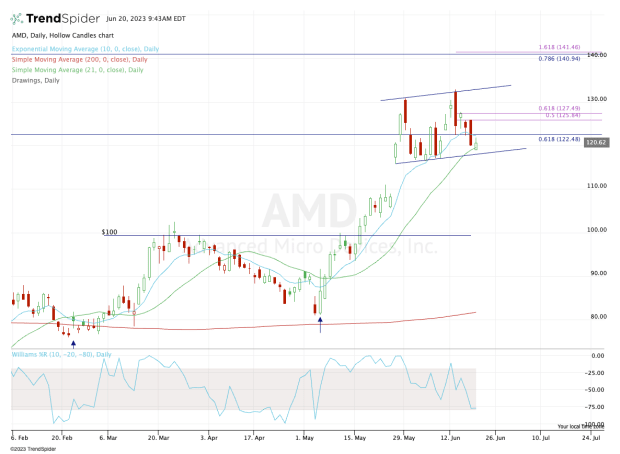

Chart courtesy of TrendSpider.com

AMD stock didn’t quite test the 200-day moving average on its post-earnings slump, but the low-$80s ultimately held as support as this stock quickly made its way back to and eventually through $100.

After Nvidia’s earnings report, AMD gapped up to a new trading range, currently between the $117 area and the low-$130s. So far, that range is being marked by higher highs and higher lows.

With the recent dip, AMD stock is trading down into the 21-day moving average — it’s first test of this measure in about six weeks — as well as range support.

If this zone fails to hold as support, then the $116 to $117 area will be called into action. Below that and AMD could go on to fill the gap down around $109.

Don't Miss: Snap Stock Set to Break Out Like SoFi, Upstart?

On the upside, the bulls want to see Advanced Micro Devices regain the 10-day moving average. Ideally, it will also clear the $126 to $127.50 zone, which is the 50% to 61.8% retracement zone of the current dip.

Should it get back above those marks, the low-$130s are back in play, as well as the recent high up at $132.83.

No matter how traders slice it, AMD remains in a bullish trend. The stock may be working on its fourth decline in the past five sessions, but it has generated substantial gains over the past few weeks (as well as the past few months).

Until support starts to fail, the bulls remain in control. For now, see that $116 to $117 holds as support.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.