FAANG is an enormous part of the market, not only because of its size but because of sentiment as well.

While it’s got some heavy-hitting names in the group, it lacks some of the other important stocks out there, like Tesla (TSLA) and Microsoft (MSFT). Still, FAANG plays a critical role in the stock market.

Take Apple (AAPL) — the biggest stock in the market with a $2.75 trillion market cap — and Amazon (AMZN). Both stocks have been charging way higher, up 33% and 42% from the 2022 lows, respectively.

The rallies have been nothing short of amazing. The question many investors have now is: Can these holdings continue to lead the broader market move higher?

Trading Apple Stock

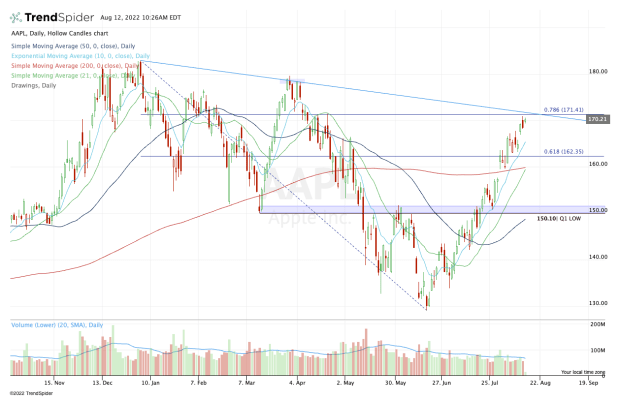

Chart courtesy of TrendSpider.com

Apple shares have traded higher in six straight weeks and in seven of the past eight weeks. The chart above shows how fast and furious the move has been.

Now that Apple stock is coming into an area of interest on the charts, I am curious to see how it handles the current zone. The 78.6% retracement comes into play near $171.50, while downtrend resistance is just above this measure (blue line).

If Apple can push through this area, the move could be very impressive, unlocking a potential push into the $177.50 to $180 zone. Any move to or above $180 has been tough for Apple stock to maintain traction, and I suspect the same in this scenario.

On the downside, the 10-day moving average has been active support. That will be the expectation when Apple shares do finally pull back.

If this level does not hold, $160 is a reasonable pullback target. Not only was this level post-earnings support, but it’s also where we find the 200-day moving average.

Trading Amazon Stock

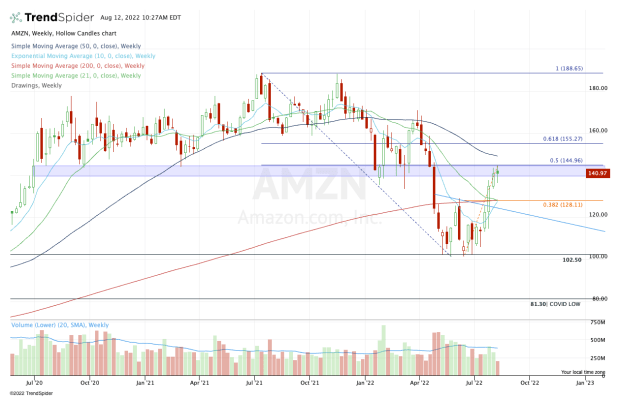

Chart courtesy of TrendSpider.com

Amazon’s push has been less consistent but more potent. The shares are up in four straight weeks and in five of the past six. A large part of the rally can be attributed to earnings, where Amazon stock jumped 10.4% in a single day following the results.

It helped that the shares had rallied 6.5% over the span of two sessions ahead of the report as well.

In any regard, Amazon stock is running into a tough spot near current levels. The $145 level was previous support and while the stock was volatile in the first quarter of 2022, the $140 to $145 zone held up well.

However, it failed as support in the second quarter: The shares plunged below this zone. Additionally, the 50% retracement comes into play near the $145 level, as does the 10-month moving average.

All these measures give me pause here. But if Amazon stock can push higher, the 50-week moving average could be in play near $150, then the 61.8% retracement above that.

On the downside, $128 stands out to me. Currently, the bulls will find the 10-week, 21-week and 200-week moving averages in this zone, as well as the 38.2% retracement of the current rally.

If AMZN shares do dip that far, that may be the first significant area of support.