Campbell Soup (CPB) was up 4.5% at last check after its better-than-expected earnings. That's enough to send the stock to 52-week highs.

If we’ve learned anything this year, it’s the importance of relative strength. It’s what I’ve been highlighting lately, with stocks like Ulta (ULTA), TJX (TJX) and solar stocks.

Campbell Soup stock's ability to make new annual highs in a tough trading environment like this shouldn’t be overlooked.

Of course, it helps when the company delivered a top- and bottom-line beat before the open, aided by 15% revenue growth.

Even better, management raised its guidance for the full year. It now expects revenue to grow 7% to 9% vs. consensus estimates of 5.1% and a prior outlook of 4% to 6% growth.

For earnings, management expects $2.90 to $3 a share vs. a prior outlook of $2.85 to $2.91 a share and compared with the consensus estimate of $2.91 a share.

Trading Campbell Soup Stock on Earnings

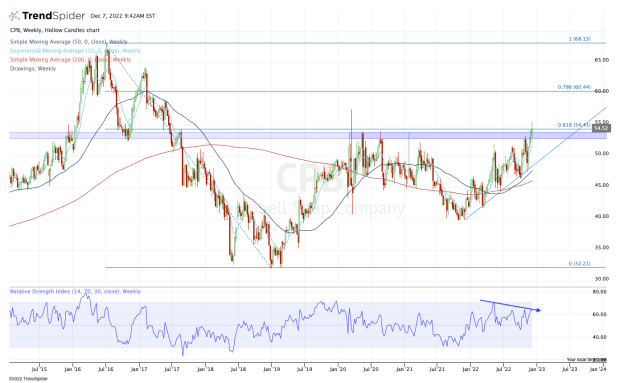

Chart courtesy of TrendSpider.com

On the weekly chart above, Campbell Soup stock is attempting to clear a major area between $52 and $54. Also in the mix is the 61.8% retracement at $54.41.

With Wednesday’s rally, the stock is hitting its highest level since the first quarter of 2020.

If Campbell Soup stock can clear this area, it could set up for a rally to the 78.6% extension near $60 a share.

Ultimately, very long-term bulls will look to make sure that the trend remains intact for a push up to the $65 to $68 area.

On the downside, seeing some consolidation wouldn’t be the worst thing in the world. There’s also some bearish divergence on the RSI reading (noted at the bottom of the chart), but it’s nothing to panic about until and unless Campbell Soup stock breaks trend and rotates lower.

Without price confirmation, none of these indicators mean very much.

That said, if the stock can stay above the 10-day moving average and the $52.50 to $54 area, then the price action is quite healthy. Short-term traders should use that as their benchmark if they're looking to buy the dip.