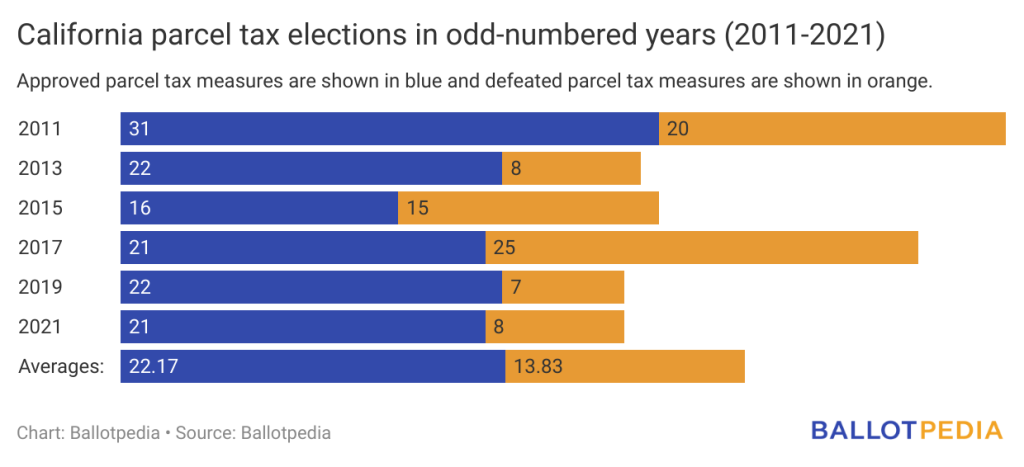

From 2011 to 2021, voters decided 216 parcel tax-related ballot measures in California during odd-numbered year elections. Voters approved 133 (61.57%) and rejected 83 (38.43%). Through April, voters have decided on nine parcel tax ballot measures in California in 2023. Eight (88.89%) were approved, and one (11.11%) was defeated. This approval rate is higher than the average for odd-numbered years from 2011 to 2021.

On average, 36 parcel tax-related measures appeared on ballots in California during an odd-numbered year.

Parcel taxes are a form of special property tax, which must be paid by the owners of parcels, or units, of real estate. However, unlike standard property taxes, which are based on the value of the property, a parcel tax is an assessment based on the characteristics of the parcel. These assessments can include taxing a parcel based on square footage or by dwelling unit, or the tax may be a flat rate per parcel.

Parcel taxes can be imposed by public school districts and on other local units of government, including cities, counties, and special districts. California is the only state that allows parcel taxes as a method for funding schools.

Of the parcel taxes approved by voters in 2023, South Pasadena Unified School District had the highest parcel tax measure, which asked voters to renew a current parcel tax at a rate of $4,764 per parcel for seven years to provide education funding.

The one parcel tax measure that was defeated by voters would have established a tax based on the square foot of buildings ($0.32 per square foot of homes, $1.42 per square foot for lodging, and other rates) to provide funds to acquire, operate, and maintain the Napa County Fairgrounds.

The measure that had the highest vote of approval was in the Salmon Creek Fire Protection District in Humboldt County, which was approved with 111 (96%) voters in favor and five (4%) opposed. The measure enacted a $75 per year special tax for each parcel to fund the Salmon Creek Volunteer Fire Company.

In 2023, Ballotpedia is covering local ballot measures that appear on the ballot for voters within the 100 largest cities in the U.S., within state capitals, and throughout California. You can review the coverage scope of the local ballot measures project here. Ballotpedia is also covering a selection of election-related and policing-related ballot measures outside of the largest cities.

Additional reading:

Parcel tax elections in California