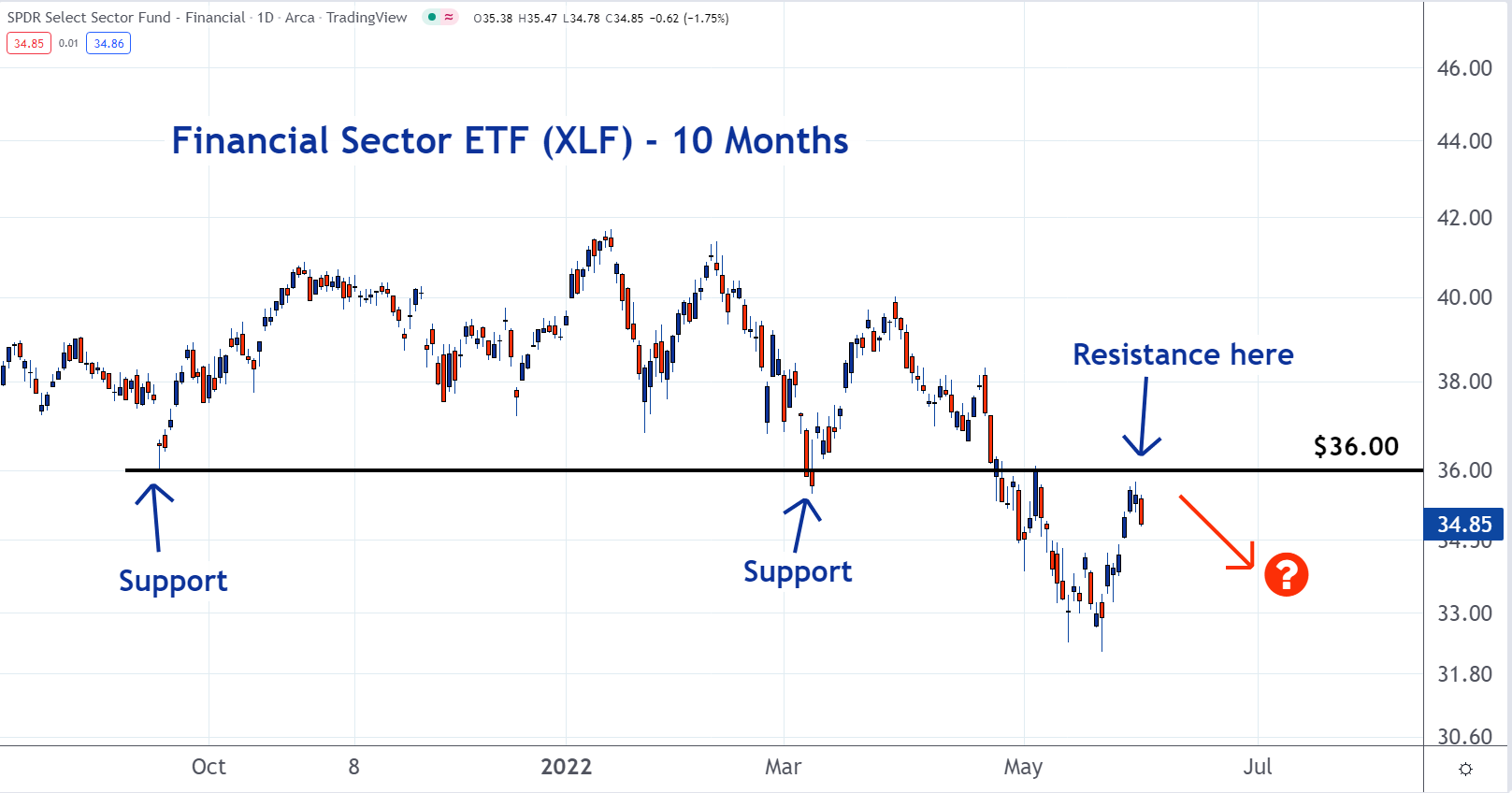

In the stock market, levels that had been support can convert into resistance levels. This may have just happened with the Financial Select Sector SPDR Fund ETF (NYSE:XLF), which means it may trend lower.

The conversion from support to resistance happens because of buyers’ remorse. As you can see on the chart below, the $36 level was important support for XLF in September and March. Many investors bought the ETF when it was there.

But now the price is lower.

A number of the investors who still hold it now regret their decision to buy. They want out, but they're reluctant to take a loss.

As a result, they place their sell orders at, or close to, the same price they bought at. In this case, it’s $36. If there are enough of these sell orders, it will create resistance and that’s what happened here. It could be the start of a new downtrend.

To learn more about trading, check out the new Benzinga Trading School.