Too many investors remain focused on bitcoin, growth stocks and FAANG. While they play an important role in the stock market, they don’t play the only role.

Entire groups continue to trade well. Energy is one, while financials and retail stocks also have some shining stars.

One such star? Walmart (WMT).

While shares of the Bentonville, Ark., retail giant had been decimated earlier this year due to a multitude of macro pressures, the stock has been trading much better lately.

The company’s recent earnings report helped jumpstart the most recent rally. Walmart stock rallied 6.5% the day it reported. It has since climbed about 11%, rallying in eight of nine trading sessions since the earnings.

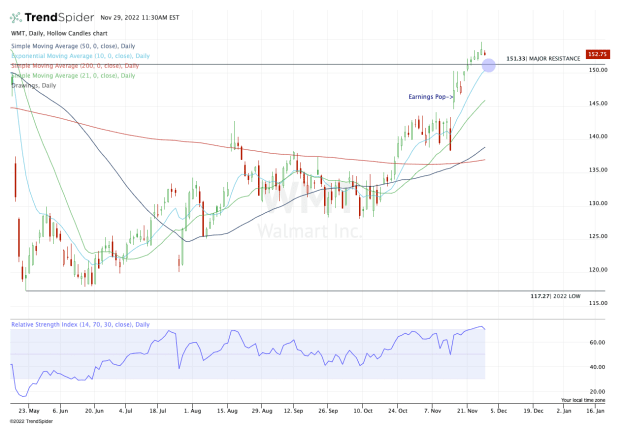

Even though Walmart stock is not making new 52-week highs, it’s hitting its highest level in six months. Let’s look at the chart.

Trading Walmart Stock

Chart courtesy of TrendSpider.com

For traders, it’s imperative to find the relative strength in the market. Sometimes that’s easy, like during raging bull markets. Other times — like now — it’s not so easy, but the stocks are there for those willing to find them.

The type of leadership we’re seeing from Walmart stock is key for bullish traders. Specifically, they should be looking to buy the dips on strong stocks.

In the case of Walmart, I’m looking at the $150 to $151.50 area.

There we find a major prior resistance level — which is really between $150 and $152 — as well as the rising 10-day moving average. Further, $150 was initially resistance after the earnings but eventually gave way.

If the bulls are in control, this is the area they will defend when Walmart stock pulls back.

Should support fail, it opens the door down to the rising 21-day moving average and the post-earnings low at $144.55.

That’s followed by the $142.50 to $143.50 area, which was resistance ahead of the earnings.

Should the most immediate support area hold, the bulls can look for a bounce back up to the recent high near $154.50. If Walmart stock can clear $155, it opens the doors back up to the $160 area.

.jpg?w=600)