Shares of Procter & Gamble (PG) at last check were down about 1% in a declining stock market.

At one point, P&G shares were down 2.5%. Now it’s down about the same amount as the S&P 500.

Investors obviously were hoping for a better post-earnings-report response in P&G, but at least the stock is finding some buyers after a down open.

The company reported roughly in-line earnings results and a slight sales beat for its fiscal second quarter. And management gave a slight boost to its full-year guidance.

Management now expects all-in sales to range from down 1% to in-line vs. a prior outlook of down 3% to down 1%.

One problem? The company reiterated its earnings outlook of flat to 4% growth, meaning the expected improvement in revenue won’t give much of a boost to the bottom line.

Still, the post-earnings reaction could be worse, particularly given the action in the overall market.

Trading Procter & Gamble Stock

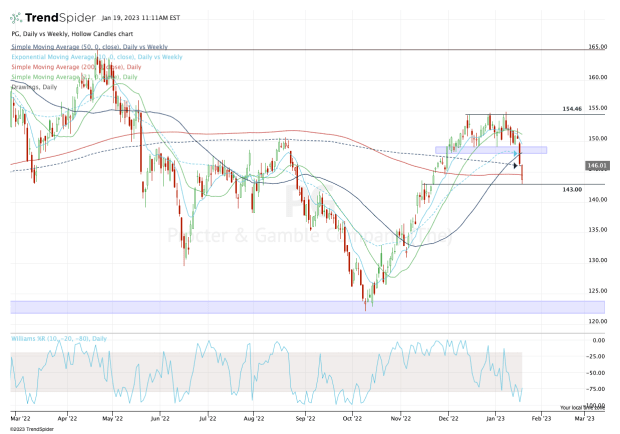

Chart courtesy of TrendSpider.com

After opening below the 200-day moving average, the shares traded down to the $143 area — a breakout level from November — and turned higher.

In other words, Procter & Gamble stock held a key area and is working to reclaim a number of key measures on the upside. So far, it’s back above the 200-day, which is a great start.

From here, aggressive longs could be long P&G with a stop-loss just below today’s low. Fresh buyers and those who are already long alike would love to see the stock continue to reclaim key areas.

Specifically, the stock is trading back to the 50-week moving average and has now filled the gap.

On the upside, a further push will put the $148 to $149 area in play, which was recent support and where the 10-week and 50-day moving averages come into play.

Back above $150, and P&G bulls will be looking for the stock to retest recent resistance near $154 to $155.

On the downside, it’s key for shares to hold the $143 lows. A break of that level puts the $138 to $138.50 zone back on the table.