PepsiCo (PEP) has quietly enjoyed a nice upside ride in 2023.

As of last Monday’s high, shares were up almost 18% from the 2023 low and were up about 9% year to date. At that time, shares were also riding a three-month win streak and hitting all-time highs.

Put simply, it was a pretty good time to be a PepsiCo shareholder. However, the last seven trading sessions have put a damper on that.

Including today’s near-1% dip at last glance, PepsiCo stock has fallen in seven of the last eight sessions. That streak is broken up only by a meager 0.15% gain on Friday.

From last week’s high to this week’s low, shares are down more than 6%. For a tech stock, that’s nothing. But that's a pretty big move for a stock like PepsiCo, as the decline has wiped out a bulk of the stock’s year-to-date gains (it’s now up just 2.2% in 2023).

Don't Miss: Amazon Stock Has Done Well -- and Now Investors Can Buy the Dip

Interestingly, defensive stocks like PepsiCo were seeing market strength just a few weeks ago and many were hitting new highs as a result. Now though, this group is having the rug pulled out from under it.

We’re seeing similar price action in Walmart (WMT), McDonald’s (MCD), Mondelez (MDLZ), Coca-Cola (KO) and others.

Time to Buy the Dip in PepsiCo Stock?

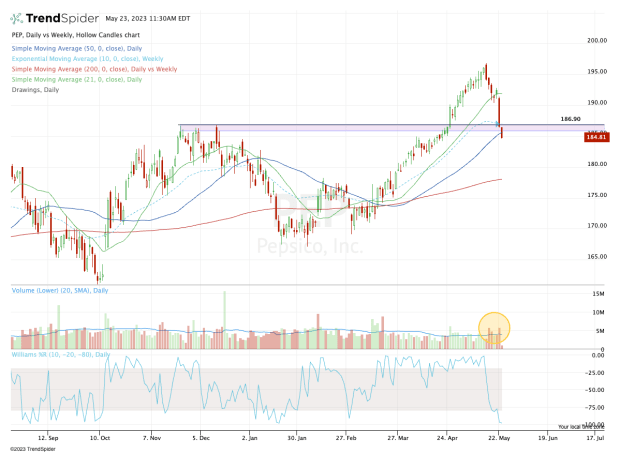

Chart courtesy of TrendSpider.com

The chart of PepsiCo stock looks heavy. What I mean by that is, the stock seems to be effortlessly knifing through support, while volume has been above average. It’s not robust volume necessarily, but bulls would likely feel more confident if the decline was being met with buyers and if it was occurring on lower volume.

At the heart of the issue? The $186 to $187 zone.

In this area we have the 10-week and 50-day moving averages, as well as a key prior breakout zone.

Don't Miss: Can AI Power Nvidia Stock to All-Time Highs?

It would be one thing if PepsiCo quickly bounced from this area or broke below it and quickly reclaim it, but shares continue to trade near session lows — and notably, below this zone.

Ideally, bulls will see this area hold as support. For those buying now, the $183 to $184 zone should hold if shares are going to make a stand.

On the upside, traders can trim their position if we get a bounce into the low-$190s. For now though, that’s a secondary concern vs. looking for support to take hold.