Nvidia (NVDA) stock is working on its third straight daily decline on Tuesday, which has it lower for the week. For a stock that’s rallied in 11 of the last 12 weeks, a down week surely stands out.

However, bulls shouldn’t be too quick to give up the best-performing stock in large-cap tech.

Earlier this month, I called Nvidia “One of the Best Stocks to Own Right Now” in the midst of the stock rallying almost 24% amid a nine-day win streak.

Simply an observation, Nvidia’s perception of being one of the best stocks of 2023 is backed up by data.

Don't Miss: Cathie Wood's ARKK ETF Pressured a Bit. Has It Bottomed?

Of the dozen US publicly traded equities with a market cap in excess of $400 billion, only three stocks have generated a year-to-date return of 50% or more: Nvidia, Tesla (TSLA) and Meta (META).

Nvidia’s 79% gain for the year easily tops Tesla and Meta’s gains of roughly 66% and 52%, respectively. The next-best performer — Apple (AAPL) — sports a gain of “just” 20% this year.

Now though, traders must gauge whether Nvidia stock has outrun its buyers. Put another way, has the stock rallied too far, too fast?

Trading Nvidia Stock

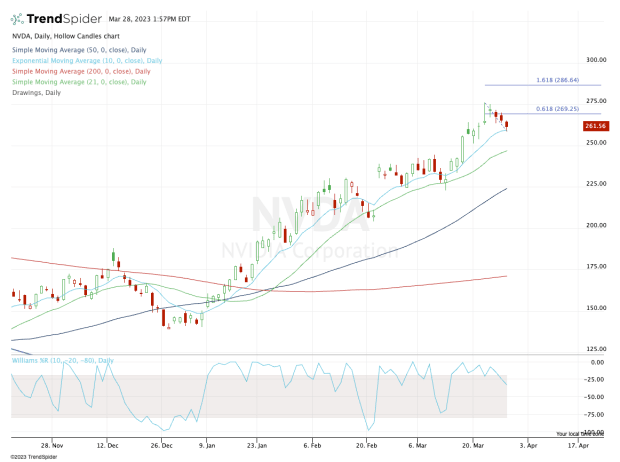

Chart courtesy of TrendSpider.com

Nvidia stock has been a monstrous performer, but now traders have to be a little more cautious. Meaning that stocks can’t surge higher at this pace forever and at some point, Nvidia will need a larger correction and/or some consolidation.

With that said, it’s hard for bulls to fight a bullish trend until it fails.

Aggressive buyers can try being long Nvidia stock against today’s low at $258.50. A break of this level — and especially a close below it — may have investors looking at the $250 area and the 21-day moving average.

For now, Nvidia is finding support at the 10-day moving average.

Don't Miss: Cybersecurity Stocks Are Surging. Here's the Trade Now.

On the upside, look to see how the stock handles $270. Above that mark puts the recent highs in play near $275.

If Nvidia stock is able to find its footing and ramp back to new 2023 highs, then it could open the door up to the 161.8% extension near $286.

Tired as Nvidia may be, the trend is still a friend for the bulls. Let’s see if we can get one more solid bounce out of this stock.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.