Some warning signs are going off on Monday morning, one of them courtesy of Lululemon Athletica (LULU).

The athleisure apparel specialist's shares were off as much as 12% after the open following a bearish update. The overall market is rallying nicely on the day.

Lululemon stock is hitting multimonth lows after management warned that gross margins contracted slightly last quarter.

Previously, management expected gross margins to expand by 0.1 to 0.2 percentage point. Instead, gross margins likely contracted about 1 percentage point in the quarter.

Management also estimates fourth-quarter earnings at $4.22 to $4.27 a share vs. a prior outlook of $4.20 to $4.30 a share. Further, management now expects revenue of $2.66 billion to $2.7 billion vs. a prior outlook of $2.605 billion to $2.655 billion.

It seems like a knee-jerk reaction given that the news isn’t that bad. Macy’s (M) also provided a negative update this morning, while Abercrombie & Fitch (ANF) provided a bullish update. So write it all down to a mixed morning for the retailers.

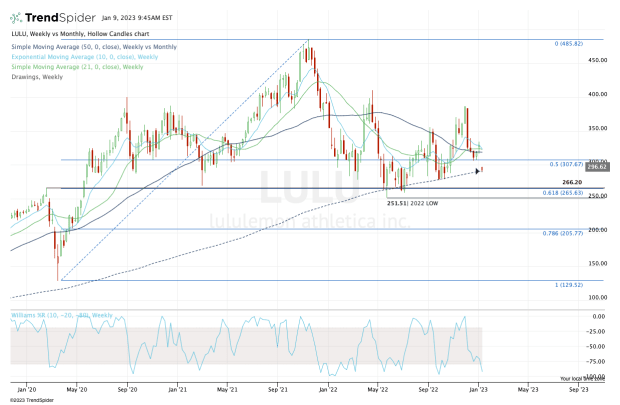

Meantime, let's look at LULU's chart.

Trading Lululemon Stock

Chart courtesy of TrendSpider.com

So far, there’s some mild dip-buying in Lululemon stock as it finds its footing along the 50-month moving average.

This has been a better support measure than the 200-week moving average, and for the most part it has buoyed Lululemon over the last 12 months.

Bulls should keep a close eye on this morning’s low near $289.50. A break of this level and a close below the 50-month moving average -- particularly on a weekly basis -- should have traders a bit cautious.

Technically speaking, that could open the door down to the $265 area. This was a big breakout area, then strong support. It’s also the 61.8% retracement from the all-time high down to the 2020 low.

I would expect this level to initially act as support. If it fails, it would open the door down to the 2022 low near $250.

On the upside, let’s see if Lululemon stock can push back up through $300. If it can, $307.50 is in play, which was recent support.

Above that and the gap-fill is in play near $316.50, along with a cluster of its daily and weekly moving averages.

The bottom line: I didn't think the news was all that bad, but it’s hard to fight this type of price action.

Keep an eye on $289.50 on the downside and $300 on the upside. A break of either level can create a continuation trade in that direction.