Amid marketwide volatility, Adobe Systems (ADBE) reported earnings on June 16 after the close.

The stock is down about 1.25% at last check June 17, which is not what the bulls had hoped for. But it’s better than the 7.5% decline it was sporting earlier in the session.

While it was a solid quarter for the graphics-software specialist — earnings and revenue beat expectations — guidance was the culprit behind the selloff. Revenue guidance for its fiscal third quarter and the full year came up short of consensus expectations.

But with the Nasdaq down about 34% from the high and Adobe stock down fully 52% (as measured from the all-time high in November to today’s low), perhaps bulls are unfazed by the guidance.

Should it leave them feeling “warm and fuzzy?”

Not necessarily, investor should ask themselves whether a guide of $17.65 billion against the analyst consensus of $17.85 billion — a difference of $200 million, or a bit more than 1% — may not be worth getting worked up over after the stock has already been cut in half.

Let’s look at the key levels from here.

Trading Adobe Stock

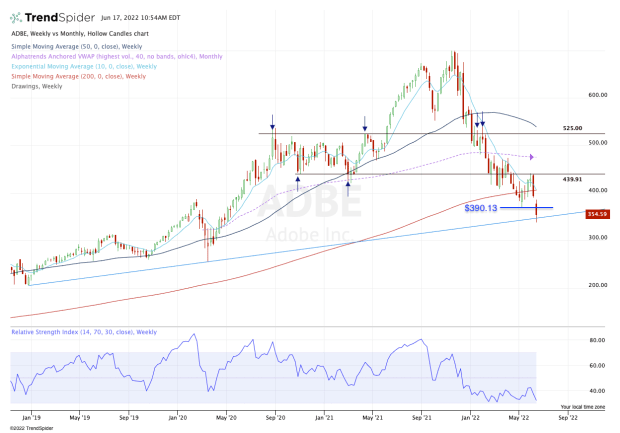

Chart courtesy of TrendSpider.com

The action in Adobe has been very methodic. It had that wonderful breakout over $525 in 2021, broke below that key level in January and then was rejected by it as it became resistance. At that point, the bears clearly were in control.

Adobe stock went on to break below $440, which was a key support level in 2020 and 2021. Then that level became resistance once the stock tried to rally.

After chopping around the 200-week moving average, the stock now is trading lower and undercutting the May low. On the plus side — and admittedly, it’s not much to hang one’s investing hat on — the stock is bouncing from uptrend support (blue line).

If we can get a sustained bounce in Adobe, look for it to rebound back to the May low near $390.

Above that puts the $400 level in play, which is where the 10-week and 200-week moving averages come into play. The bulls will need the stock reclaim these measures for there to be any serious change in momentum.

But if it can do that, it will open the door up to $440.

On the downside, this week’s low becomes key at $338. Below that and the $325 level could be in play, followed by the $300 to $305 zone.