Target (TGT) stock has been under pressure since the retail giant reported earnings in mid-May. But it's also been stuck longer term, currently down in four straight months.

On Wednesday, May 17, the shares initially rallied 2.5% after the company reported a top- and bottom-line beat of analyst estimates. But the guidance disappointed investors.

While a handful of megacap tech stocks continue to drive the S&P 500 and Nasdaq higher, other sectors like retail continue to trade poorly.

Don't Miss: Trading Nvidia Stock as It Surges to Record Highs After Earnings

Since its one-day post-earnings jump, Target stock has declined more than 12.5% and has fallen in six straight sessions.

Now, the stock is trading down into key support. Along with this support level, the stock also pays out a dividend yield just above 3%.

In September, Target raised its dividend by 20%, marking the 51st consecutive year of an annual dividend increase.

Are the dividend and the technical setup attractive enough to bring in buyers?

Trading Target Stock

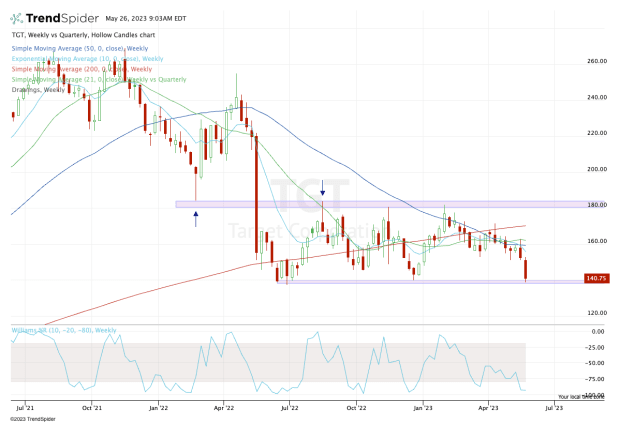

Chart courtesy of TrendSpider.com

A few factors are likely in play when it comes to Target's slump.

First, the overall action in the retail sector is not encouraging, whether that’s Ulta Beauty (ULTA), Home Depot (HD), Target or one of many other names. This sector is not trading well.

Second, worries that a recession might set in do not help companies that live and die on consumer spending. So Target is being lumped into that concern.

Third, controversy has not had a great effect on stocks in the short term. That’s been notable with names like Anheuser-Busch (BUD), but now it’s also clear in names like Target. To be sure, I think the first two factors have had a bigger impact than this, as Target shares have been struggling for months now.

The valuation for Target stock is reasonable — if management doesn’t lower guidance. Since we don't know whether that will be the case, investors can work with only what we know right now, which is that Target is a consistent dividend-paying stock and the shares are trading into prior support.

Don't Miss: Apple Stock Has Two Buy-the-Dip Spots (and One Is Really Attractive)

A simple look at the weekly chart shows the stock down almost 50% from the all-time high, while it's currently trapped between $138 to $140 on the downside and about $180 on the upside. The 52-week low is $137.13.

Investors could buy Target stock around $140, use a stop-loss just below this range — say, something like $135 — and at the very least look for a rebound to the $160 area, then potentially $180.

A breakout over $180 would leave buyers in a great position with a low cost basis, although plenty needs to happen before that takes place.

The bottom line is simple: Each investor can build a trade to fit their risk profile, but this is one reasonable way to look at Target stock from a technical and fundamental perspective.

Memorial Day Savings! Unlock trusted portfolio guidance for a fraction of the price. Subscribe now.