Procter & Gamble (PG) is trading roughly 2% higher on Wednesday after the consumer-products company’s third-quarter earnings results.

The group reported a 2.5% dip in earnings and a 1.9% increase in sales, with both tallies topping analysts’ expectations.

But due to the strengthening U.S. dollar, management was forced to trim its full-year revenue outlook. The company now expects a 1% to 3% decrease vs. a prior expectation of flat to 2% growth.

Is this mixed report better than feared and enough to prompt the buyers?

P&G stock pays out a 2.9% dividend yield, trades at roughly 22 times earnings — with its trailing P/E multiple at its lowest level in about five years — and is forecast to grow earnings about 7.5% next year.

If today’s gains stick amid a declining overall market, the bulls may have something to work with regarding the technicals.

Trading Procter & Gamble Stock on Earnings

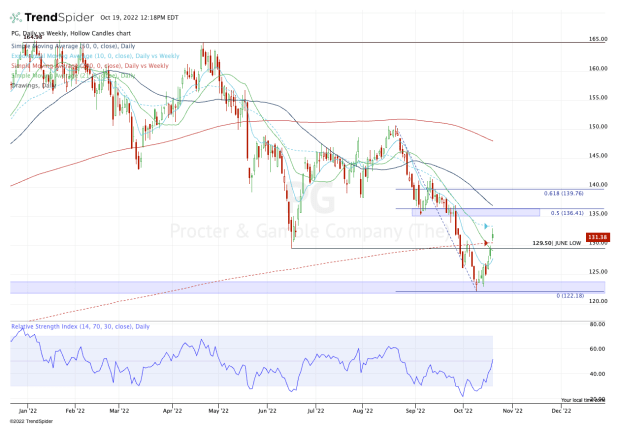

Chart courtesy of TrendSpider.com

At its low, Procter & Gamble stock was down about 26% from its 52-week high. That happened when it dipped into the low-$120s and bottomed at $122.18.

This was a key support zone in 2021 and was roughly the 61.8% retracement from the all-time high down to the covid low.

With today’s post-earnings pop, the shares are back above the June low at $129.50, as well as the 10-day, 21-day and 200-week moving averages. It’s an impressive push — if it can close here.

The stock has a decent dividend, a low valuation relative to its historic average, and now has the technicals acting a bit better.

From here, though, it's key that P&G stock holds above $129.50 and the moving averages laid out above.

If it cannot do so, traders can’t rule out another retest of the low-$120s.

But if the stock can stay above support, then a push up toward $135 could be in play. In that zone, we find the 50% retracement of the current decline, the declining 50-day moving average and a prior support area that failed earlier this month.

Above that could put the 61.8% retrace in play near $140.

The bottom line: If Procter & Gamble stock can clear the 10-week moving average, more upside could be in play. But for the bulls to justify a long position, it’s paramount that the stock stay above $129.50 and its key moving averages.