U.S. stocks on Wednesday are lower, with tech leading the way despite the relief rally underway in bonds.

Why does any of this matter? Because investors are trying to sort out which direction is next following the monthly CPI report, which was released before the open.

Bulls were likely leaning on the consumer price index coming in below expectations — highlighting that inflation is cooling — to use it as an excuse for a much-needed oversold rally.

We saw nice premarket gains ahead of the report, which moved at 8:30 a.m. ET. Those gains reversed lower once the CPI report for April came in at 8.3%, which was above expectations for 8.1%.

While the reading was below last month’s measure of 8.5% — and thus potentially last month was the peak — it’s still not instilling much confidence for investors.

The S&P opened lower on the day and made a run at yesterday’s low. It stopped short, though, and ripped higher in early trading before losing momentum and drifting back down.

I would guess that there is also a lot of repositioning from large firms and unwinding of hedges that were put in place ahead of the report.

With all the intraday noise, traders are trying to sort out where we go from here.

Trading the S&P 500

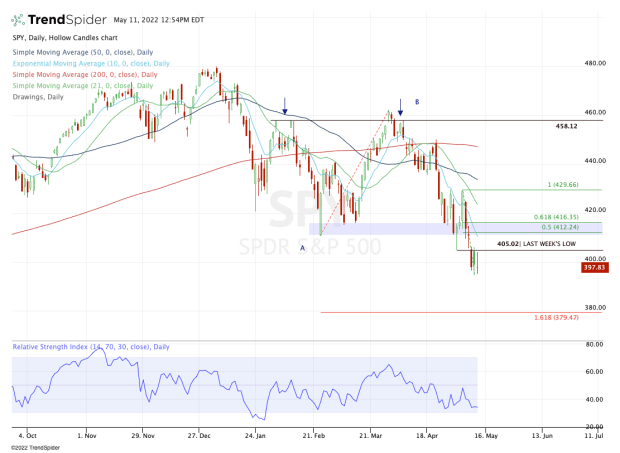

Chart courtesy of TrendSpider.com

As I look at the chart for the SPDR S&P 500 ETF (SPY), it’s clear that last week’s low near $405 is acting as resistance. It has rejected the SPY ETF each day this week.

It’s also clear that support has been coming into play in the $395 to $396 area.

This is where things get tricky.

The S&P 500 has fallen in five straight weeks. It has not done that since 2002 — 20 years ago. There have been plenty of bad stretches between then and now, and there are a lot of headwinds at the moment.

At some point, however, we have to recognize that an oversold rally is likely at some point, even though the prevailing trend is lower.

On the plus side, the levels are pretty clear-cut.

If SPY trades below $395, it’s a no-touch on the long side. It could simply be an undercut of the low and a reversal, but if that’s the case, then fine. Aggressive bulls can get long again on the rebound back over this level.

This is a reasonable approach because a move below $395 and failure to reclaim it opens the door to a potentially larger move to the downside. According to my measures, that would be $390 and then roughly $380.

On the upside, clearing this week’s high at $406.41, and thus the key $405 area, could quickly open the door up to the $410 to $413 area.

Above that and the $416 level could be on tap, followed by the declining 21-day moving average.

As the prominent hedge-fund investor Paul Tudor Jones recently reiterated, capital preservation is the top priority for traders at this moment.