Block (SQ) shares early in the session on Friday were up almost 5%. The rise faded to 1.5% and at last check, the shares were up about 3%.

The move up followed the payment-tech company's fourth-quarter results.

It also comes amid a backdrop of broader market selling, as the Nasdaq is off about 2%.

As for the quarter, Block turned in mixed results. The company missed on earnings but beat on revenue as sales grew 14% year over year.

So far, the earnings aren’t having much of an impact on Block stock, nor are they doing anything to help PayPal (PYPL), which is down about 2.5% so far on the day.

Let’s look at the chart to see if we can get some more clarity going forward.

Trading Block Stock on Earnings

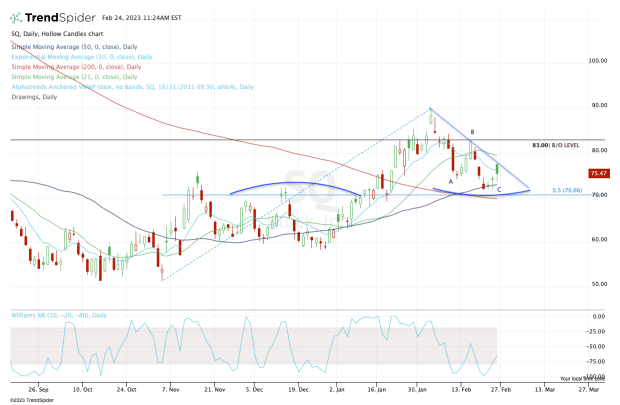

Chart courtesy of TrendSpider.com

Block gave traders a nice three-day consolidation before resolving higher on the earnings report. That has to count for something, right?

But -- the stock is below the 10-day and 21-day moving averages, while struggling with the former now.

Further, it's in the midst of an “ABC” type correction — see the annotations on the chart — but is also putting in a series of lower highs, a bearish technical development.

Lastly, it has retraced about half the recent decline, just as it did last time before rolling over to new lows.

So traders are in a tough spot as the charts are a bit mixed.

Is Block stock a buy based on holding a key area as support and trading higher on the earnings? Or is it a risk-off play as it struggles with its short-term moving averages and the recent “sell pattern?”

Ultimately, it depends on the trader.

The bears could justify a short position with a stop-loss near the post-earnings high of $77.75. All the way up to $80 would be reasonable for more aggressive traders.

But over $80 puts $83 and $86 in play on the upside. Above that and $90-plus is possible.

On the downside, the bulls must see the $70 level hold as support.

This has been a key support/resistance level over the past several months and most recently served as support.

More than that, though, a break of $70 would mean that Block stock will have lost the 50-day and 200-day moving averages, as well as the 50% retracement.

In that scenario, it could put $66, then $60, in play.