Anheuser-Busch Inbev (BUD) has been in the news a lot lately, drawing controversy over its recent marketing campaigns for its Bud Light brand. Comments from the company only fanned the flames.

Controversy soon spread to Molson Coors (TAP) and its ad campaign, too.

Don't Miss: Buy the Dip in PepsiCo Stock...If Support Can Hold

In the early goings of the controversy, Anheuser stock held up pretty well. In fact, the shares ran to 52-week highs on March 31. Through most of April, the shares handled the ongoing headlines pretty well too.

Now, though, the selling has picked up pace. BUD shares are working on their fifth straight weekly decline, down about 13% in that span and down about 14.5% from the 52-week high.

Is the stock nearing a low?

Trading BUD Stock Into Support

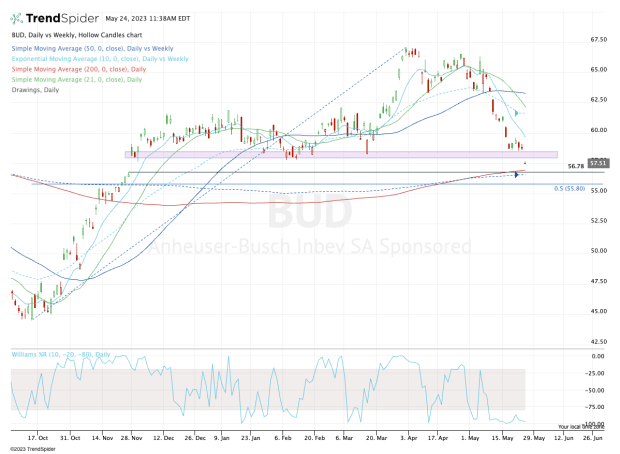

Chart courtesy of TrendSpider.com

For the past six months, the $58 area had been solid support for Anheuser-Busch stock. Amid the recent pullback, the shares were finding support just above this zone.

They're gapping lower and under pressure again on Wednesday, though, and this support level is failing. That’s just as well, as the larger and hopefully stronger support zone comes into play around $56.

In that zone, there are numerous technical levels to take note of.

They include the gap-fill level from November at $56.78 and the 50-week and 200-day moving averages. The 50% retracement is nearby, too, at $55.80.

If we get a further decline down to this zone, the bulls will likely look for Anheuser-Busch stock to bounce.

Don't Miss: Apple Stock Has Two Buy-the-Dip Spots (and One Is Really Attractive)

At the very least, buyers will know right away if this level is a good buying zone. Either it will hold and Anheuser-Busch shares will bounce or it will fail and the shares will turn lower.

Below this zone could open the door down to the $52.50 to $53 zone.

Public controversy can create great buying opportunities in stocks, but if it results in material weakness, it can become an issue.

While Anheuser-Busch shares bucked the controversy at first, they haven’t held up over the past month. Let’s see whether support comes into play and holds.

Our Memorial Day sale is on now! Get exclusive investing insights from TheStreet’s premium products. Learn more.