Amazon (AMZN) is the latest well-known tech stock to report earnings. Since mega-cap tech stocks have driven a bulk of the year-to-gains in the stock market, Amazon’s performance is even more important to investors.

Amazon shares initially jumped higher in April 27's after-hours trading session, briefly climbing more than 12% when the headline numbers hit.

The firm topped earnings and revenue estimates for the quarter, while revenue rose 9.4% year over year.

However, once the conference call was underway, the selling picked up pace. Amazon stock opened lower by about 2%, fell as much as 5% and is currently down about 4% on the day.

DON'T MISS: Meta Stock, Surging on Earnings, Faces Key Level on the Charts

It’s been a mixed picture so far in mega-cap tech. Microsoft (MSFT) and Meta (META) have superb earrings reactions. Tesla (TSLA) had a bearish reaction and Alphabet (GOOGL) (GOOG) has been mostly flat.

What can investors expect from Amazon stock going forward?

Trading Amazon Stock on Earnings

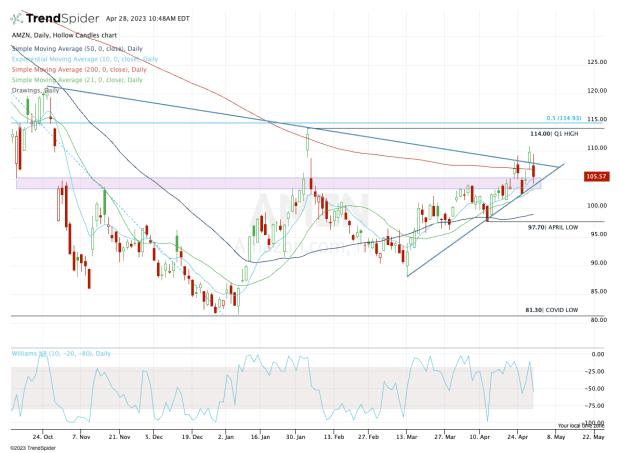

Chart courtesy of TrendSpider.com

The $102 to $105 zone remains critical for active traders in Amazon stock. Whether bullish or bearish, it doesn’t matter. This zone is the key in the short term for both groups.

Coming into earnings, Amazon stock did a good job clearing this level and even though it struggled with the 200-day moving average, it was able to close above this measure ahead of earnings.

With Friday’s post-earnings dip though, bulls are at risk of losing the $102 to $105 zone.

Don't Miss: Zoom Video Stock Has Slumped; Is It Time to Buy?

From here, bulls want to see shares hold this zone. Not only does it keep the stock above an active support/resistance zone, but it keeps Amazon above the 10-day and 21-day moving averages, as well as uptrend support (blue line).

To fall below $102 puts Amazon stock below all of these measures and opens the door down to the April low and 50-day moving average near $97.50.

On the upside, it’s incredibly simple. If shares can stay above $102 to $105, then bulls need to get Amazon back above $110 for a sustained rally to occur.

In that scenario, it could open the door back up to the $120 to $123 zone. Not only was that the after-hours post-earnings high in this area, but it was a key zone we were watching ahead of the news.

But first, let’s see if shares can regain $110.