Despite more bank-related worries, FedEx (FDX) stock is bucking the trend of the S&P 500 and is rallying notably.

At last glance the package-delivery giant's shares were up 8%; at the high, they were 11% ahead. The move comes after a better-than-expected earnings report.

Don't Miss: Is Nvidia One of the Best Stocks to Own?

The company’s fiscal-third-quarter-earnings results soared past analysts’ expectations. That’s even as revenue fell almost 6% year over year to $22.2 billion, missing estimates by over $500 million.

Earnings guidance for the full-year came in well ahead of consensus expectations as well. Management’s cost-cutting efforts are clearly paying off.

The results are not giving a boost to United Parcel Service (UPS), which were down 1% at last check.

Now the bulls are trying to figure out whether FDX's results are strong enough to justify buying the stock amid worries over the U.S. banking system and the global economy. As such, the S&P 500 is down 1.3% in midday trading on Friday.

Can FedEx continue to rally?

Trading FedEx Stock on Earnings

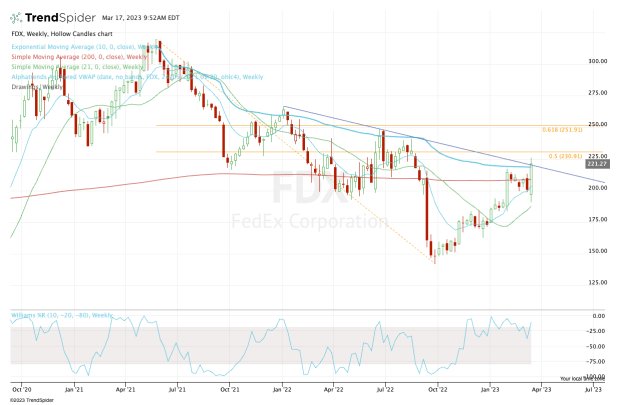

Chart courtesy of TrendSpider.com

The reaction in FedEx stock is bullish; no question about that. But it’s running into some levels that make one question whether the rally has enough steam to continue.

FedEx shares have been slowly but surely climbing off the September low. With Friday’s rally, FedEx stock is pushing through the 10-week and 200-week moving averages. That’s bullish, too.

Don't Miss: Adobe Stock Faces Staunch Resistance

But the stock is also running into downtrend resistance, as well as an anchored VWAP measure pinned to the all-time high from May 2021.

If the stock can clear this area, near $220, it opens the door back to the post-earnings high near $226, as well as the 50% retracement up near $231.

Above $231 and the bulls may be able to squeeze out more upside, potentially up to the $250 area.

On the downside, the bulls would love to see the $210 to $215 area hold as support, as that was resistance over the past few weeks. Below that and the $205 earnings gap could be filled.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.