Shares of Costco Wholesale (COST) are up at last check, in what is proving to be a mixed session for stocks.

At one point, Costco stock was down about 2.25%, but it’s now trying to push higher as it rallies off the November low.

The move comes after the retailer reported disappointing first-quarter earnings.

Costco missed on earnings and revenue expectations, while membership revenue also came up short.

It doesn't help that Lululemon Athletica (LULU) is sinking on earnings, down 12%, or that the stock market is mixed after a higher-than-expected PPI report.

Some are wondering why Costco stock isn’t falling further.

What did help is that the stock sank almost 11% in the days leading up to its earnings report, falling in five of six trading sessions.

Let’s look at the chart as the stock tries to shake off these results.

Trading Costco Stock on Earnings

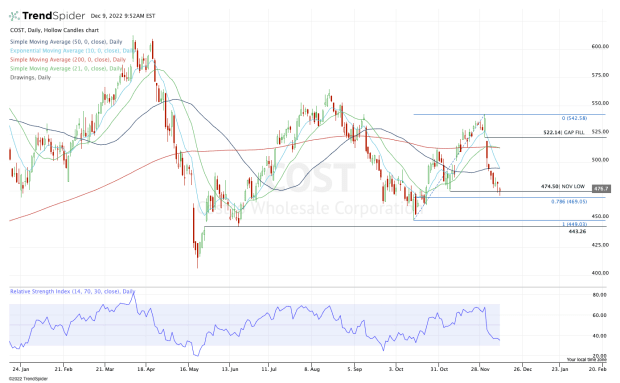

Chart courtesy of TrendSpider.com

Last week, Costco stock was making multimonth highs, trading up to $542.58 on Nov. 30. But it fell 6.5% the next day, breaking below the 10-day, 21-day and 200-day moving averages. A day later it closed below the 50-day.

Since then, the shares have been trading lower in a rather orderly fashion, with today’s low nearly testing the 78.6% retracement of the current range.

With the rally off Friday's low, Costco stock is holding the November low at $474.50.

If the stock can clear and stay above yesterday’s high at $483.33, the door opens to a potential push back toward the 10-day and 50-day moving averages near $495.

If the stock gets back above $500, a rally toward the 21-day and 200-day moving averages is possible near $513. That’s followed by the gap-fill up near $522.

As for the downside, the bulls have a decent little reversal to work with.

But if Costco stock can’t rotate over $483-and-change, then the November low remains in play. Below it keeps the post-earnings low vulnerable at $470.50.

A close below $469 opens the door down to the $443 to $450 area.

.jpg?w=600)