Shares of Broadcom (AVGO) are hesitantly enjoying a nice post-earnings rally, up about 4% on Thursday.

But there’s far more to sort through than a regular earnings report.

While the company dished out a top- and bottom-line beat and a fresh $10 billion stock buyback, all of that is being overshadowed by its $61 billion cash-and-stock deal for VMWare (VMW).

Shares of VMWare began trading higher a few days ago on reports that Broadcom could be prepping a $50 billion deal for the company.

I have liked Broadcom for years due to its strong leadership and dependable cash flow. The company has been able to return a lot of cash to shareholders over the years in the form of dividends and buybacks.

Why does that matter for trading?

While Broadcom hasn’t been immune to the selloff, its peak-to-trough decline of 24.4% is better than that of others in the space. For instance, Nvidia (NVDA) and Advanced Micro Devices (AMD) both fell more than 50% from the highs.

Now, Nvidia is trying to make up some ground — and give Broadcom a boost in the process — by rallying on its earnings report. Here are Nvidia’s key levels too.

Trading Broadcom Stock

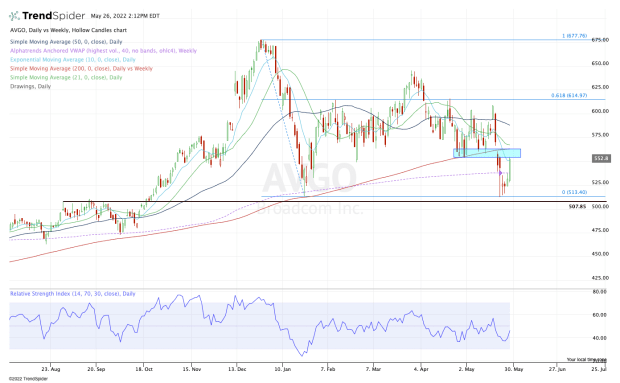

Chart courtesy of TrendSpider.com

Broadcom stock was hit hard in January, tumbling like the rest of the semiconductor space. It fell 24% in just a few weeks.

Unlike the rest of its peers, though, it did not go on to make new low after new low. In fact, only just last week did the stock crack the January low before a rather robust bounce off the low.

It solidified the importance of the $510 to $515 area, which becomes an even more important area of support now that the company is involved in a megadeal.

If the stock breaks these levels and can’t hold $500, then the bulls need to start considering just how far Broadcom stock can fall. It’s worth pointing out that ~$490 was a major breakout area.

In any regard, the shares are on the move higher at the moment.

But they're also running right into a resistance area, which comes into play between $550 and $560.

Further, it’s also running into the 10-day moving average, and just above that is former support from the 200-day moving average. For now, we must assume that this measure may be resistance.

That said, if Broadcom can clear $565, it could be looking at a larger run, potentially up toward $600.