Apple (AAPL) isn’t doing much to help the markets on Wednesday, down more than 5% on the day.

Just yesterday, Apple appeared to be setting up to reclaim the pivotal $150 area.

Not anymore.

Price action aside, Wall Street is building a little drama up around Apple stock.

Not only is it a Warren Buffett favorite — as we recently discussed earlier this month — but it’s also a marketwide favorite with a $2.3 trillion market cap.

However, that hasn’t stopped Michael Burry from taking a short position in the name.

Burry came to prominence as a short-seller when he nailed the housing bubble in 2008. Regarding Apple, his firm held more than 200,000 put options in the tech giant as of March 31.

Put options give holders the right, but not the obligation, to sell a security at a particular price by a particular time. They're generally bets that a security's price will drop.

Buffett has taken a different approach to Apple, buying the dips. Last quarter alone, he put $600 million to work in Apple and now owns more than $150 billion of the stock.

Ironically, both investors could be winners here. A decline in Apple stock will boost the value of Burry’s puts, while Buffett will likely continue buying gobs of Apple stock on the dip, hoping for a rebound.

On his last buying spree, he was able to accumulate it for only three days before a strong price bounce sent Apple higher.

Now the question is: Can Apple reclaim key support or will it continue lower?

Trading Apple Stock

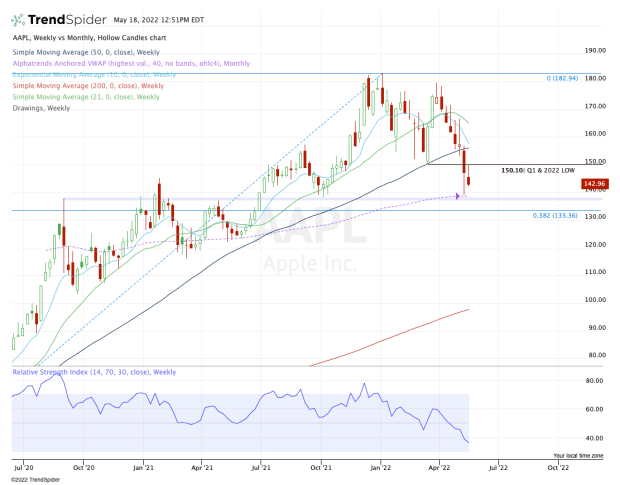

Chart courtesy of TrendSpider.com

Last week, Apple stock knifed right through the key $150 area in a brutal two-day decline. The shares fell more than 10% at the low.

At this week’s high, Apple looked as if it was going to try to reclaim this key area. But it’s being rejected and is now tumbling lower.

That leaves last week’s low at $138.80 in play, along with the weekly VWAP measure. Further, the $138 area is a key zone on the chart. It was the peak in summer 2020 when Apple announced its stock split, then resistance for about a year until a major breakout occurred.

Should this level fail as support, $133 is in play, followed by the $122 to $125 zone.

On the upside, it’s all about reclaiming $150. Above that puts the 10-week and 50-week moving averages in play, followed by the mid-$160s.

.jpg?w=600)