Rachel Reeves has announced tax hikes that will raise an eye-watering £40bn in her historic first Budget but revealed a boost to NHS spending.

Launching an attack on previous Tory governments, the chancellor said Labour had inherited a £22bn “black hole”, and would never again “allow a government to play fast and loose with public finances.

After months spent warning the public of “tough choices” ahead, Ms Reeves promised to “invest, invest, invest” in order to “fix public services” and announced a £22.6 billion increase in the day-to-day NHS health budget.

Increases to employers’ national insurance contributions, stamp duty on second homes and a scrapping of VAT exemption on private schools fees were all confirmed by the chancellor, as well as a new duty on vaping liquids.

However, there were surprise announcements that the freeze on income tax thresholds, often described as a “stealth tax”, would not be extended past 2028, while Ms Reeves has also decided against a hike in fuel duty.

Responding to the Budget, Rishi Sunak accused Ms Reeves of “fiddling the figures” and criticised the government for embarking on an “enormous borrowing spree”.

Budget 2024 latest news

- Rachel Reeves confirms Budget will raise taxes by £40bn

- Reeves attacks Tories for playing ‘fast and loose’ with public finances

- Stamp duty hike for second homes, Reeves says

- No extension on income tax threshold freeze beyond 2028, Reeves announces

- Big win for boozers as Reeves cuts draft duty

- IFS warns of further tax rises if Reeves £40bn tax gamble does not pay off

Analysis: Rachel Reeves goes on the attack on the £22bn black hole

12:44 , David MaddoxThe Independent’s polticial editor David Maddox writes:

After weeks of the Tories questioning her claims over a £22 billion black hole in the public finances, Rachel Reeves is promising a line by line analysis today to prove it exists.

She quotes the Office of Budget Responsibility (OBR) to say it was deceived by the alst government and its projections in the spring would have been “materially different” hd it known the full facts.

Ms Reeves wants to pin the blames for her tax rises and Budget misery on Tory mismanagement.

This could well be the debate framed for the next five years.

Funding for Infected Blood Scandal and Post Office compensation schemes

12:46 , Athena StavrouChancellor Rachel Reeves has announced £11.8 billion to compensate those impacted by the infected blood scandal, and £1.8 billion to compensate the victims of the Post Office Horizon scandal.

Ms Reeves said: “The previous government also failed to budget for costs which they knew would materialise. That includes funding for vital compensation schemes for victims of two terrible injustices: the infected blood scandal and the Post Office Horizon scandal.

“The Leader of the Opposition rightly made an unequivocal apology for the injustice of the infected blood scandal on behalf of the British state, but he did not budget for the costs of compensation.

“Today, for the very first time, we will provide specific funding to compensate those infected and those affected, in full with £11.8 billion in this Budget.

“I am also today setting aside £1.8 billion to compensate victims of the Post Office Horizon scandal, redress that is long overdue for the pain and injustice that they have suffered.”

Reeves opens Budget by saying her ‘belief in Britain burns brighter than ever’

12:47 , Tom BarnesChancellor Rachel Reeves opened her Budget speech by stating that her “belief in Britain burns brighter than ever”.

She told the Commons: “On July the 4th, the country voted for change. This government was given a mandate: to restore stability to our country and to begin a decade of national renewal. To fix the foundations and deliver change through responsible leadership in the national interest. That is our task and I know we can achieve it.

“My belief in Britain burns brighter than ever and the prize on offer is immense. As the prime minister said on Monday, change must be felt: more pounds in people’s pockets, an NHS that is there when you need it, an economy that is growing, creating wealth and opportunity for all because that is the only way to improve living standards.

“And the only way to drive economic growth is to invest, invest, invest.

“There are no shortcuts and to deliver that investment we must restore economic stability and turn the page on the last 14 years.”

Rachel Reeves confirms Budget will raise taxes by £40bn

12:50 , Kate DevlinThe chancellor has confirmed that her first Budget will raise taxes by an eye-watering £40bn.

But she insisted that the blame lay with the Conservatives. She accused them of blowing a hole in the public finances and failing to fund compensations schemes, such as the one for those affected by the infected blood scandal.

On her tax rises she told MPs: “Any chancellor standing here today would have to face this reality”.

Budget to raise taxes by £40 billion

12:54 , Athena StavrouChancellor Rachel Reeves told the Commons “this Budget raises taxes by £40 billion”.

She said: “The leadership campaign for the party opposite has now been going on for over three months, but in all that time not one, single apology for what they did to our country – because the Conservative Party has not changed.

“But this is a changed Labour Party and we will restore stability to our country again.

“The scale and seriousness of the situation that we have inherited cannot be underestimated.

“Together, the black hole in our public finances this year, which recurs every year, the compensation payments which they did not fund, and their failure to assess the scale of the challenges facing our public services means this Budget raises taxes by £40 billion.

“Any chancellor standing here today would face this reality, and any responsible chancellor would take action. That is why today, I am restoring stability to our public finances and rebuilding our public services.”

Reeves announces increase to minimum wage

13:00 , Athena StavrouRachel Reeves has announced the increase of minimum wage by 6.7 percent.

The chancellor told the house that the national living wage will see it rise £12.21 an hour next year as she delivers Labour’s first budget in 14 years.

It will also be raised for 18-20-year-olds by 16.3 per cent - bringing it up to £10 an hour for this group.

Ahead of the budget, John Foster, chief policy and campaigns officer at the Confederation of British Industry (CBI), said the national living wage was a “valuable tool” for protecting the incomes of the poorest in society “but with productivity stagnant, businesses will have to accommodate this increase against a challenging economic backdrop and growing pressure on their bottom line”.

Analysis: Important win for the Lib Dem leader on the carer allowance

13:02 , David MaddoxSir Ed Davey, who cares for his disabled son and previously cared for his mother, has been a staunch campaigner for carers and their financial needs.

The increase of extra income to keep the carers’ allowance to £10,000 will help thousands of people across the country.

More important will be the efforts to end the cliff edge where they lose the allowance and the issue of overpayments.

The Lib Dem leader will see this as an early personal victory as he leads his newly enlarged 72-MP bloc.

Fuel duty freeze remains

13:04 , Athena StavrouThe chancellor has just said that the government will keep the freeze on fuel duty.

This is good news for drivers, who would have had the 7p rise passed on to them at the pump.

Fuel duties, or taxes, apply to purchases of petrol, diesel and a variety of other fuels used both for vehicles and domestic heating.

Reeves attacks Tory legacy: ‘We will never again play fast and loose with public finances’

13:06 , Tom BarnesRachel Reeves said the Government would publish a “line-by-line breakdown of the £22 billion black hole that we inherited”, saying this showed “hundreds of unfunded pressures on the public finances”.

The Chancellor told MPs: “The Office for Budget Responsibility has published their own review of the circumstances around the spring budget forecast.

“They say that the previous government, and I quote, ‘did not provide the OBR with all the available information to them’ and that had they known about these ‘undisclosed spending pressures that have since come to light’ then their spring budget forecast for spending would have been, and, I quote again, ‘materially different’.”

Ms Reeves added: “Let me make this promise to the British people: never again will we allow a government to play fast and loose with the public finances and never again will we allow a government to hide the true state of our public finances from our independent forecaster.

“That’s why today, I can confirm that we will implement in full the 10 recommendations from the independent Office for Budget Responsibility’s review.”

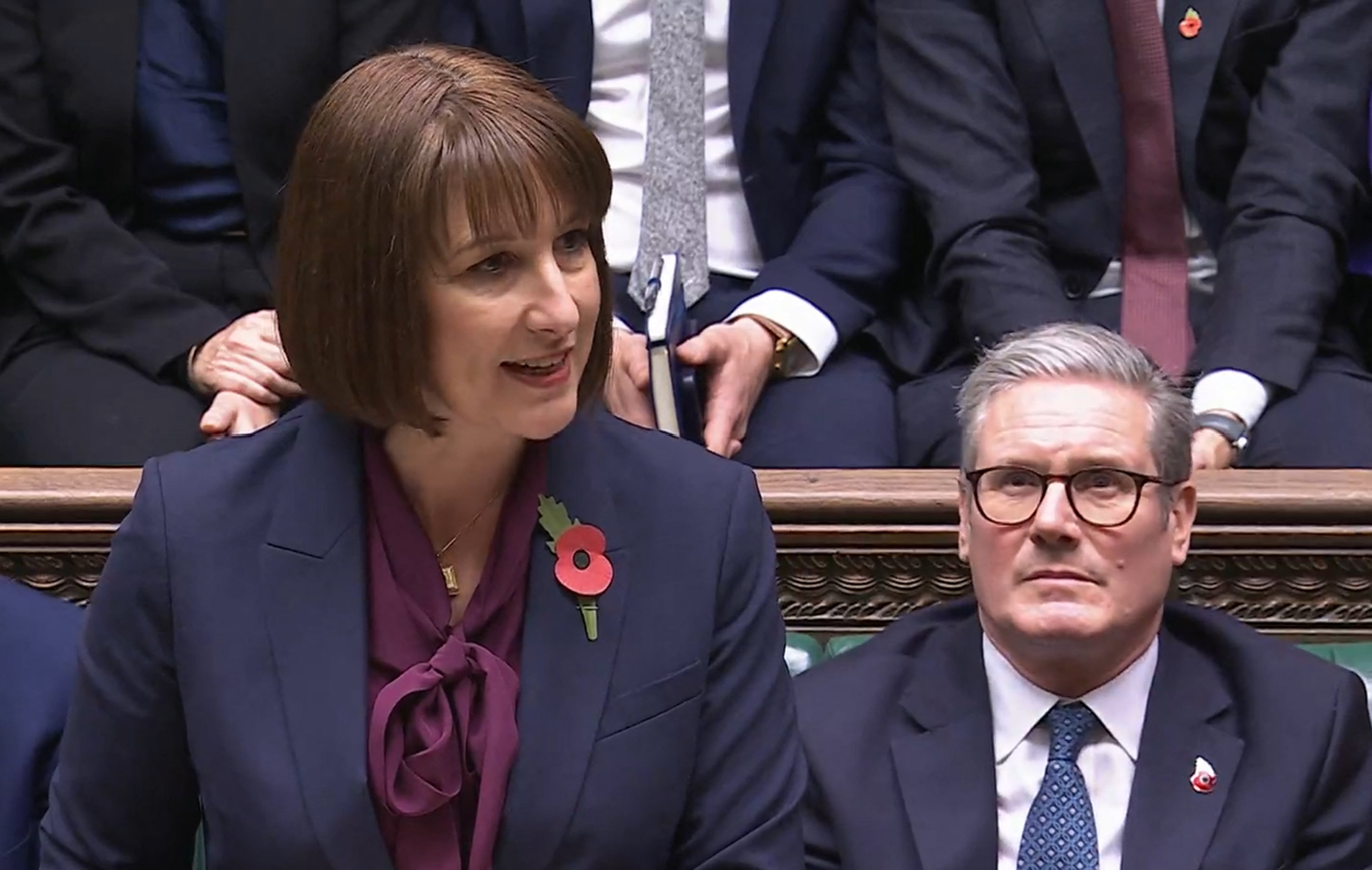

Increase to employers’ national insurance contributions

13:06 , Athena StavrouA 1.2 per cent increase to employers’ national insurance contributions (NICs) has just been confirmed. This is different to NICs paid by workers – it is paid by their employers on top of their wages.

The rate will now rise from 13.8 per cent to 15 per cent. Previous analysis has estimated that this measure could raise up to £4.5bn, but some economists are more critical.

The Institute for Fiscal Studies (IFS) has spoken out against the move in the past, saying it would raise closer to £4.5bn.

What’s more, director Paul Johnson previously said it would constitute a “straightforward breach” of Labour’s manifesto pledge not to raise taxes on working people, as employers are likely to pass the rise off in the form of lower wage growth.

Analysis: Rachel Reeves announces big increase in carers allowance

13:08 , Holly BancroftChancellor Rachel Reeves told the Commons: “Carers allowance currently provides up to £81.90 per week to help those with additional caring responsibilities. Today I can confirm that we are increasing the weekly earning limits to the equivalent of 16 hours at the national living wage per week. The largest increase in carers allowance since it was introduced in 1976.

This means a carer can now earn over £10,000 a year while receiving carers allowance - allowing them to increase their hours where they want to and allowing them to keep more of their money.”

She also said she was concerned about carers getting in to debt to repay DWP overpayments and confirmed that the work and pensions secretary would carry out a review to “develop the right solutions”.

Analysis: Reeves pulls out her first rabbit

13:10 , David MaddoxHave briefed there will be “no rabbits” produced in her Budget, the chancellor has produced one on employers’ national insurance contributions.

By exempting 650,000 small businesses from NICs altogether and reducing the bill for another million she has seen off some of the criticism of the overall tax rise on NICs.

It is a clever move because if she wants to produce economic growth she will need to get it from start-ups and small businesses going forward.

Capital gains tax to be increased

13:11 , Athena StavrouThe headline rates of capital gains tax will increase, with the lower rate rising from 10 per cent to 18 per cent and the higher rate from 20 per cent to 24 per cent, the Chancellor has announced.

Capital Gains Tax (CGT) is paid on the profit made when an asset which has increased in value is sold. It is applied to things like the sale of personal possessions worth more than £6,000 (apart from a car), property that’s not the seller’s main home, shares and business assets.

Analysis: Reeves caves over fuel duty

13:13 , Archie MitchellRachel Reeves has become the latest chancellor to cave under pressure to keep fuel duty frozen.

In a very expensive boost to drivers, Ms Reeves said she will spend more than £3bn avoiding an increase in the levy next year and promised “no higher taxes at the petrol pump”.

She said that baked into the numbers she inherited from the previous government is an assumption that fuel duty will rise by inflation next year, and that a temporary 5p cut will be reversed.

The chancellor said it would cost more than £3bn to keep the cut, but added that letting fuel duty rise next year would be “the wrong choice for working people”.

She becomes the latest in a long line of chancellors to crumble under pressure from the motoring lobby to keep fuel duty frozen, rather than letting it rise in line with inflation.

Help for small businesses announced

13:15 , Athena StavrouChancellor Rachel Reeves has unveiled an increase to the Employment Allowance for small businesses, which allows eligible employers to reduce their national insurance liability.

She told the Commons: “I am today increasing the Employment Allowance from £5,000 to £10,500. This means 865,000 employers won’t pay any national insurance at all next year, and over one million will pay the same or less as they did previously.

“This will allow a small business to employ the equivalent of four full-time workers on the national living wage without paying any national insurance on their wages.”

Reeves confirms no increase to national insurance, VAT or income tax for working people

13:15 , Joe MiddletonChancellor Rachel Reeves has confirmed she will not increase national insurance, VAT or income tax for working people.

She told the Commons: “The last government made cuts of £20 billion to employees’ and self-employed national insurance in their final two budgets.

“These tax cuts were not honest. Because we now know they were based on a forecast which the OBR (Office of Budget Responsibility) say would have been ‘materially different’ had they known the true extent of the last government’s cover-up.

“Since July, I have been urged on multiple occasions to reconsider these cuts. To increase the taxes that working people pay and see in their payslips. But I have made an important choice today: To keep every single commitment that we made on tax in our manifesto.

“So I say to working people: I will not increase your national insurance, your VAT, or your income tax. Working people will not see higher taxes in their payslips as a result of the choices I make today. That is a promise made – and a promise fulfilled.”

Non-dom tax abolished

13:18 , Athena StavrouThe Chancellor has just announced the abolishment of the non-nom tax status from April 2025.

She told the house that those who “make this country their home” they should pay the correct tax.

A “non-domiciled individual” is a person who lives in the UK but is not settled here permanently.

They will only pay UK tax on money made in the country, and can avoid paying it on their foreign income if they opt to claim the “remittance basis”. This allows wealthy individuals living in the UK to elect the lower-tax country as their domicile, making for major savings.

Analysis: Reeves goes ahead on ‘ideological’ private schools tax

13:20 , David MaddoxThere are serious doubts now that imposing VAT on private school fees will be anything more than ideological rather than raise £1.6 billion needed to fund 6,000 new teachers.

Ms Reeves though has ignored the warnings and gone where no other chancellor has gone before in taxing education.

Already this is a clear dividing line with the Tories who have vowed to reverse the tax on schools and it leaves Labour in danger of looking as though they are attacking the middle class and aspiration.

It is certainly a move which Tony Blair - an old boy of Fettes in Edinburgh (the Scottish Eton) - would not have considered.

Thousands of children are now set to be moved into state schools at the cost of the taxpayer.

Reeves announces fresh tax on vaping and one-off tobacco duty rise

13:21 , Joe MiddletonChancellor Rachel Reeves said the government will renew the tobacco duty escalator and introduce a flat-rate duty on all vaping liquid from October 2026.

She added: “Alongside an additional one-off increase in tobacco duty to maintain the incentive to give up smoking.

“And we will increase the soft drinks industry levy to account for inflation since it was introduced, as well as increasing the duty in line with CPI (Consumer Prices Index) each year going forward. These measures will raise nearly £1 billion per year by the end of the forecast period.”

We want to discourage non-smokers & young people from taking up vaping.

— HM Treasury (@hmtreasury) October 30, 2024

From 1 Oct 2026, we’re introducing a vaping duty for the first time at £2.20 per 10ml of liquid.

Plus a one-off tobacco duty rise to keep the incentive to choose refillable vaping over smoking. pic.twitter.com/yxzOHYlA1E

Big win for boozers as Reeves cuts draft duty

13:21 , Archie MitchellDespite unveiling £40bn worth of tax hikes, Rachel Reeves showed a soft spot for Britain’s boozers in her Budget.

The chancellor promised to cut draft duty by 1.7 per cent, taking a penny off the price of a pint in the pub.

It came as Ms Reeves confirmed she will let duty on non-draft products rise in line with inflation.

The move shows Ms Reeves is backing Britain’s beleaguered hospitality industry, with pub and restaurant bosses having consistently called for the balance of taxes to be tilted away from hospitality venues and towards supermarkets.

Analysis: Relief for the poorest households in debt

13:22 , Holly BancroftRachel Reeves has said that she will reduce the level of debt repayments that can be taken from people’s Universal Credit payments.

After discussion with think tanks such as the Joseph Rowntree Foundation, Ms Reeves announced that the level of debt repayments that can be taken out of people’s Universal Credit will be lowered from 25 per cent to 15 per cent each month.

This is good news for 1.2 million of the poorest households who will be able to keep more of their Universal Credit payments. And hopefully put them in a better financial position to manage their debt in the long run. Those who benefit will gain an average of £420 a year, according to Ms Reeves’ calculations.

The Joseph Rowntree Foundation has been calling on the government to take this step so that people aren’t forced to choose between going without essentials or getting into debt.

Allowing families to keep more money each month will help them feed their children and pay other households bills - hopefully keeping them from going deeper into debt and relying on crisis charity help.

Chancellor undoes Tory tax threshold freezes in final Budget rabbit

13:25 , Archie MitchellRachel Reeves has pulled a final Budget rabbit out of the hat, promising to end the tax threshold freezes introduced by Rishi Sunak.

The so-called stealth tax, which saw workers quietly dragged into higher tax brackets, were a way of raising billions of extra revenue without explicitly raising income tax or national insurance.

But while Ms Reeves said extending the freeze could raise “billions of pounds to deal with the black hole in our public finances and repair our public services”, she said it “would hurt working people and take more money out of their payslips”.

It would have been embarrassing for the chancellor to keep the freezes in place, having accused the Tories of “picking the pockets of working people” over the move in the past.

Measures to crackdown on shoplifting

13:28 , Athena StavrouReeves has announced further action to crackdown on shoplifting on UK highstreets.

The chancellor said the government is set to scrap “effective immunity for low value shoplifting,” and provide additional funding to crackdown on organised gangs that target retailers.

Analysis: Reeves risks backlash with inheritance tax hike

13:30 , Kate DevlinCritics have denounced it as a “death tax” and Ms Reeves has been warned her she risks punishing middle-class homeowners, but the chancellor did announce plan to squeeze millions of pounds more from inheritance tax.

The levy is routinely found to be one of voters’ least favourite measures, despite just a tiny number of estates paying it.

Official figures released last week also show Britons are already paying more inheritance tax.

The Treasury took in £4.3bn in the six months since April, £400m more than in the same period in the previous financial year and a rise of 10 per cent, HM Revenue and Customs date showed.

Reeves announces passenger duty rise of 50% for private jets and aims jab at Sunak

13:30 , Joe MiddletonChancellor Rachel Reeves has announced a passenger duty rise of 50 per cent for private jets.

She mocked Tory leader Rishi Sunak as she joked his “ears have pricked up” when she mentioned air passenger duty.

She told the Commons: “Air passenger duty has not kept up with inflation in recent years so we are introducing an adjustment, meaning an increase of no more than £2 for an economy class short-haul flight.

“But I am taking a different approach when it comes to private jets, increasing the rate of air passenger duty by a further 50%. That is equivalent to £450 per passenger for a private jet to, say, California?”

‘Deeply disturbing’: Charity condemns Labour’s continuation of Tory benefits plans

13:32 , Holly BancroftRachel Reeves has announced that Labour will continue with Tory reforms to the work capability assessment, which is used to decide eligibility for working-age incapacity benefits.

In a bid to keep the benefits bill down, Labour will reduce access to these benefits, but the plans have been met with fury by disability campaigners who said the announcement was “deeply disturbing”.

Richard Kramer, chief executive of Sense, has said the government has “played into the dangerous narrative that disabled people should be forced to work and tightened the Work Capability Assessement. They did this knowing that not all disabled people can work - and that, withint three years, it will leave more than 424,000 disabled people, who are unable to work, worse off by more than £4,000 a month.”

“We are demanding that this dismal decision is urgently reversed”, he said.

Stamp duty hike for second homes

13:34 , Chloe HubbardStamp duty land tax surcharge for second homes will increase by two percentage points to five per cent, and will come into effect from Thursday, Reeves announced.

“This will support over 130,000 additional transactions from people buying their first home, or moving home, over the next five years,” she pledged during the Budget.

No extension on income tax threshold freeze beyond 2028

13:38 , Athena StavrouThe Government will not extend the freeze on income tax and national insurance thresholds beyond 2027/28, the Chancellor has announced, saying it would “hurt working people” to keep thresholds frozen.

There was speculation Reeves would extend the freeze, in a move that would have been criticised as a way for the Treasury to boost revenue from income tax without increasing its rates. Since 2021, the personal allowance has been frozen at £12,570. This is the amount that can be paid before income tax deductions begin.

The three rates of income tax have also remained frozen during this time. Although an extension isn’t an income tax rise per se, it would have meanr more workers paying more income tax in effect.

‘Significant real-terms funding increase’ for local government, Reeves says

13:41 , Tom BarnesRachel Reeves said there would be a “significant real-terms funding increase” for local government next year, noting this included £1.3 billion of additional grant funding to deliver “essential services”.

The Chancellor said there would be at least £600 million in grant funding for social care and £230 million to tackle homelessness and rough sleeping.

Ms Reeves also said: “We are today confirming that Greater Manchester and the West Midlands will be the first mayoral authorities to receive integrated settlements from next year, giving mayors meaningful control of the funding for their local areas.”

£500mn increase in funding to fix potholes

13:42 , Tom BarnesRachel Reeves has announced a £500m increase in road maintenance budget in order to fix an additional 1 million potholes each year.

£650m of local transport funding will also be spent to improve connections.

£5bn to be invested in housebuilding

13:44 , Athena StavrouChancellor Rachel Reeves has announced “over £5 billion of Government investment” in housebuilding and £1 billion of funding to remove dangerous cladding next year.

The move is a boost to Labour’s cornerstone promise to build 1.5 million homes to address the housing crisis.

HS2 tunnel to be built to London Euston

13:47 , Athena StavrouThe Chancellor has announced that the government is “committing the funding required” to begin tunnelling work to bring HS2 to London Euston station.

The announcement will be welcomed following speculation that the line could instead finish outside of London.

£1.4bn to rebuild 500 schools

13:51 , Athena StavrouThe Chancellor has announced £1.4 billion to rebuild more than 500 schools.

The move is part of a 19 per cent real-terms increase in the Department for Education’s capital budget, along with £2.1 billion for school maintenance.

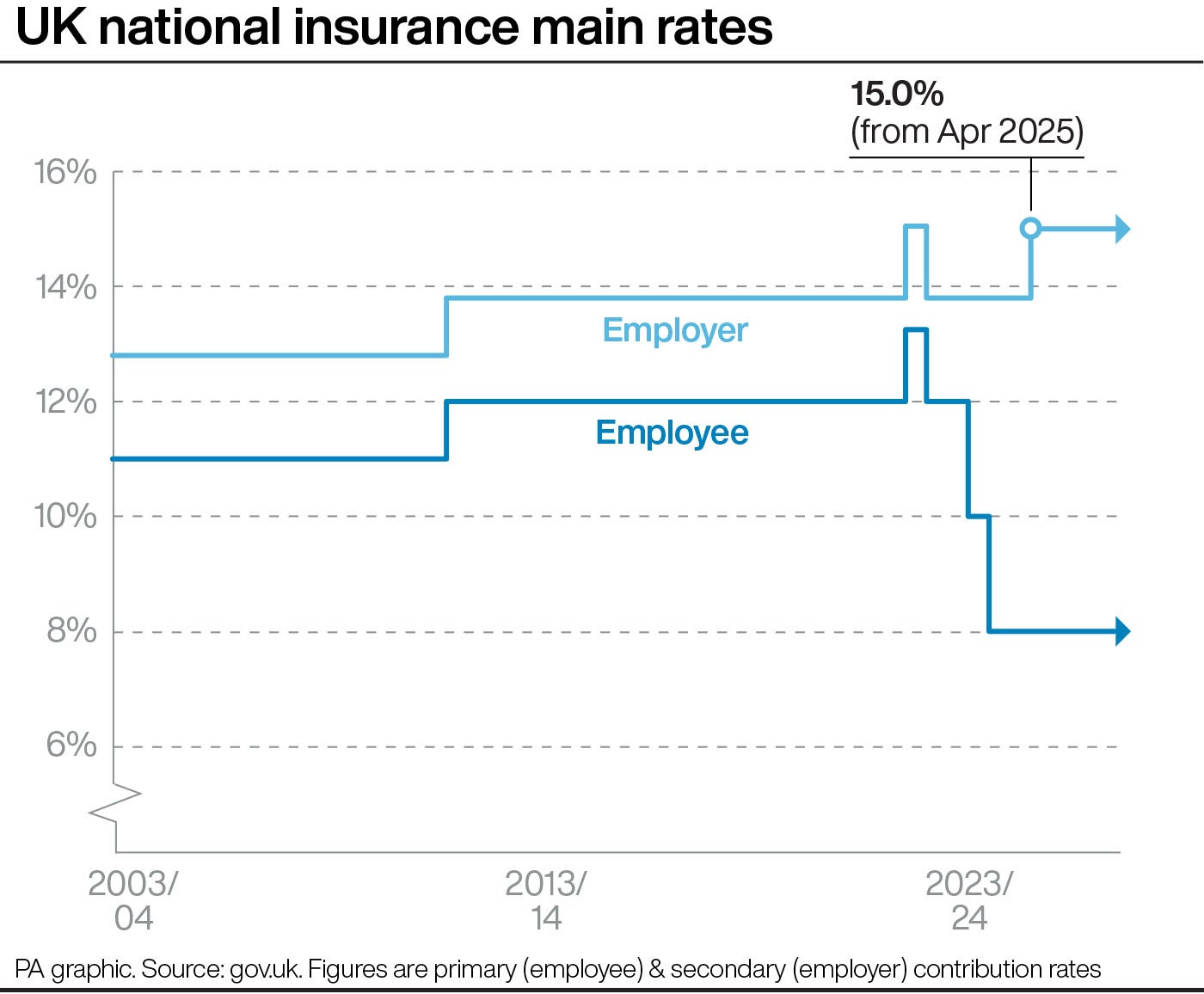

Graph of UK national insurance main rates

13:52 , Athena Stavrou

Reeves announces £22.6bn increase in the day-to-day health budget and 10-year plan

13:57 , Joe MiddletonChancellor Rachel Reeves has announced a £22.6bn increase in the day-to-day health budget.

Announcing the government’s plans for the NHS, Ms Reeves told the Commons: “In the spring, we will publish a 10-year plan for the NHS to deliver a shift from hospital to community, from analogue to digital, and from sickness to prevention. Today, we are announcing a down payment on that plan to enable the NHS to deliver 2% productivity growth next year.”

She added: “Today, because of the difficult decision that I have taken on tax, welfare and spending, I can announce that I am providing a £22.6 billion increase in the day to-day health budget, and a £3.1 billion increase in the capital budget, over this year and next year.

“This is the largest real-terms growth in day-to-day NHS spending outside of Covid since 2010.”

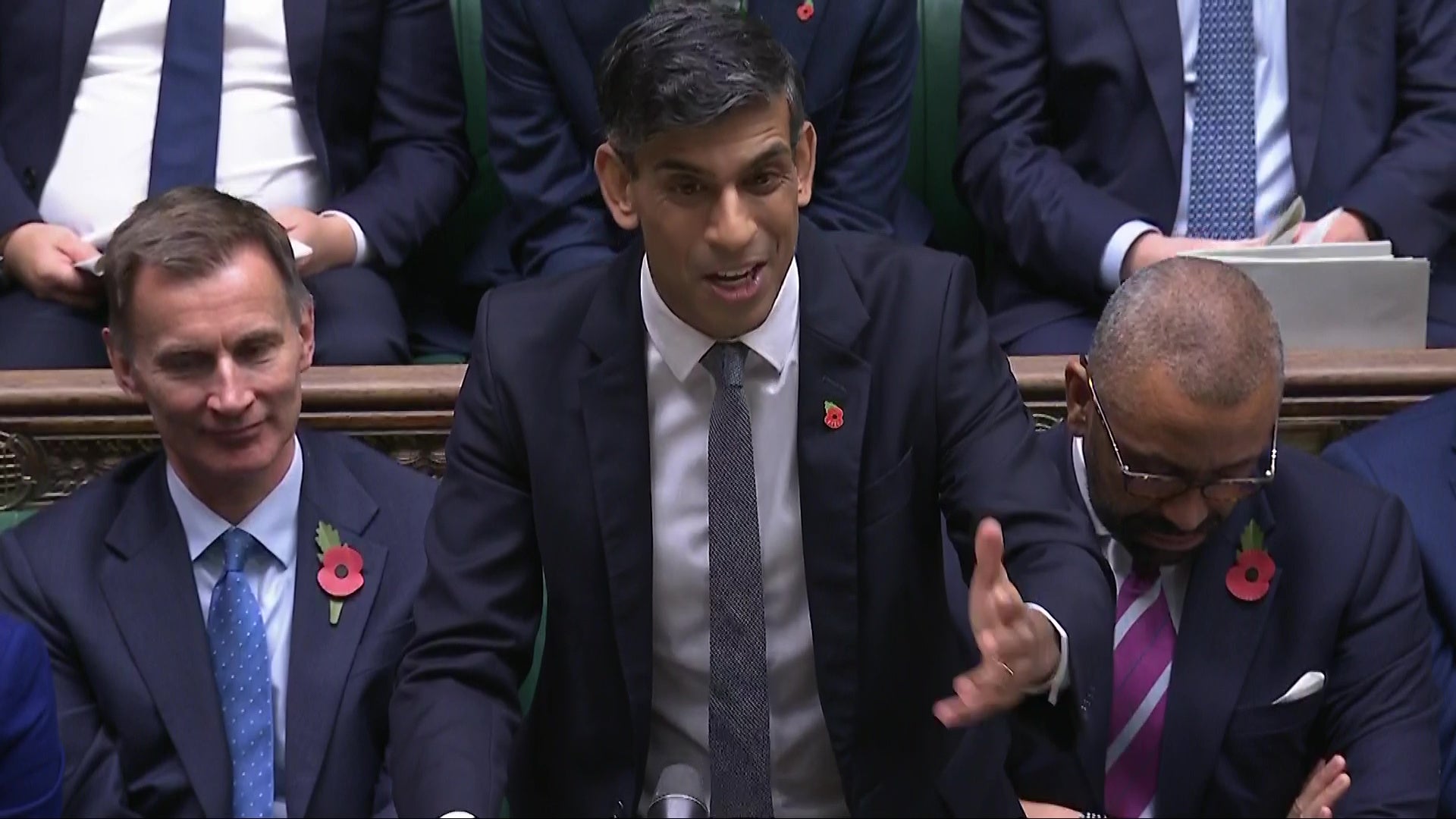

Rishi Sunak is responding to Rachel Reeves Budget

14:02 , Joe MiddletonThe former prime minister Rishi Sunak is responding to Rachel Reeves Budget in the Commons.

Mr Sunak repeats a similar point he has been making for weeks and that Labour has raised taxes.

He said: “Time and again we Conservatives warned Labour would tax, borrow and spend far beyond what they were telling the country and time and again they denied they had such plans.

“But today the truth has come out, proof that they planned to do this all along because today’s Budget sees the fiscal rules fiddled, borrowing increased by billions of pounds, inflation-busting handouts for the trade unions, Britain’s poorest pensioners squeezed, welfare spending out of control and a spree of tax rises they promised the working people of this country they would not do.”

How will the employer National Insurance rise affect you?

14:07 , Joe MiddletonRachel Reeves has confirmed that employer national insurance contributions (NICs) will rise following an announcement at Labour’s first Budget.

The measure has caused strong political debate, focused on whether it would break Labour’s manifesto pledge to not raise taxes on “working people.”

Ministers and Treasury officials have indicated the government’s position is that the measure would not break their manifesto pledge. Meanwhile, Institute for Fiscal Studies director Paul Johnson has argued it would be a “straightforward breach.”

Here are the facts about the debate and how the measure could affect you:

How would raising employer national insurance in the Budget affect you?

Sunak claims pensioners have been ‘squeezed’ in Budget

14:13 , Joe MiddletonRishi Sunak has warned that Britain’s poorest pensioners have been “squeezed” in the Budget.

He told the Commons: “Britain’s poorest pensioners squeezed, welfare spending out of control and a streak of tax rises they promised the working people of this country they would not do.

The former prime minister said: “National insurance, up. Capital gains tax, up. Inheritance tax, up. Energy taxes, up. Business rates, up. First-time buyer stamp duty, up. Pensions tax, up. They have fiddled the figures.”

Watch: Rachel Reeves pledges unprecedented NHS funding boost to transform healthcare

14:21 , Joe MiddletonSunak accuses Reeves of ‘tidal wave of anti-business regulations'

14:32 , Andy GregoryRishi Sunak has accused the chancellor of “delivering a tidal wave of anti-business regulations” and claimed the Labour Party is led by people “who have no experience of business”.

The former prime minister told the Commons: “Today, the OBR has forecast growth is going to be lower under this government than it was forecast to be under the Conservatives, that’s the change they have brought.

“This is what happens when the Labour Party is led by people who have no experience of business. Relentlessly talking down our economy, delivering a tidal wave of anti-business regulations, destroying our flexible labour market, and raising taxes to the highest level in our country’s history.

“It’s a classic Labour agenda – higher taxes, higher borrowing, no plan for growth and working people paying the price.”

Watch: Rachel Reeves mocks Rishi Sunak with private jet announcement

14:35 , Andy GregoryRachel Reeves mocked Tory leader Rishi Sunak as she unveiled a rise of 50 per cent on air passenger duty for those travelling by private jet.

Budget sets Britain ‘on path towards national renewal’, says TUC

14:39 , Andy GregoryThe Trades Union Congress has hailed Rachel Reeves’ first Budget as a “vital first step towards repairing and rebuilding Britain”, but warned that “there is still a lot more work to do to clean up 14 years of Tory mess and economic decline.

TUC chief Paul Nowak said: “The chancellor was dealt a terrible hand by the last Conservative government – a toxic legacy of economic chaos, falling living standards and broken public services. But with today’s budget the Chancellor has acted decisively to deliver an economy that works for working people.

“The government’s investment plans are a vital first step towards repairing and rebuilding Britain – securing the stronger growth, higher wages and decent public services that the country desperately needs.

“Tax rises will ensure much-needed funds for our NHS, schools and the rest of our crumbling public services, with those who have the broadest shoulders paying a fairer share. The chancellor was right to prioritise hospitals and classrooms over private jets.

“There is still a lot more work to do to clean up 14 years of Tory mess and economic decline – including better supporting and strengthening our social security system. But this budget sets us on an urgently needed path towards national renewal.”

Pound strengthens slightly after Budget, but FTSE remains in the red

14:41 , Andy GregoryThe pound has strengthened following Rachel Reeves’ Budget – although the FTSE 100 Index remained in the red.

Sterling, which was down 0.4 per cent against both the US dollar and euro prior to the Budget – later stood 0.2 per cent higher at $1.303 dollars and 0.1 per cent lower at €1.201.

However, London’s FTSE 100 Index fell 0.6 per cent.

What impact will Budget have on rail travel costs?

14:45 , Andy GregoryRegulated train fares in England will increase by up to 4.6 per cent next year and the price of most railcards – excluding the discount mechanism for disabled passengers – will rise by £5, Rachel Reeves announced in her Budget.

The increase in fares is one percentage point above July’s Retail Prices Index (RPI) measure of inflation, which until 2023 was used by Westminster governments to set the cap on annual rises in regulated fares.

But a Budget document published by the Treasury stated that the 4.6 per cent rise will be “the lowest absolute increase in three years”, with fare changes to come into force in March.

Budget averts 36% fall in net public investment, IPPR analyst says

14:51 , Andy GregoryRachel Reeves’ Budget will keep investment in the public sector roughly stable over the course of this parliament, according to Carsten Jung, head of macroeconomics at the IPPR think-tank.

The new plans contrast with a 36 per cent fall under the previous Tory government’s plans, Mr Jung said.

Excellent news that the government is significantly boosting public investment! Instead of falling by a third it's now roughly stable (0.7pp of GDP higher on average). Less than we recommended, but of crucial importance for raising growth. pic.twitter.com/UygadvYpRj

— Carsten Jung (@carsjung) October 30, 2024

Watch live: Office for Budget Responsibility responds to Rachel Reeves’ £40bn tax hikes

14:53 , Andy GregoryLabour accused of ‘betrayal’ of Scottish whisky industry

14:58 , Andy GregoryBritish multinational Diageo has reacted angrily to Rachel Reeves’ Budget, accusing the chancellor of breaking Labour’s promise to support the Scottish whisky industry.

Nuno Teles, managing director of the firm’s UK arm, said: “On the campaign trail, Keir Starmer pledged to ‘back the Scotch whisky industry to the hilt’.

“Instead, the government has broken this promise and slammed even more duty on spirits. This betrayal will leave a bitter taste for drinkers and pubs, while jeopardising jobs and investment across Scotland.”

Labour MPs express relief after bracing for ‘massive spending cuts’

15:07 , Andy GregoryLabour MPs have expressed relief over Rachel Reeves’ Budget, in comments to LabourList.

One said they had seen “lots of messages in my [Constituency Labour Party] WhatsApp saying they are looking forward to canvassing this weekend much more now”.

Another new MP told the outlet of their “enormous relief”, saying: “The weeks of stories beforehand suggested massive cuts to public services and spending, instead we have a Budget for long-term economic growth and which gets to work rebuilding our services and infrastructure.”

And Labour council leader described the Budget as “absolutely superb”, praising increased funding for local government and a “transformational investment” in the NHS.

Reeves confirms new Office for Value for Money

15:09 , Howard MustoeThose with keen ears will have noticed the chancellor mention the Office for Value for Money.

In the summer, Ms Reeves said she had told Treasury officials to do a rapid audit of public spending.

She also said she would set up an independent watchdog called the Office for Value for Money in an effort to cut waste and get technology to speed things up in the civil service.

The office will aim to intervene where waste is detected as well as helping government departments sharpen up their buying methods.

As well as spending well, it will ensure the taxpayer gets value from things like the sale in Nat West shares that the government owns.

Today she confirmed that top civil servant David Goldstone will chair the body.

Watch: Rishi Sunak reacts to Budget 'Broken promise after broken promise'

15:14 , Joe MiddletonGot questions about the Budget?

15:23 , Joe MiddletonChancellor Rachel Reeves has delivered her first Budget, which included a few curveballs.

So what will the announcements mean for your finances? And when will changes come into force?

The political ramifications of the budget are also worth exploring. What does Wednesday’s announcement reveal about Reeves’ and Starmer’s long-term plans?

Join a live Q&A with our chief political commentator John Rentoul at 4pm. You can submit a question for John here.

IFS warns that Reeves is taking a gamble with £40bn tax rises and big boost for public services

15:50 , Joe MiddletonThe Institute for Fiscal Studies (IFS) has warned that Rachel Reeves is taking a significant gamble with her large tax rises and extra borrowing to fund public services.

Responding to the Budget, Paul Johnson, director of the IFS, warned that the government could have to up push taxes up again if spending pressures on public services do not abate.

He said: “In broad brush strokes, that was the Budget we had been led to expect: big tax rises, more cash for public services, more borrowing and more investment. Look beyond the headline numbers, and there are two big judgements – one could say gambles – that the Chancellor seems to be making.

Mr Johnson added: “The first gamble is that a big cash injection for public services over the next two years will be enough to turn performance around, and that many of the temporary spending pressures won’t persist.

“If she’s wrong about that, and spending pressures don’t dissipate after two years, then to avoid cutting unprotected areas she may well need to come back with another round of tax rises in a couple of years’ time – unless she gets lucky on growth.”

“Which brings us to the second gamble: that this extra borrowing will be worthwhile. Under pre-election plans we were set to borrow an average of £59 billion per year over the next four years. We now expect to borrow an average of £85 billion. The hope is that the benefits – from more funding for public services in the next couple of years, and from more public investment throughout the parliament – will more than offset the costs.

“These costs include higher debt servicing costs but also, according to the OBR, higher inflation and higher interest rates than we’d otherwise have seen.

“A lot hinges on how well the government spends the money. The additional investment is extremely front-loaded, which doesn’t fill me with confidence on how efficiently it will be spent - if indeed it is spent in that timescale.”

Reaction: Reeves Budget could slow interest rates cuts

16:01 , Joe MiddletonResponding to the Chancellor’s Budget today, Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales said: “The OBR’s latest outlook offers an underwhelming view of the UK economy with slight downgrades to their GDP projections from 2026. Tax rises on businesses combined with poor productivity could mean that growth is shallower than the OBR is expecting.

“While these tax hikes announced could undermine the government’s growth mission, the ultimate test for this budget will be whether the long overdue boost to investment can significantly increase productivity and living standards over the long term.

“Though a November interest rate cut looks nailed on, the upward pressure on inflation from the notably higher business costs resulting from some of the measures announced may mean that policy is loosened more slowly than expected.”

Reaction: Budget marks ‘positive shift’ for UK economy, says left-of-centre think-tank

16:12 , Joe MiddletonThe Institute for Public Policy Research (IPPR) said Rachel Reeves taken an “important step towards building a better Britain” but warned there is more work to do in relation to making the tax system fairer

Harry Quilter-Pinner, interim IPPR executive director, said: “Today’s budget marks a decisive, positive shift for the UK economy. By setting a course that involves higher investment than the previous government planned, and additional tax revenue to support public services, the chancellor is steering the country away from stagnation and austerity, towards a better economy.

“On investment, the chancellor has heeded our call that getting the fastest growth in the G7 will not be possible with the lowest investment in the G7. This budget marks the moment when the UK turns the tide on our low investment, low productivity, low wage economy. The focus must now be on increasing investment year on year, and spending it well, to deliver shared growth.

“Today’s tax reforms have prevented the worst of the planned spending cuts that were inherited from the previous government. But there is more work to do. A wealthy millionaire or billionaire will still be able to pay a lower rate of tax than the average nurse. And the overall spending envelope will still leave some departments with tough decisions to make.

“The new government inherited a terrible economic situation after many years of crisis and mismanagement. Today the chancellor has taken important steps towards building a better Britain. But decades of economic damage cannot be undone in one budget. This must be the start of a decade of national renewal.”

Reeves goes after employers with young workers the clear winners

16:27 , Joe MiddletonChancellor Rachel Reeves took aim at employers in her first budget, hitting them with higher taxes and raising the minimum wage, leaving young workers as the clear winners.

The minimum wage for 18 to 20-year-olds will rise 16 per cent to £10 as part of a plan to equalise the rate with older earners, while the national living wage got a 6.7 per cent top-up to £12.21 an hour.

“The most significant impact will be on 18-20 year olds, who will see the largest increase to the National Minimum Wage on record,” said John Harding, a partner at accountants PwC.

Drinkers will also enjoy a penny off draught pints and duty on petrol has been frozen again.

The picture is darker for the better-off, on whose shoulders the chancellor warned the biggest burden will fall.

Howard Mustoe reports

Reeves goes after employers with young workers the clear winners

Construction industry warns tax rises could threaten plans to build houses

16:30 , Millie CookeThe construction industry has warned that the increase in the rate of employer national insurance (NI) could threaten the government’s mission to solve the housing crisis.

Amit Oberoi, executive chairman of The Considerate Constructors Scheme (CCS) - a non-profit aiming to raise standards in construction - warned “smaller, agile building firms” could close as a result of the changes.

He warned: “We welcome the announcement of increased infrastructure investment and the announcement of £3 billion to boost the supply of homes and support small housebuilders. However, I’m concerned the decision to increase employers’ National Insurance rate makes that more difficult.

“Solving the housing crisis and retaining staff is not just about large construction, but keeping alive many smaller, agile building firms.

“We’re already hearing sounds of real distress from SMEs, and these changes will cause many to close, potentially mid-project. This will be disruptive to the government’s goals of building homes and retaining vital construction skills, both of which are essential to deliver housing at the rates the country needs.”

Voices: A strong performance, chancellor – but you can’t afford another Budget like this

16:45 , Joe MiddletonThanks to some nifty sleights of hand, the chancellor was able to declare that she had not broken any electoral pledges. But will Rachel Reeves’s spending plans revive the government’s floundering fortunes, asks Andrew Grice

A strong performance, chancellor – but you can’t afford another Budget like this

Reaction: Reeves Budget has ‘kicked the can down the road' on poverty

17:01 , Alex CroftThe Rachel Reeves Budget has “kicked the can down the road” on Britain’s poverty challenge until earliest next Spring, says the Resolution Foundation think tank.

Mike Brewer, the organisation’s interim chief executive, said: “The first Labour Budget in 15 years was an historic moment, and huge in both tax and spend terms. Rachel Reeves announced £326 billion of extra funding for public services and investment across the parliament, funded by the biggest tax rising Budget on record along with extra borrowing.

“The Chancellor has done a reasonable job of ensuring a balanced package of tax reforms. Essentially, she has more than reversed the last Government’s pre-election National Insurance cuts with post-election National Insurance rises. But there are winners and losers in this convoluted policy reversal, with self-employed workers and small businesses being the big winners and firms employing lots of low or very high earners worse affected.

“The Chancellor has delivered a Budget that engages with the seriousness of Britain’s economic challenges. But it is only the first step of what will be needed to secure strong public services, end stagnation, and lift living standards for all.

“And while the Chancellor has confronted Britain’s austerity challenge, she has kicked the can down the road on Britain’s equally pressing poverty challenge until next Spring at the earliest. A failure to reverse damaging welfare cuts could see over 200,000 more children affected by the two-child limit.”

Reaction: Budget was ‘missed opportunity’ says Jeremy Corbyn

17:13 , Alex CroftFormer Labour Party leader Jeremy Corbyn has branded Rachel Reeves’ budget a “missed opportunity to bring about the transformative change this country needs”.

A joint statement from the Independent Alliance - Mr Corbyn’s new alliance of five independent MPs - said the Budget chooses to “bake in decades of inequality by feigning regret over ‘tough choices’ it does not have to make”.

It referenced the decisions to keep the 2-child benefit cap, cut winter fuel allowance and increase the bus fare cap, and the additional £3 billion for military expenditure.

The Independent Alliance welcomed increases to the minimum wage and Carers’ Allowance, but said it is “beyond disappointing” that this has come with “cuts to social security and disability benefits”.

It also welcomed “long overdue investment in hospitals”, adding that the government must ensure this money goes straight to the NHS rather than “private healthcare shareholders”.

Today’s budget was a missed opportunity to bring about the transformative change this country needs.

— Jeremy Corbyn (@jeremycorbyn) October 30, 2024

A statement from the Independent Alliance. pic.twitter.com/iWPywxDfmg

Watch: Rachel Reeves delivers Budget message to ‘girls and women’ as UK’s first female chancellor

17:27 , Alex CroftReaction: Greenpeace criticise fuel duty freeze

17:42 , Alex CroftRachel Reeves should have combined a fuel duty increase with “major investment” into public transport, Greenpeace UK says.

Greenpeace UK’s senior transport campaigner, Paul Morozzo, said: “The cost of oil is falling, which presented the Chancellor with a perfect opportunity to finally get rid of the freeze on fuel duty.

“A sensible government approach would be to combine an increase in fuel duty with major investment to improve, expand and reduce the cost of public transport. Unfortunately the Chancellor has used this Budget to maintain the freeze and put up bus fares, which will only hurt those on the lowest incomes.”

Ami McCarthy, Greenpeace UK’s head of politics, said: “Changing the fiscal rules is a common sense step that will allow us to make the long-overdue investment the country drastically needs. The Chancellor must use the additional funds to go further and faster on green measures that will boost the economy, and tackle the climate and cost of living crises at the same time, like home insulation, public transport, and jobs in industries of the future.

“Progressive tax measures are welcome, but the Chancellor should go much further to tax the super-rich and corporate polluters. Making them pay their fair share would raise hundreds of billions for communities suffering from climate impacts at home and abroad.”

Tax calculator: See how Rachel Reeves’ Budget will affect you

17:57 , Alex CroftRachel Reeves has unveiled huge tax hikes of £40bn in her Budget as Labour bids to fix the nation’s finances.

Key policies include a hike in employers’ national insurance contributions, a rise in stamp duty for second homes and a freeze on fuel duty.

Capital gains tax will also rise – to 18 per cent for the lower rate and 24 for the higher – while the chancellor also unveiled a reform of inheritance tax.

Use our tax calculator to see how Rachel Reeves’ Budget will impact you:

Tax calculator: Check out how Labour’s Budget will affect you

Catastrophic cost of Brexit on UK trade revealed in stark OBR warning

18:13 , Alex CroftBrexit is on course to cut UK trade by 15 per cent, the government’s independent financial watchdog has warned.

Vote Leave campaigners argued that British trade would receive a boost from exiting the European Union in the run up to 2016’s referendum.

But in documents published alongside Rachel Reeves’ Budget the Office for Budget Responsibility (OBR) said that “weak growth in imports and exports over the medium term partly reflect the continuing impact of Brexit, which we expect to reduce the overall trade intensity of the UK economy by 15 per cent in the long term.”

The figures led to claims that Brexit was the “elephant in the chancellor’s study”.

The prime minister has said that he wants to reset the UK’s relationship with the EU, fixing it for the benefit of “generations to come”.

Read the full report from our Whitehall Editor, Kate Devlin:

Catastrophic cost of Brexit on UK trade revealed in stark OBR warning

Reaction: Local Government Association says Budget is 'step in the right direction’

18:29 , Alex CroftThe Local Government Association (LGA), which represents hundreds of local authorities in the UK, says the budget is a “step in the right direction” but councils still face a “precarious short and long-term future”.

Chair of the LGA, Cllr Louise Gittins, said: “It is encouraging that the Chancellor has responded today by providing £1.3 billion extra funding for the next financial year, which will help meet some – but not all - of the significant pressures in adult and children’s social care and homelessness support.”

Cllr Gittins commended funding for children with special educational needs and disabilities, children’s social care reforms, Right to Buy reform, funding for potholes, affordable housing and childcare, among other measures.

She added: “This is a step in the right direction, but councils and the services they provide to their residents still face a precarious short and long-term future. The government needs to give explicit clarity on whether councils will be protected from extra cost pressures from the increases to employer national insurance contributions.

“Only with greater funding certainty through multi-year settlements and more clarity on financial reform, can councils protect services, meet the needs of residents and work in partnership on the government’s priorities, from social care to housing, inclusive economic growth and tackling climate change. We look forward to continuing to work in partnership with the government to address these issues for councils and communities.”

John Curtice: Voters are backing Reeves now – but she needs her gamble to pay off before the next election

18:45 , Alex CroftThe short-term politics of Rachel Reeves’ Budget are clear. Taxes that affect most voters’ pay are not increased. Even the duty on petrol remains unchanged, while the much anticipated extension of the freeze of income tax thresholds was notable by its absence.

Yet, at the same time, spending on public services is increased this year and next – including (above all) on the health service. And there was even a one penny cut in the price of draught beer sold in pubs.

Read the rest of election guru and polling expert Sir John Curtice’s Voices piece:

Voters are backing Reeves now – but she needs her gamble to pay off

Debunked: Did Labour lie in their election manifesto?

19:02 , Alex CroftDid Labour mislead the public during their summer election campaign by claiming they wouldn’t tax working people?

Rachel Reeves has now confirmed that employer national insurance contributions (NICs) will rise in Labour’s upcoming budget, raising eyebrows about whether this goes against their manifesto pledge.

Many are wondering if this move breaks the promise to not increase taxes on working people.

The Independent spoke to Daniele Girardi, an economist at King’s College London, to get his take on whether Labour is staying true to their word or stepping back from their commitments.

What was missing from Labour’s historic Budget?

19:18 , Albert TothA sombre stage had been set for months before the new Labour government’s first Budget. The gloomy messaging began when Rachel Reeves unveiled told the Commons the public purse was facing a £22bn “black hole” at the end of July. It continued when the prime minister warned that the coming event would be “painful.”

With these bleak warnings in place, many predicted the worst from the fiscal event. Some expectations were met: the chancellor confirmed £40bn in tax rises, announcing expected tweaks to capital gains, national insurance and more.

However, there were also some surprises, alongside several measures that had been “leaked” being completely omitted from the statement.

Here’s what was missing from the Labour Budget:

Rishi ‘Hulk’ Sunak’s last hurrah: angry, energised and personally affronted - comment

19:32 , Alex CroftThe Budget reply was Rishi Sunak’s last big gig in the House of Commons – despite Keir Starmer’s joke during Prime Minister’s Questions that the Conservatives change leader so often, “he may be back here” soon.

In those exchanges, Starmer and Sunak were all courtesy and best behaviour. Starmer paid tribute to his defeated opponent’s “decency”; Sunak was softly spoken and bipartisan.

As he listened to Rachel Reeves’s Budget, however, Sunak underwent a Hulk-like transformation. Reeves was tribal and aggressive, blaming 14 years of Tory failure for the tax rises she had been forced to announce.

Rishi ‘Hulk’ Sunak’s last hurrah: angry, energised and personally affronted

Reaction: Humanitarian charity ‘profoundly disappointed’ at aid budget cut

19:34 , Alex CroftTwo humanitarian charities have expressed disappointment at the failure to uplift the Official Development Assistance budget, which aims to promote economic development and welfare in developing countries.

Hannah Bond, Co-CEO of ActionAid UK said: “We are profoundly disappointed that the Chancellor has chosen not to uplift the Official Development Assistance (ODA) budget in the Autumn statement today. For a government that came to power pledging to reset its global relationships and place tackling climate change at the core of its foreign policy, this statement is an indication it plans to do anything but.

“After the previous government took a wrecking ball to projects aimed at tackling gender inequality, Labour is following in their footsteps by further abandoning women and girls when they need it the most. We urge them to rethink this decision and consider what it signals to the rest of the international community."

Khusbu Patel, interim Executive Director at the International Rescue Committee UK, said: “In the Autumn Budget today, the government missed the opportunity to protect the already strained aid budget. With UK aid spending projected to fall even further, failing to act today will significantly impact almost 300 million people in need of humanitarian assistance around the world.”