KEY POINTS

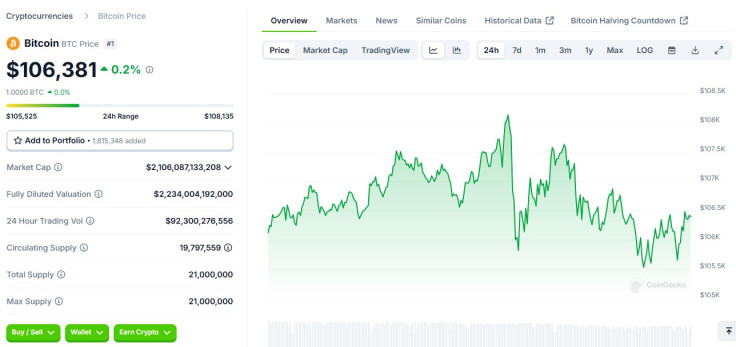

- $BTC traded above $108,100 at one point Tuesday night

- Some industry experts are divided over the implications of a Bitcoin fund

- There is concern a $BTC purchase strategy may not be the best idea

- One expert believes Bitcoin should 'remain the people's money'

Bitcoin has broken another price record-high for the second straight day amid optimism about the possibility of the United States under Donald Trump establishing a national strategic BTC reserve.

At one point Tuesday night, BTC was trading above $108,100, just a day after it broke the $107,000 mark. The top digital asset has been on a 10% weekly increase as the crypto community continues to celebrate positive developments within the industry.

Why is $BTC Surging?

While Bitcoin's surge may have been affected by various factors in the broader financial market and multiple positive moves in the crypto industry, such as hype around Ripple's RLUSD stablecoin, the major driver for the digital currency's spike in recent days is the rising hope for a U.S. strategic Bitcoin reserve.

Over the weekend, the incoming U.S. president reaffirmed plans to establish a BTC strategic reserve, triggering much enthusiasm among Bitcoiners and crypto bulls.

Sen. Cynthia Lummis of Wyoming, a Trump ally, has repeatedly said in recent months that she will push for a BTC reserve through a bill that includes a provision stating the U.S. government will purchase Bitcoins.

El Salvador has already been implementing the said strategy since late 2022. Salvadoran President Nayib Bukele is a renowned Bitcoin maximalist and has been pushing for mass adoption among his countrymen, but results haven't reached expectations so far.

US $BTC Reserve Optimism Triggers Debate, Raises Concerns

While many crypto users have said a U.S. Bitcoin reserve will ultimately be good for the BTC community and the broader crypto market, there have been debates about how the reserve will affect crypto and whether the impacts will be good or bad.

For Matthew Sigel, head of digital assets research at global investment manager VanEck, the U.S. government can do what it wants with Bitcoin since it is "free for anyone to adopt."

1) BTC is free for anyone to adopt

— matthew sigel, recovering CFA (@matthew_sigel) December 18, 2024

2) the US government is by the people and for the people

3) I agree, thus I have a different suggestion for how the US should acquire its Bitcoin than in the open market

4) Maybe, maybe not. All currencies die eventually.

He did admit that he would have "a different suggestion for how the U.S. should acquire its Bitcoin than in the open market."

Sigel's comments were in response to Base Layer LLC Founder @0xemon's statements that Bitcoin "should remain free" of any government involvement and should "remain the people's money."

https://t.co/WQHTNnz7cB

— eMon (@0xemon) December 18, 2024

1) BTC should remain free of any gov involvement

2) it should remain the peoples money

3) it’s a bad political move that might look like pumping holders bags in the short term

4) it could lead to the end of BTC relevance just like the demise of the…

He argued that establishing a national BTC fund isn't a good political move and might end up affecting the "relevance" of the world's first decentralized cryptocurrency in a negative way, similar to the end of "the gold standard."

Nic Carter, a founding partner at Castle Island Ventures, told Bloomberg Tuesday that if the government will "HODL" its existing stockpile of seized Bitcoins, then it could be a workable national fund.

Castle Island Ventures Founding Partner @nic__carter does not expect a strategic Bitcoin reserve because it wouldn't benefit anyone if we were to shake confidence in global markets by implying the dollar is at risk https://t.co/dqUnpVoaCq pic.twitter.com/cL8AbMGG9M

— Bloomberg TV (@BloombergTV) December 17, 2024

On the other hand, he doesn't think it's likely that Congress will actually support Lummis's bill that will make the government acquire BTC as it would "signal a move away from the dollar system."

"We shouldn't do something that would call into question our own solvency," he pointed out. He said it would definitely benefit Bitcoiners if a strategic reserve on BTC is adopted, but he thinks it won't benefit anyone "if we were to shake confidence in global markets by implying the dollar is at risk."

El Salvador's $BTC Gamble

For El Salvador, its bet on Bitcoin has so far been paying off. On Monday, after the BTC price broke above $107,000, Bukele floated the country's Bitcoin treasury.

Bukele first announced the nation's Bitcoin strategy late in 2022, during the crypto winter. Since then, El Salvador has been purchasing 1 BTC on a daily basis, and on-chain data shows that the country hasn't missed a single purchase.

It is unclear whether the U.S. will follow in El Salvador's footsteps should it push through with a national BTC reserve, but it can be safe to say that based on how Trump has moved since being elected, crypto's voice is being heard.