The world keeps on moving even when it’s in turmoil. Broadcom (AVGO) can attest to that, as the company reported earnings on Thursday after the close.

With the broader market lower on the day, Broadcom shares are actually up about 4% on the day and are hitting new session highs following better-than-expected results.

The company beat on earnings and revenue expectations and provided a strong outlook. Don’t forget it yields almost 3% with its dividend, too.

It has not been an easy run for Broadcom, but the stock has been trading much better lately. At one point in January, shares were down 25% from the high in less than a month.

Amid one portion of that decline, shares fell in 10 out of 12 sessions, as everything related to tech and semiconductors were under pressure. That’s true for Advanced Micro Devices (AMD) and Nvidia (NVDA) as well.

Not many stocks were able to avoid new lows in February, as most took out the January low on that nasty Feb. 24 gap-down open. However, Broadcom was not in that mix.

While it too gapped lower, it didn’t take out the prior month’s low and the action has been constructive lately. Obviously there are some concerns on whether the stock can continue to fight the market volatility.

Trading Broadcom Stock

Chart courtesy of TrendSpider.com

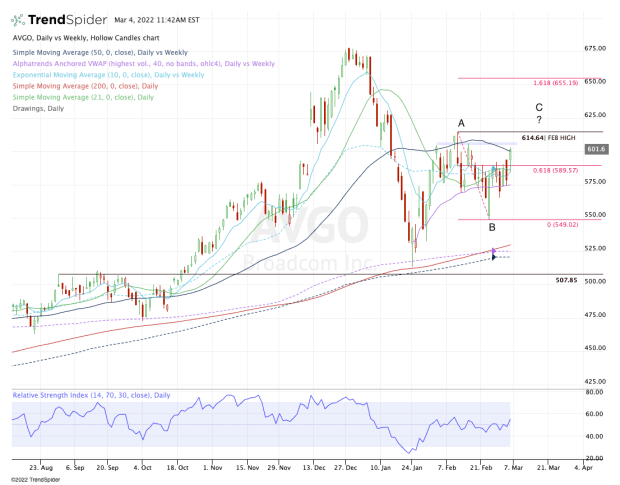

After such a huge decline, the trouble is figuring out which type of correction a stock is in.

Is Broadcom currently in the midst of a rallying leg in an even larger downturn, or is it now working on a potential “ABC” upside rally?

For now, I’m siding with the latter — the bullish takeaway.

Why? Because if this was a bearish setup, my view is that the February low would have been much closer to the January low. In fact, in an ideal bearish scenario it would have broken below the Jan. 24 low.

Instead it put in a higher low.

With today’s rally, Broadcom stock is also breaking out over the 61.8% retracement of the current dip. Plus Broadcom has pretty good fundamentals.

That all said, I’m not a raging bull by any means. That’s because the Volatility Index is still above $30 and as Broadcom shares race into the 50-day moving average.

So far this year, the 50-day has been resistance for most stocks and that has been the case for Broadcom too. If it can push through this measure — and that’s a big "if" — then the $615 area is in play, which is the February high.

Above the February high and we could have a monthly-up rotation on our hands. That could open the door up to the $650 to $655 zone, where the 161.8% extension of the current range comes into play.

On the downside, I would lose all faith if Broadcom lost the $575 level. That would put it below the 10-day and 21-day moving averages, as well as the 61.8% retracement, the post-earnings low and the daily VWAP measure.