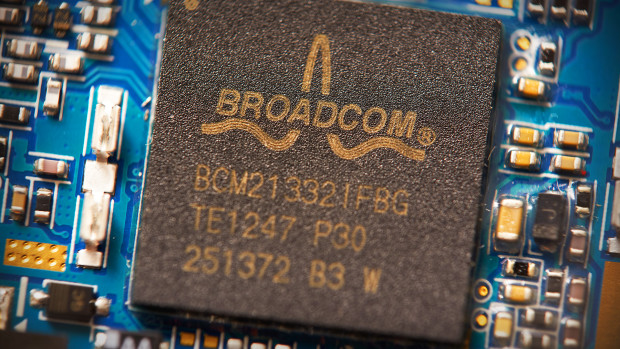

Broadcom (AVGO) -) shares slumped lower in pre-market trading after a muted near-term sales outlook, linked to weaker enterprise spending, clouded an otherwise solid third quarter earnings report.

Broadcom's adjusted earnings of $10.54 per share for the three months ending in July, an 8.3% increase from last year, edged past Wall Street forecasts while revenue rose 5% to an analyst-beating $8.88 billion, powered for the most part by growth in AI-related chip sales.

Looking into the current-quarter, Broadcom said revenues should come in at around $9.27 billion, again supported by accelerating AI growth, but that figure only match Street forecasts. Still, AI chip sales are on track to represent around 15% of overall revenues this fiscal year, and 25% by the end of fiscal 2025, suggest a solid longer-term profit track for a company that enjoys a gross margin of more than 75%.

"As you know, we supply a major hyperscale customer with custom AI compute engines. We are also supplying several hyperscalers a portfolio of networking technologies as they scale up and scale out their AI clusters within their data centers," CEO Hock Tan told investors on a conference call late Thursday.

"Now representing over $1 billion, this represented virtually all the growth in our infrastructure business in Q3 this year on year," he added.

Broadcom shares were marked 4.6% lower in pre-market trading to indicate an opening bell price of $880.10 each.

- Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.