Shares of Broadcom (AVGO) are rallying nicely on Friday, up about 4.5% after the company reported earnings.

However, the stock is running into a stubborn area on the charts. While the charts didn’t offer much comfort ahead of the print, the post-earnings rally is trying to improve the technical situation.

The rally comes after Broadcom delivered a top- and bottom-line beat for its fiscal third quarter, with revenue climbing 25% year over year.

The company also offered promising guidance, with a better-than-expected revenue outlook for the fourth quarter.

That sentiment clashes with what we’ve heard from other chip companies. The one that immediately comes to mind is Nvidia (NVDA), which has struggled from an earnings perspective and suffered another blow earlier this week due to the U.S.on restricting certain A.I. chip sales to China.

Let’s look at the key levels for Broadcom.

Trading Broadcom Stock on Earnings

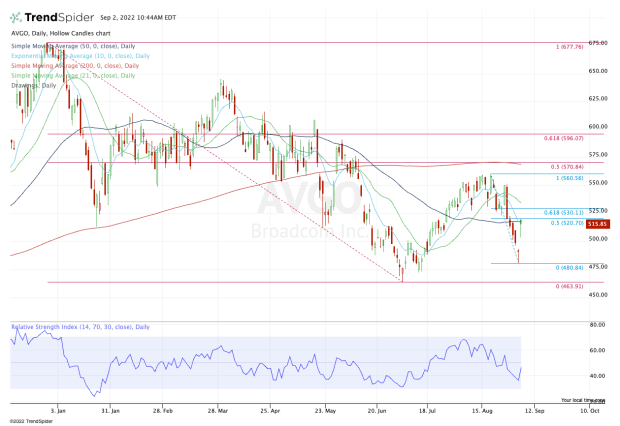

Chart courtesy of TrendSpider.com

Shares of Broadcom fell in five straight sessions, but rebounded nicely off the lows on Thursday. Of course, the risk was earnings after the close.

Currently, Broadcom stock is rallying into the 50% retracement of the current range, as well as the 10-day and 50-day moving averages. This is a key spot on the chart, as it would be easy for the stock to fail at this zone.

If it can push through, it opens the door to the $530 area where it finds the 21-day moving average and the 61.8% retracement.

The bulls really gain control if the stock can clear these levels. It would put the $550 to $560 zone on the table. If we see this zone, it would be worth taking a refreshed look at the charts at that point in time.

So what happens if the $520 area is resistance?

In that scenario, bulls must be aware of today’s low and the $500 level. If Broadcom stock breaks below this level, the gap-fill level near $493 is in play, followed by this week’s low down near $480.

If that level breaks, then the 2022 low is back in play near $464.

While the ranges are fairly wide, the levels are quite clear. Broadcom stock must clear $520 on the upside, then $530 to unlock a larger rally. On the downside, it must hold $500 to $505. Otherwise, lower prices could be in store.