Zillow Gr (NASDAQ:ZG) has been analyzed by 19 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 7 | 6 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 4 | 3 | 1 | 0 |

| 2M Ago | 1 | 2 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 2 | 0 | 0 |

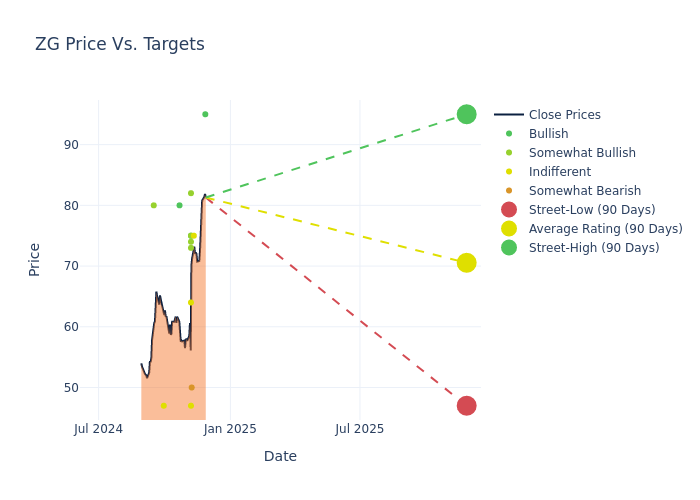

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $67.37, with a high estimate of $95.00 and a low estimate of $47.00. Observing a 18.42% increase, the current average has risen from the previous average price target of $56.89.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Zillow Gr among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jason Kreyer | Craig-Hallum | Raises | Buy | $95.00 | $70.00 |

| Shyam Patil | Susquehanna | Raises | Neutral | $75.00 | $55.00 |

| Trevor Young | Barclays | Raises | Underweight | $50.00 | $36.00 |

| Tom White | DA Davidson | Raises | Buy | $75.00 | $71.00 |

| Jason Kreyer | Craig-Hallum | Raises | Buy | $70.00 | $55.00 |

| Maria Ripps | Canaccord Genuity | Raises | Hold | $64.00 | $56.00 |

| Nicholas Jones | JMP Securities | Raises | Market Outperform | $82.00 | $62.00 |

| Brad Erickson | RBC Capital | Raises | Outperform | $74.00 | $66.00 |

| Mike Burton | Goldman Sachs | Raises | Neutral | $47.00 | $42.00 |

| Thomas Champion | Piper Sandler | Raises | Overweight | $73.00 | $62.00 |

| Mark Mahaney | Evercore ISI Group | Raises | Outperform | $75.00 | $55.00 |

| Chris Kuntarich | UBS | Raises | Buy | $80.00 | $70.00 |

| Brad Erickson | RBC Capital | Maintains | Outperform | $66.00 | $66.00 |

| Nicholas Jones | JMP Securities | Maintains | Market Outperform | $62.00 | $62.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Maintains | Neutral | $47.00 | $47.00 |

| Tom White | DA Davidson | Raises | Buy | $71.00 | $52.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Maintains | Neutral | $47.00 | $47.00 |

| Jay McCanless | Wedbush | Raises | Outperform | $80.00 | $50.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Announces | Neutral | $47.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Zillow Gr. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Zillow Gr compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Zillow Gr's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Zillow Gr's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Zillow Gr analyst ratings.

Delving into Zillow Gr's Background

Zillow Group Inc is an Internet-based real estate company that offers its customers an on-demand experience for selling, buying, renting, or financing with transparency and ease The group works with real estate agents, brokers, builders, property managers, and landlords to pair technology with top-notch service. The group has brands such as Zillow, Trulia, StreetEasy, Hotpads, Zillow Rentals, Zillow Home Loans, ShowingTime, Follow Up Boss, Aryeo and others.

Financial Milestones: Zillow Gr's Journey

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Zillow Gr's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 17.14%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Zillow Gr's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -3.44%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -0.44%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Zillow Gr's ROA excels beyond industry benchmarks, reaching -0.31%. This signifies efficient management of assets and strong financial health.

Debt Management: Zillow Gr's debt-to-equity ratio is below the industry average. With a ratio of 0.25, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.