London (AFP) - BP returned to profit in 2021 as oil and gas prices surged following a huge loss the prior year when the pandemic struck, the British energy giant revealed Tuesday.

BP posted a net profit of $7.6 billion (6.7 billion euros) last year, compared with a loss after tax of $20.3 billion in 2020, the company said in a statement.

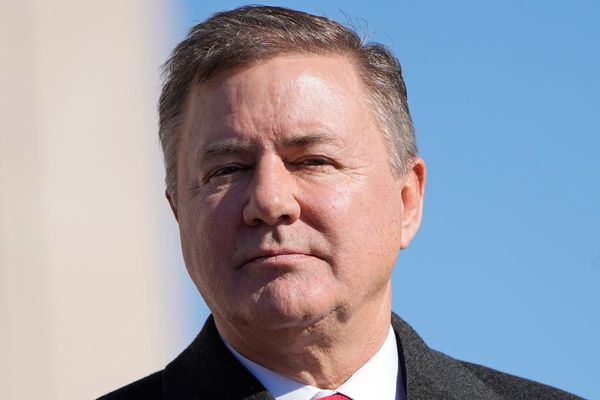

"2021 shows BP doing what we said we would -- performing while transforming," said BP chief executive Bernard Looney.

The company also announced plans to accelerate its target to reduce operational carbon emissions.

"We are accelerating the greening of BP," Looney said.

"This allows us to raise our low carbon ambitions, and we are now aiming to be net zero across operations, production and sales by 2050 or sooner -- unique among our peers."

BP said it aims to reduce operational emissions by 50 percent by 2030.

That compared with its previous target of 30-35 percent by the end of the decade on its path to net zero by mid-century.

"The past two years have reinforced our belief in the opportunities that the energy transition presents -- to create value for our shareholders and to get to net zero," added Looney, who became BP chief executive when the coronavirus began taking hold worldwide in early 2020.

Cash surplus

BP on Tuesday also said it would return $4.15 billion to shareholders via a share buyback thanks to a surplus cash flow.

Group revenue ballooned 49 percent last year to $157.7 billion, with oil and gas prices rocketing thanks to rebounding demand for energy as economies reopened from lockdowns.

Like its rivals, BP slumped deep into the red in 2020 as the Covid-19 pandemic slashed energy demand and prices.

That resulted in top oil companies shedding thousands of jobs.

Prices have since rebounded sharply, with the benchmark Brent North Sea oil contract trading at $94 per barrel this week -- the highest level in more than seven years.

Surging crude prices are, however, weighing on business costs and individuals' spending power as inflation worries mount worldwide.

European gas prices have also blazed a record-breaking trail over the past year on strong winter demand and the unrest between key supplier Russia and consumer nations.

Electricity prices have additionally seen massive gains.

BP rival Shell last week announced annual net profit totalling $20.1 billion, also after a huge loss in 2020.