Comstock via Canva

Investing in bonds is like ordering a cheese pizza: They’re plain, reliable, and maybe even a bit boring. While fixed-income investments like bonds can help to diversify your portfolio and provide balance during market volatility, bond investing also comes with its own set of complex and somewhat confusing terminology. And because bond prices move in the opposite direction of interest rates, many investors are often left scratching their heads. But once you understand a few basic metrics, like bond duration, you will find bonds to be a pretty straightforward investment—one that can provide you with a safe and stable stream of income.

What Is Bond Duration?

First of all, you shouldn’t confuse the financial term “duration” with a timeframe. In the bond world, duration has everything to do with interest rates.

Many investors already know that bonds and interest rates have an inverse relationship. You may have even heard the phrase, “If interest rates rise, bond prices will drop.” Bonds are sensitive to interest rate risk, which means that when interest rates rise, the value of bonds falls, and when interest rates decline, bond prices go up.

Bond duration is a measurement that tells us how much a bond’s price might change if interest rates fluctuate. Its full definition is actually a little more technical than that since duration measures how long it will take an investor to be repaid a bond’s price from the cash flows it produces. After all, bond investors are placing loans to a borrower (a corporation, the federal government, etc.), which must be repaid with interest by their maturity date.

What Does High Bond Duration Mean?

Bonds with high duration are more prone to the ups and downs of market volatility that happens in an environment of changing interest rates. Bonds with the highest durations are typically long-term bonds with low coupons.

What Does Low Bond Duration Mean?

Bonds that have lower duration are more stable against interest rate fluctuations. So these bonds are typically shorter term bonds.

Are Bonds With Low Duration Better Than Bonds With High Duration?

You might actually find bonds with a higher duration an attractive investment in an environment of falling interest rates. When there’s volatility, bonds with low duration and high coupons would be best. It all depends on your risk preference, your holding period, and your goals.

Bond Duration Vs. Maturity

Speaking of maturity dates, it’s important to note that bond duration and maturity are not the same thing. In plain English, “maturity” means the point in time that something becomes fully grown, so the maturity date of a 30-year Treasury bond is 30 years into the future. Its duration, however, is a calculation that takes into account several factors, including yields, coupon payments, and others, all rolled into one.

On the surface, it can seem pretty confusing, but for most investors, the main takeaway is that bond duration predicts how sharply the market price of a bond will change as a result of changes in interest rates. The higher the bond duration, the greater the level of interest rate risk. Knowing that can help you determine whether or not a particular bond is a good investment for you—especially if you plan on selling your bond prior to its maturity date.

Examples of Bond Duration

The rule of thumb is, for every 1% change in interest rates, the value of the bond will either increase or decrease by the same amount as its duration. By examining three different bonds, zero-coupon bonds, short-term bonds and long-term bonds, we can shed light on just how much duration can affect its value.

Zero-Coupon Bonds

The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest.

Its duration is equal to its time to maturity.

When a coupon is added to a bond, the duration will always be less than its maturity.

Short and Medium-Term Bonds

In a nutshell, the general rule is that for every 1% increase in interest rates, a bond’s price will decrease 1% for every year of duration.

Alternatively, for every 1% decrease in interest rates, the bond will increase 1% for every year of duration.

For example, if interest rates rose by 2%, a 10-year Treasury with a coupon of 3.5% and a duration of 8.4 years would fall in value by 15%.

Long-Term Bonds

Let’s use the 30-year Treasury with 4.5% coupon and a duration of 14.5 years as another example. If rates rose 2% in this scenario, the bond would lose 26% of its value! So you see how interest rate changes can really play havoc on bonds with longer terms. Even though its coupon is greater, the higher duration makes it more prone to interest rate fluctuations.

Why Is Bond Duration Important?

Generally speaking, bonds with shorter maturities carry less risk because they return an investor’s principal more quickly than a long-term bond would. Say you lent two people money. The first person gratefully accepted your loan for a period of 5 years, and the second person took it for 10 years. You would receive more of the first person’s money sooner because their principal would come due several years earlier.

In a similar way, bonds with shorter maturities usually have lower duration than bonds with longer maturities. Just remember, the higher the duration, the more sensitive the bond is to interest rate changes, and thus, the more prone it is to interest rate risk.

How Do I Calculate the Duration of a Bond?

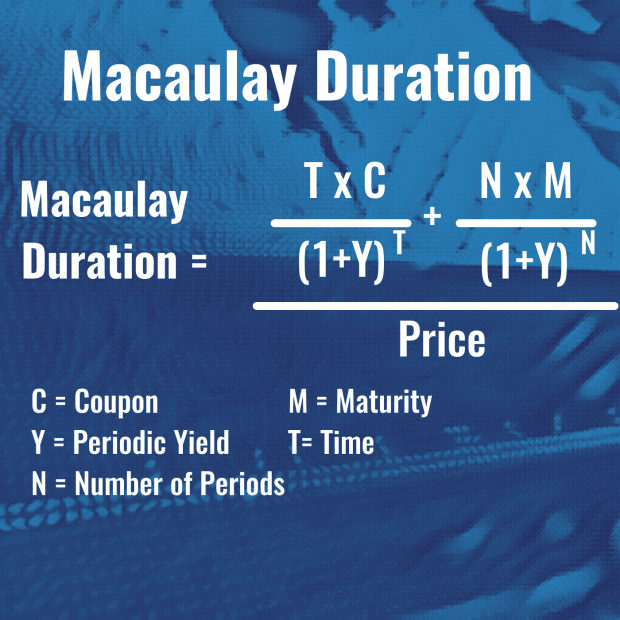

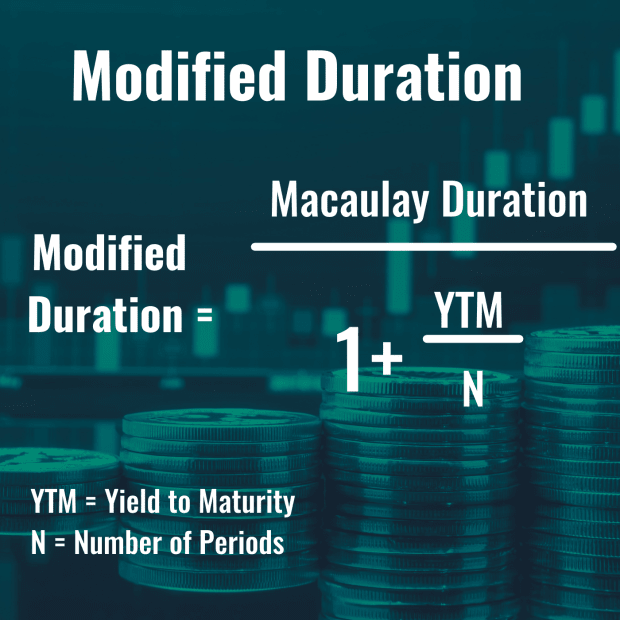

The great news is that you probably won’t need to calculate it yourself because brokerage firms publish data about bond duration on their websites. But if you wanted to do the heavy lifting, you would have a choice between two formulas: Macaulay Duration, which is expressed in years, and Modified Duration, the more modern measurement, which takes into account varying coupon payment schedules, and is expressed as a percentage. It’s a more precise calculation.

Macaulay Duration Formula

Comstock via Canva

Macaulay Duration tells us the weighted average time it would take to receive cash flows from a bond.

Modified Duration Formula

Comstock via Canva

To calculate Modified Duration, you need to know a bond’s yield to maturity.

Other Factors Affecting a Bond’s Value

Duration may seem elusive, but it’s just one factor that affects a bond’s value. Some other factors include the following.

Credit quality

This refers to the issuer's creditworthiness, or the ability to repay its principal and interest on time. Credit quality is illustrated by ratings, which range from high to low, with triple-A being the highest and D being the lowest. Lower-quality bonds usually sport large coupons to make the increased risk more attractive to investors.

Inflation risk

Since bonds make payments on a fixed schedule, inflation can factor in over time, eroding the value of the bond. Economic price increases, known as inflation, cause the value of the bonds to deteriorate.

Default risk

When a bond issuer enters default, they are unable to make period coupon payments or pay the principal of a bond. Default risk is one of the risks a bond investor makes when purchasing a lower-rated bond. After all, you want to be sure the bond issuer can make timely payments—or any payments at all!

Call risk

In the case of some bonds, known as callable bonds, the issuer can “call” the bond before maturity, which means that the investor must reinvest it at a lower interest rate.

TheStreet Smarts

TheStreet’s Single Smartest Insight From The Day

Exclusive newsletter delivered to your inbox daily covering important investing topics pulled from TheStreet’s premium content.

- Cut Through The Noise

- Your Personal Financial Advisor

- Investing Cheat Sheet

Determining If Bond Investing Is Right for You

Not that many investors paid attention to bond duration before the 1970s because interest rates were relatively stable. In the 1970s and 1980s, however, interest rates started fluctuating dramatically, and people wanted a metric that would help them assess price volatility on their fixed-income investments, like bonds.

While bond investing is generally less risky than stock investing, factors like duration become important considerations if you decide to sell a bond before its maturity date.

And all of this, of course, is what makes investing so exciting.