When interest rates go up, bonds go down. Investors’ expectation that more interest rate hikes are ahead also leads to the selling of fixed-income instruments.

It’s bad news for bonds when Federal Reserve Bank of Minnesota President Neel Kashkari says he’s not ready to declare a pause in rate hikes until he sees compelling evidence that core inflation is tamed.

Bond experts like to compare the 30-year type to the 10-year type and the 10-year to the two-year to measure the likelihood of a recession.

If the two-year yield is greater than the 10-year yield, it’s considered a signal that a business cycle contraction is likely. Right now, that’s how it looks.

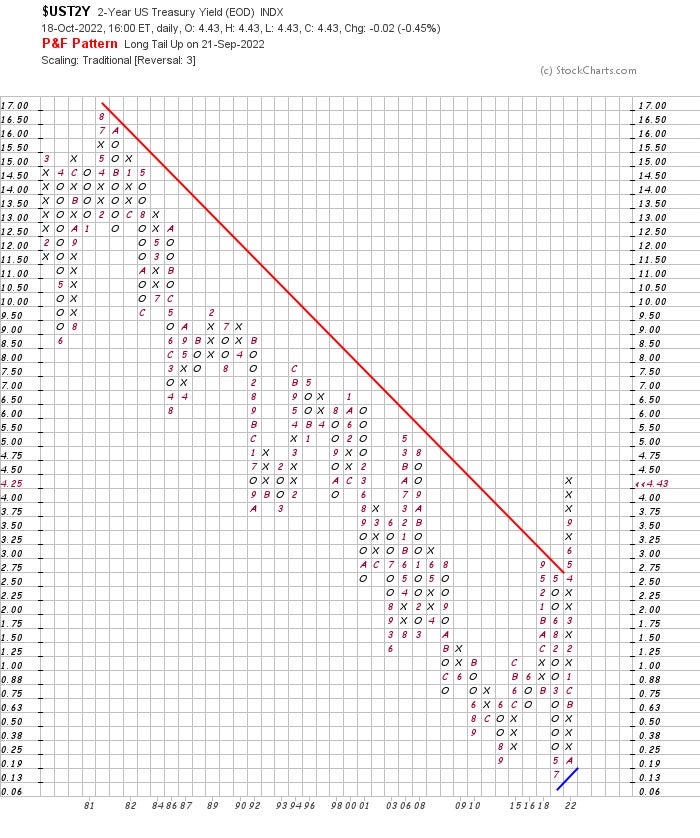

The two-year Treasury yield just hit 4.43%. Take a look at the way it’s broken above that long-term downtrend in yields (represented by the declining red line).

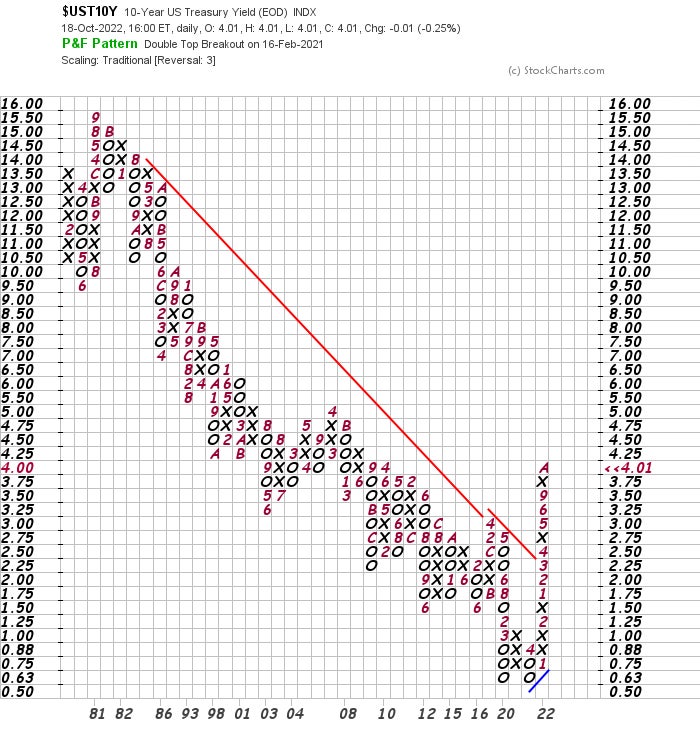

Compare this to the 10-year Treasury yield:

The yield here is up to 4.01%, and the rise in yields has broken above the long-term downtrend line. JP Morgan Chase & Co. says this yield has risen for 11 straight weeks.

So, with the two-year yield above the 10-year yield, many economists are expressing concern that a recession could be imminent.

If that’s true and more rate hikes are coming, bonds will continue to be sold.

This is a problem for the iShares 20+ Year Treasury Bond Exchange-Traded Fund (NYSE:TLT), a benchmark of sorts for the bond market. The year-to-date decline for the big bond exchange-traded fund (ETF) is 32% as it dropped from 145 in early January to that much lower current price. This is the lowest level for the ETF since late 2018.

Note how the 50-day moving average (the blue line) has crossed below the 200-day moving average. This is considered bearish by price chart analysts. It’s also not a good sign that the price remains well below both of those moving averages nor is its inability to rally at all for the past eight sessions.

At some level, the bond market will begin to stabilize and buyers will move in again, but we’re not there yet. For this market to gain real strength again, it will have to be clear that the Fed is about to pivot to lower interest rates. If Fed member Kashkari is right, bond investors may be in store for a long wait.

Read next: This High-Yield Real Estate Fund Is Targeting A 15%-19% Annualized Return

Latest Private Market Insights:

- Private credit investment platform Percent recently launched a new offering that provides exposure to factored invoices and financed purchase orders originated with a 12% APY.

- The CalTier Multi-Family Portfolio Fund recently completed a new investment in lakefront multifamily and mixed-use development. The CalTier Multi-Family Portfolio Fund is one of the few non-traded real estate funds available to non-accredited investors and has a minimum investment of $500. Year to date, the fund has produced an annualized cash-on-cash return of 7.02%.

Charts: Courtesy of StockCharts