Transcript:

Conway Gittens: I’m Conway Gittens reporting from the New York Stock Exchange. Here’s what we’re watching on TheStreet today.

One day after the Dow closed above 43,000 for the first time ever - stocks are mixed. Techs are a drag but financials are mostly higher. Bank of America, the country’s second largest bank, topped profits estimates due to strength in its trading unit. Goldman Sachs beat forecasts on strong numbers from investment banking. Cost controls and a slight revenue bump helped Citigroup exceed expectations.

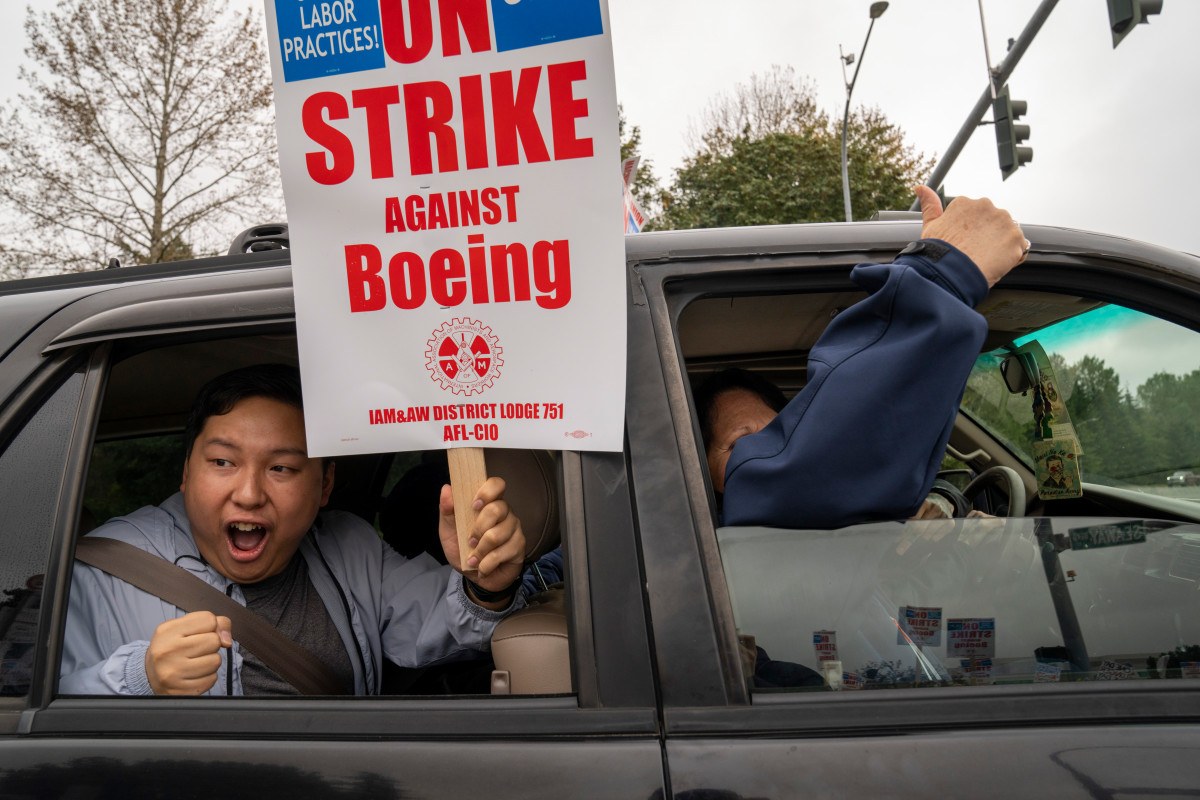

Related: Boeing machinist strike is getting messier

Turning to other headlines: Boeing is looking to raise up to $25 billion to bolster its finances as it grapples with a crippling workers’ strike now in its second month.

The airplane maker said it could raise the money through stock or bond offerings spread across 3 years. “This universal shelf registration provides flexibility for the company to seek a variety of capital options as needed to support the company’s balance sheet over a three year period.”

The cash infusion would come on top of a new $10 billion line of credit it has received from a collection of banks.

Boeing is under pressure to shore up its finances as the walkout by 30,000 machinists grounds business to a halt. S&P Global Ratings warns Boeing’s credit rating is in jeopardy as it loses an estimated $1 billion a month.

Watch ICYMI This Week:

- How to prepare for the Great Wealth Transfer

- Chuck E. Cheese sees strong demand despite inflation, recession fears

- How food inflation actually impacts average Americans

- TD hit with largest ever bank fine

There’s also some belt tightening going on. Boeing is planning to lay off 17,000 workers and further delay production on its latest wide-body plane in order to survive the strike.

Boeing’s troubles, however, began before the strike. Two deadly plane crashes and a door flying off mid-air delayed production, put its safety record under scrutiny, and caused the company to burn through cash.

That’ll do it for your Daily Briefing. From the New York Stock Exchange, I’m Conway Gittens with TheStreet.

Don't miss the move: Subscribe to TheStreet's free daily newsletter