Boeing (BA) stock on Wednesday morning tried to rally, but the sellers lined up after the aerospace stalwart reported earnings before the open.

As the conference call got underway Wednesday, investors clearly didn’t like what they'd heard. Boeing stock was down 5% in midday trading and closed lower by nearly 9%.

On Thursday, it's rallying. The shares opened slightly higher on the day and at last check were up nearly 6%.

Boeing grew revenue 4.5% year over year but missed analysts’ expectations. Management expects positive free cash flow this year and resumed deliveries of its 787 plane.

One explanation for the initial weakness? The company may choose to discontinue its 737 Max 7 and/or Max 10 planes if certain ACSAA deadlines are not amended, which would have a negative financial impact, according to management.

As for the stock, it’s fading from a key area on the chart. Let’s look.

Trading Boeing Stock on Earnings

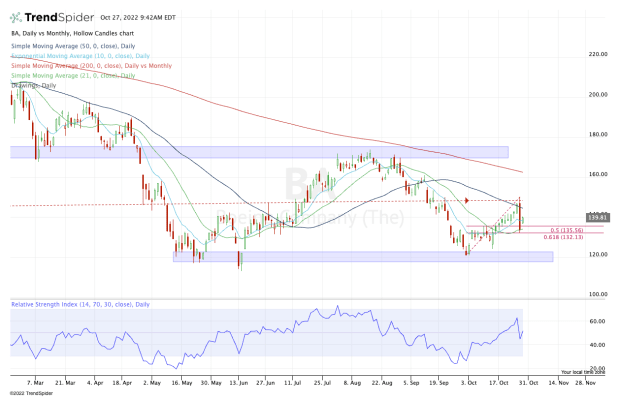

Chart courtesy of TrendSpider.com

For a moment, Boeing stock was pushing through the 50-day and 200-month moving averages this morning.

With Wednesday's reversal off the highs, though, Boeing is not only failing to reclaim these measures but it’s being outright rejected.

From here, it creates a very clear setup for traders.

The ideal support zone for both shorts to cover and bulls to buy would be around $120.

Along the way, the $132 to $135 area will be a key inflection point. There, we have the 50% to 61.8% retracement of the current rally, as well as the 21-day moving average.

If the stock finds support here, Boeing shares could rebound back toward the 50-day and 200-week moving averages and the $150 area. To get there, it will need to clear the $141 level, which is about the midway point of Wednesday's post-earnings range.

If it doesn’t find support, it could open the door down to a big test of the $120 zone. If Boeing revisits this zone, bulls will need it to hold as support.

If it doesn’t, there’s not much standing in the way of an even deeper decline, potentially back down to $100.