Boeing (BA) shares caught a lift earlier this week on reports that one airline had placed a large order for the 737 MAX.

Ryanair placed a $40 billion order, helping give the stock a boost as it was near key support. The reports came at a time where investors may have needed a little reassurance.

Why? The stock didn’t have a great earnings reaction a few weeks ago and Boeing's 737 MAX jet — the same one mentioned above — faced another setback (although it wasn’t Boeing’s fault).

Don't Miss: Alphabet Stock Teeters on a Breakout. Here's the Trade.

The shares initially rallied almost 5% on April 26 on a mixed earnings report but ended the session higher by just 0.4%.

The post-earnings weakness was not all that surprising. That’s particularly true as the stock was struggling with resistance ahead of the results, and then the mixed quarter wasn’t enough to draw in the buyers.

Let’s take a fresh look at Boeing stock.

Trading Boeing Stock

Chart courtesy of TrendSpider.com

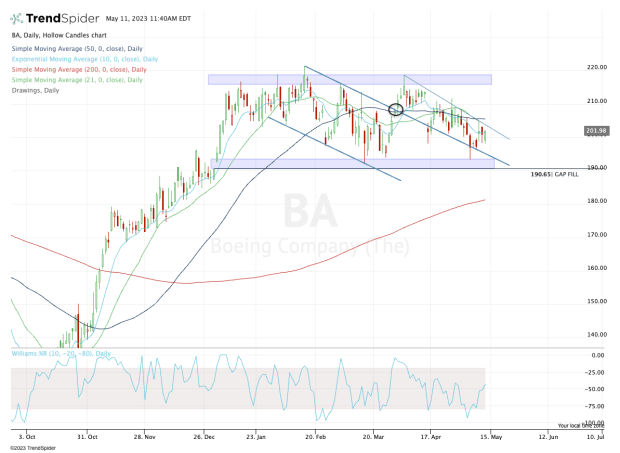

Broadly speaking, Boeing stock has been stuck between the mid-$190s and the $215 area all year. While it has lacked bullish momentum, many may view the price action as simple consolidation given the big rally it took to get to this area.

Boeing actually had a nice bull-flag look to it and then broke out of this pattern at the end of March.

Again, though, the shares failed to break out over $215 and since then have seen each rally fail. On the plus side, last week’s dip down to $193 held firm and ignited a nice bounce.

Don't Miss: Visa, MasterCard Face Tough Economic Scenario. The Stocks Still Can Set Records.

For a larger move to occur, the bulls want to see the stock clear the $206 level. If the stock can do so, it will put Boeing above the 10-day, 21-day and 50-day moving averages, as well as the 50% retracement of the current dip.

If it can clear the 61.8% near $209, that opens the door back up to the $215 area. Above that area and Boeing stock will be worth another look, as the stock will be in a breakout.

On the downside, a move below $193 could put the gap-fill level in play at $190.65. Below $190 and it’s possible we see a larger decline, potentially down toward $180 and the 200-day moving average.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.