Data shows that a large number of cryptocurrency traders have been fooled by calls to “buy the dip.”

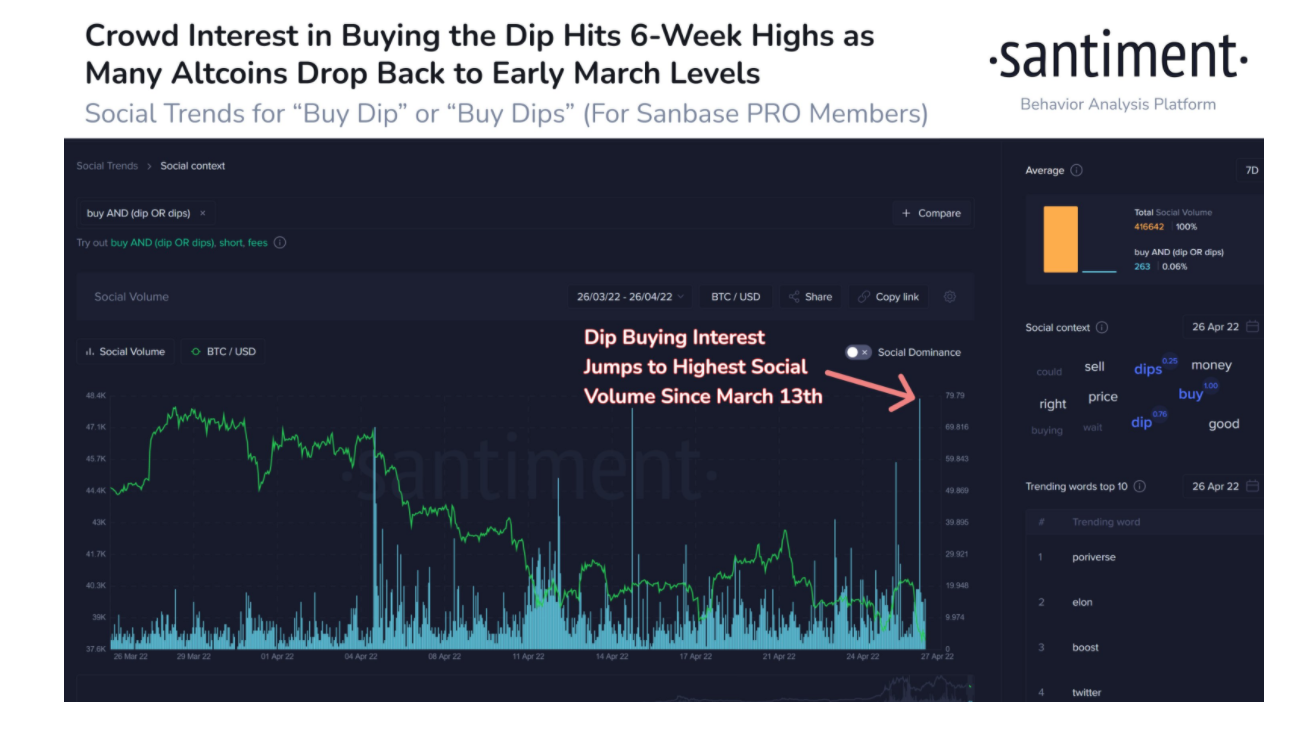

What Happened: Blockchain analytics platform Santiment has established a reliable trend of the mainstream crowd being incorrect on calls to buy the dip.

“As we can see, when 'buy the dip' begins to trend, prices typically don't bounce as traders were hoping,” analysts at Santiment said.

“It is often not until after the crowd gives up hope of a dip being the 'dip to buy' that prices actually begin to recover.”

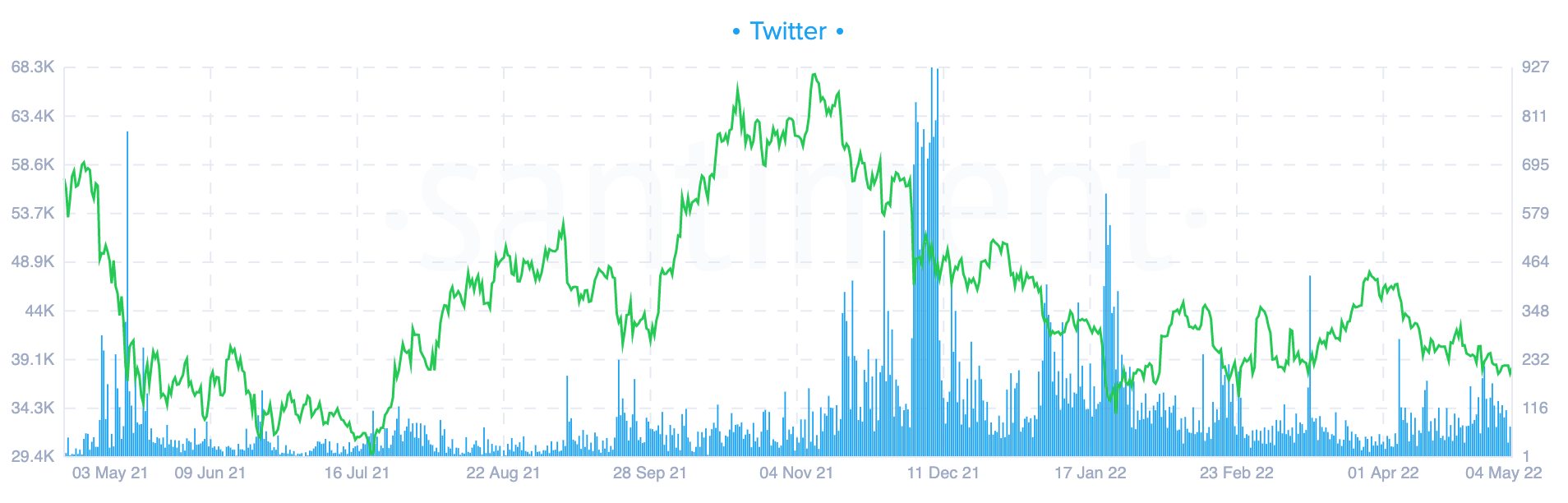

A closer look at calls to buy the dip on Twitter Inc (NYSE:TWTR) shows that prices have dropped even further after dip-buying calls hit peak social volume.

After social volume around the subject trails off, the crypto market begins to see more convincing buying activity.

See Also: HOW TO BUY CRYPTOCURRENCY

At press time, Bitcoin (CRYPTO: BTC) was trading at $38,400, losing 17% of its value over the last 30 days. Ethereum (CRYPTO: ETH) was trading at $2,800, down 20% over the same period.

Meme-based cryptocurrency Dogecoin (CRYPTO: DOGE) saw some momentum in April after Tesla Inc (NASDAQ:TSLA) CEO Elon Musk acquired Twitter Inc. (NYSE:TWTR). At the time of writing, DOGE was trading at $0.10, losing 10% over the last 30 days.